Rhode Island Amended Uniform commercial code security agreement

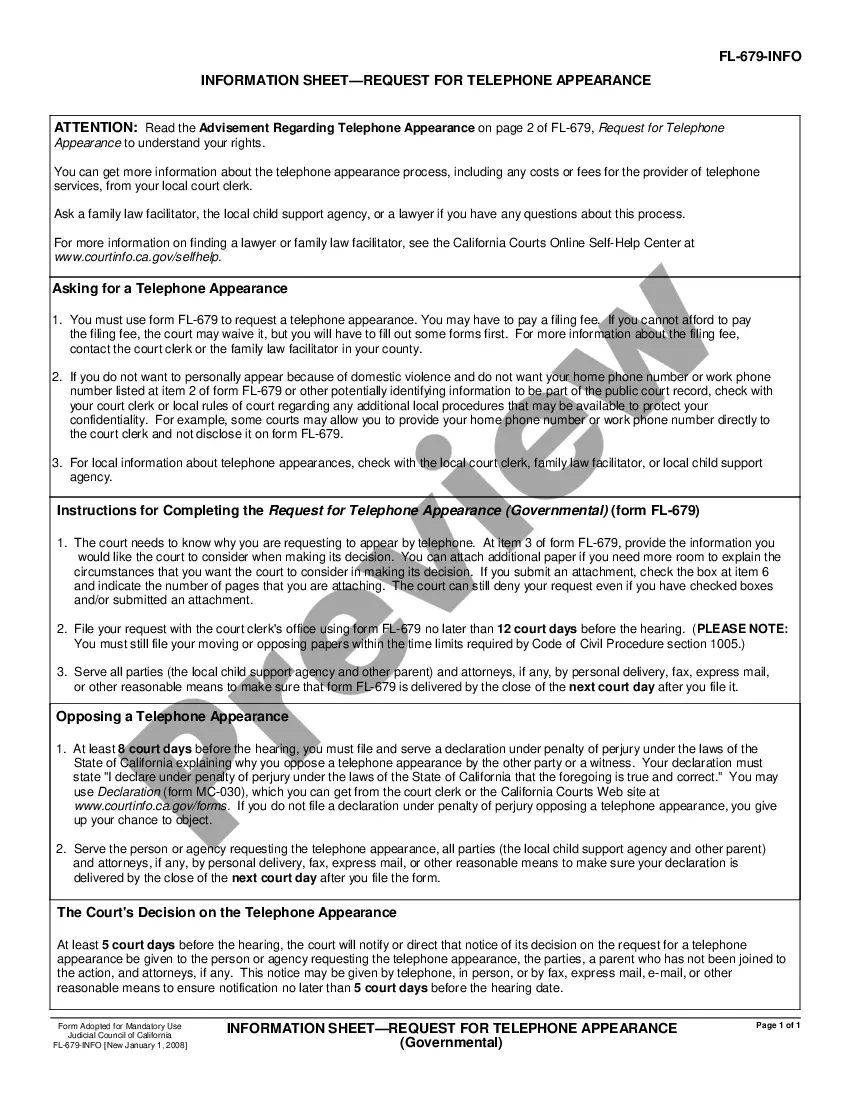

Description

How to fill out Amended Uniform Commercial Code Security Agreement?

US Legal Forms - one of many biggest libraries of legitimate kinds in the United States - delivers a wide range of legitimate document themes you may download or print out. While using web site, you may get a huge number of kinds for enterprise and personal purposes, sorted by groups, suggests, or search phrases.You will discover the latest variations of kinds just like the Rhode Island Amended Uniform commercial code security agreement within minutes.

If you already have a membership, log in and download Rhode Island Amended Uniform commercial code security agreement in the US Legal Forms catalogue. The Down load option will appear on each type you view. You gain access to all previously delivered electronically kinds within the My Forms tab of your own account.

If you would like use US Legal Forms initially, here are basic guidelines to help you started out:

- Be sure you have chosen the correct type for the area/area. Click the Review option to examine the form`s content. Look at the type information to actually have selected the appropriate type.

- When the type does not match your demands, utilize the Search industry near the top of the display screen to discover the one that does.

- If you are happy with the shape, affirm your decision by visiting the Acquire now option. Then, opt for the pricing program you like and give your accreditations to register for the account.

- Procedure the transaction. Make use of charge card or PayPal account to complete the transaction.

- Find the formatting and download the shape on the device.

- Make changes. Complete, modify and print out and indicator the delivered electronically Rhode Island Amended Uniform commercial code security agreement.

Every template you included with your account lacks an expiration particular date and is the one you have forever. So, if you want to download or print out one more backup, just visit the My Forms portion and then click about the type you will need.

Gain access to the Rhode Island Amended Uniform commercial code security agreement with US Legal Forms, one of the most substantial catalogue of legitimate document themes. Use a huge number of professional and state-particular themes that fulfill your company or personal requires and demands.

Form popularity

FAQ

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

A security agreement must contain a description of the collateral that reasonably identifies it. A security agreement that identifies the collateral as all the debtor's assets is sufficient under the UCC.

Perfection: The process by which secured parties protect their security interests in collateral against the claims of third parties who may look to the same collateral to satisfy the debtor's obligations to them.

(The UCC uses the term "authenticate" to include the possibility of electronic signatures.) A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods. The agreement also must provide a description of the collateral.

Typically, perfection is achieved by filing a document called a ?financing statement,? sometimes referred to as a ?UCC 1.? The financing statement must identify the debtor, the creditor, and the collateral against which the creditor has a claim.

UCC § 1-201(35) defines a ?Security Interest? as ?an interest in personal property or fixtures that secures payment or performance of an obligation.? In the context of suretyship, the security agreement is usually found in the Indemnity Agreement.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.