Rhode Island Loan Guaranty Agreement is a legally binding document that serves as a means of securing a loan or credit facility by providing a guarantee from a third party. This agreement is commonly used in the state of Rhode Island to mitigate the risk faced by the lender, as it ensures that the loan will be repaid even if the borrower defaults. This comprehensive description will discuss the key aspects of the Rhode Island Loan Guaranty Agreement, its purposes, types, and the benefits it provides. The primary objective of a Rhode Island Loan Guaranty Agreement is to offer a lender an additional layer of protection and reassurance when granting a loan. It establishes a legal obligation for the guarantor, who can be an individual or an organization, to repay the loan if the borrower fails to do so. This agreement is a contractual arrangement that outlines the terms, conditions, and responsibilities of all involved parties. There are generally two types of Rhode Island Loan Guaranty Agreements: 1. Personal Guaranty: This type of agreement involves an individual or individuals personally assuming responsibility for repaying the loan if the borrower defaults. The guarantor's personal assets, such as real estate, bank accounts, or investments, may be used as collateral in the event of default. 2. Corporate Guaranty: In this type, a business organization assumes the responsibility of guaranteeing the loan on behalf of the borrower. The organization agrees to repay the lender if the borrower is unable to meet their obligations. Corporate guaranty provides a shield to the borrower's personal assets, making it an attractive option for businesses seeking loans. The Rhode Island Loan Guaranty Agreement encompasses several crucial elements, including: 1. Guarantor's Obligations: The agreement clearly defines the guarantor's obligations, including the amount and duration for which they are liable. This includes the principal amount of the loan, interest, fees, and any associated costs. 2. Default and Remedies: The agreement outlines the circumstances under which the guarantor will be considered in default. It also specifies the remedies available to the lender in case of default, such as filing a lawsuit, seizing collateral, or utilizing other legal means to recover the outstanding debt. 3. Indemnification: The guarantor agrees to indemnify the lender for any losses incurred due to the borrower's default. This ensures that the lender can recover the full amount of the loan, including any legal fees or expenses. 4. Governing Law: The agreement stipulates the governing law of Rhode Island, ensuring that any disputes arising from the agreement are resolved within the state's legal framework. 5. Severability: This clause ensures that if any provision of the agreement is deemed unenforceable, the remaining provisions remain valid. The Rhode Island Loan Guaranty Agreement offers several benefits for all parties involved: 1. Increased Lending Opportunities: By providing loan guaranties, lenders are more likely to grant credit to borrowers who may not have sufficient collateral or credit history to obtain loans on their own. 2. Lower Interest Rates: With a guarantor in place, lenders can offer reduced interest rates as the risk is minimized, benefiting the borrowers. 3. Improved Creditworthiness: For borrowers, having a guarantee from a reputable guarantor can enhance their creditworthiness, making it easier to secure financing in the future. 4. Trust and Confidence: The agreement fosters trust between lenders, borrowers, and guarantors, enhancing the overall confidence in the transaction. In summary, the Rhode Island Loan Guaranty Agreement ensures the security of loans by providing a guarantee from a third party, be it an individual or an organization. By understanding the nuances of this agreement, borrowers can access the financial support they require, while lenders can minimize their risk exposure. Whether it is a personal guaranty or a corporate guaranty, this agreement plays a crucial role in facilitating lending and fostering economic growth in Rhode Island.

Rhode Island Loan Guaranty Agreement

Description

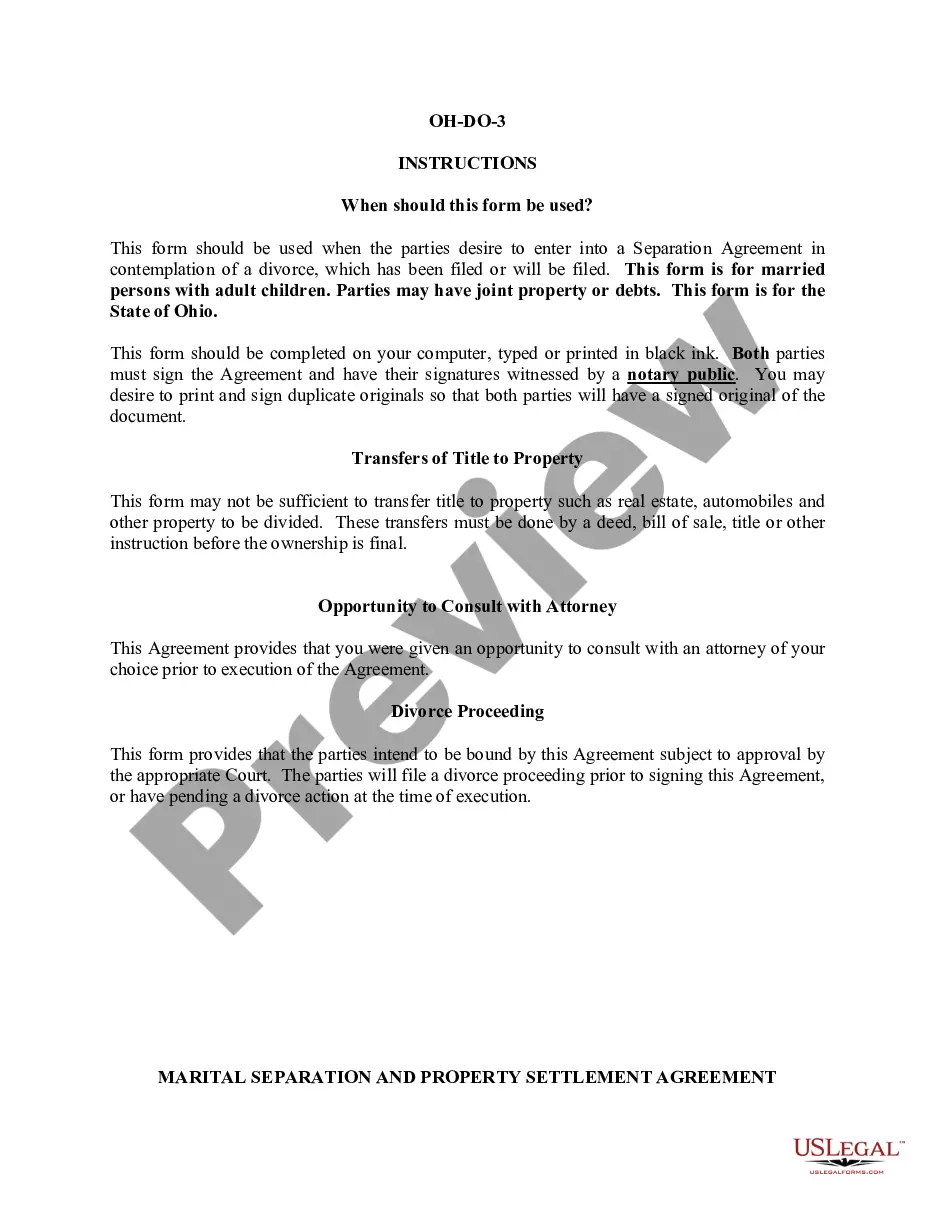

How to fill out Rhode Island Loan Guaranty Agreement?

If you wish to comprehensive, download, or print legal document templates, use US Legal Forms, the largest assortment of legal kinds, that can be found on-line. Use the site`s basic and convenient search to obtain the paperwork you will need. Various templates for enterprise and personal functions are sorted by categories and states, or key phrases. Use US Legal Forms to obtain the Rhode Island Loan Guaranty Agreement within a few mouse clicks.

Should you be previously a US Legal Forms consumer, log in to the accounts and click the Download key to find the Rhode Island Loan Guaranty Agreement. You can even entry kinds you previously saved in the My Forms tab of the accounts.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form to the appropriate town/country.

- Step 2. Utilize the Review choice to look over the form`s content material. Don`t forget to read through the outline.

- Step 3. Should you be unhappy with the kind, take advantage of the Look for discipline towards the top of the display to discover other variations of your legal kind design.

- Step 4. Once you have found the form you will need, select the Acquire now key. Opt for the pricing strategy you prefer and put your qualifications to sign up on an accounts.

- Step 5. Method the financial transaction. You should use your charge card or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the formatting of your legal kind and download it on the gadget.

- Step 7. Total, change and print or signal the Rhode Island Loan Guaranty Agreement.

Every legal document design you acquire is your own for a long time. You have acces to each and every kind you saved with your acccount. Click the My Forms section and pick a kind to print or download again.

Be competitive and download, and print the Rhode Island Loan Guaranty Agreement with US Legal Forms. There are millions of professional and condition-distinct kinds you can use to your enterprise or personal requirements.

Form popularity

FAQ

Guarantor agrees to the provisions of this Guaranty, and hereby waives notice of (a) any loans or advances made by Lender to Borrower, (b) acceptance of this Guaranty, (c) any amendment or extension of the Note, the Loan Agreement or of any other Loan Documents, (d) the execution and delivery by Borrower and Lender of ...

Guaranty, n. The promise to pay the debt or fulfill the obligation of another if that person fails to do so {the father signed a guaranty for his son's car loan}.

A guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

1. a pledge of responsibility for fulfilling another person's obligations in case of that person's default. 2. a thing given or taken as security for a guaranty. 3.

Writing a Guarantee A statement letting your potential customers know you believe in your product. ... Give the customer a fair time period to try the product. ... State what happens if the customer isn't happy with the product. ... Finally, the most important elements of your guarantee are honesty and transparency.

?Guaranteed.? Merriam-Webster.com Dictionary, Merriam-Webster, .