The Rhode Island Qualified Domestic Trust Agreement, also known as DOT, is a legal arrangement designed to address the complex issue of estate planning for non-U.S. citizen spouses. This particular type of trust is crucial for couples where one spouse is a non-U.S. citizen and the other is a U.S. citizen or resident. A DOT is created to ensure that the non-U.S. citizen spouse can inherit the assets of the U.S. citizen spouse without triggering immediate estate taxes. In most cases, non-U.S. citizens are subject to estate tax on any assets exceeding the federal exemption amount, which can be significant. However, with a DOT, the estate tax is usually deferred until the non-U.S. citizen spouse passes away or receives distributions from the trust. Rhode Island recognizes the importance of Dots, and various types of DOT agreements are available to meet the specific needs and circumstances of different couples. These types may include: 1. Revocable DOT: This type of trust allows the U.S. citizen spouse to retain the ability to modify or revoke the trust during their lifetime. It provides more flexibility in managing assets and tax planning. 2. Irrevocable DOT: In contrast to the revocable DOT, this trust cannot be modified or revoked once established. While it may limit some flexibility, it provides more certainty and protection for the non-U.S. citizen spouse over the long term. 3. Testamentary DOT: This trust is created through a will and only takes effect upon the death of the U.S. citizen spouse. It allows for greater control over the assets during their lifetime and provides a reliable framework for estate distribution. 4. Lifetime DOT: This type of DOT is established during the lifetime of the U.S. citizen spouse and serves as a means to gradually transfer assets to the non-U.S. citizen spouse, while still maintaining the protection from immediate estate taxes. By utilizing a Rhode Island Qualified Domestic Trust Agreement, couples can effectively plan their estates, ensuring that wealth is preserved, and the non-U.S. citizen spouse can benefit from the assets without an excessive tax burden. It is crucial to consult with a qualified estate planning attorney to determine the most suitable DOT type and ensure compliance with the Rhode Island state laws and federal regulations.

Rhode Island Qualified Domestic Trust Agreement

Description

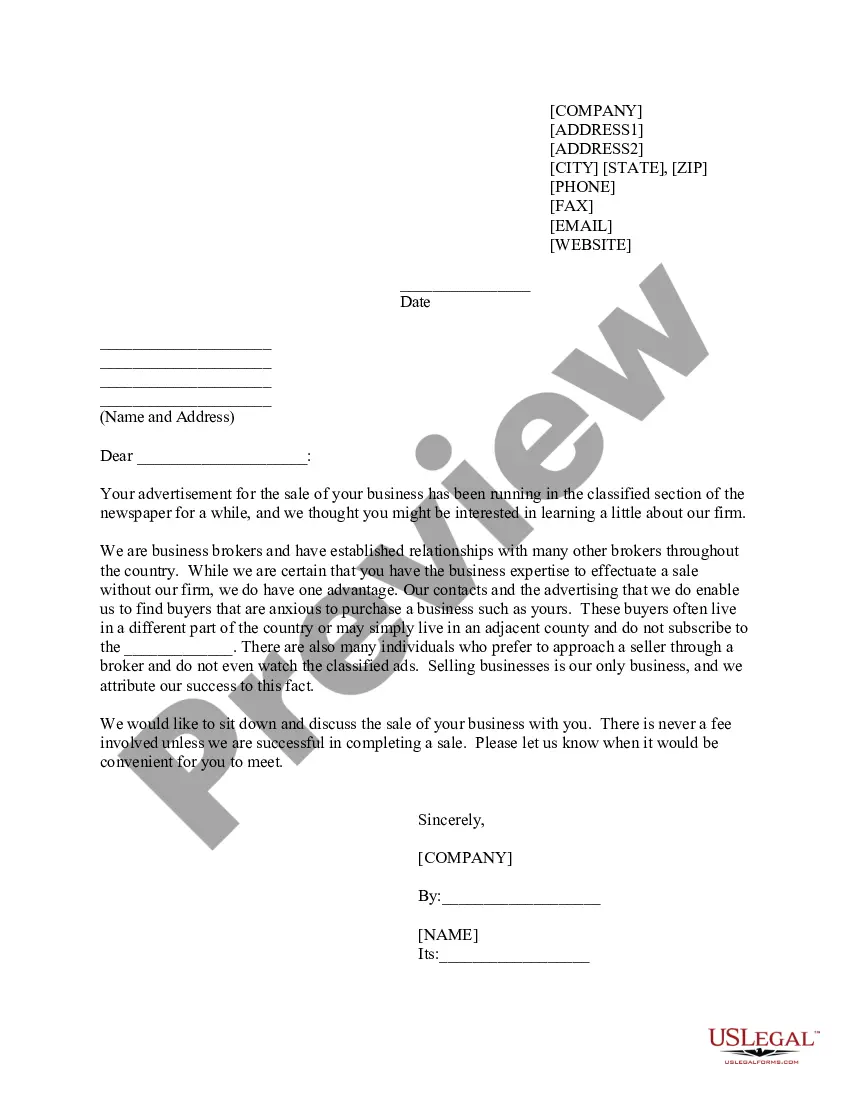

How to fill out Rhode Island Qualified Domestic Trust Agreement?

If you have to comprehensive, obtain, or produce authorized file themes, use US Legal Forms, the greatest collection of authorized kinds, that can be found on the web. Make use of the site`s simple and easy handy lookup to find the files you want. Various themes for company and person uses are sorted by types and claims, or key phrases. Use US Legal Forms to find the Rhode Island Qualified Domestic Trust Agreement in just a couple of clicks.

Should you be already a US Legal Forms client, log in to your bank account and click on the Download option to find the Rhode Island Qualified Domestic Trust Agreement. Also you can access kinds you previously downloaded inside the My Forms tab of your bank account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for your correct city/country.

- Step 2. Make use of the Preview choice to look over the form`s content material. Don`t overlook to read the description.

- Step 3. Should you be unsatisfied with the type, utilize the Lookup discipline towards the top of the screen to discover other versions from the authorized type web template.

- Step 4. Once you have discovered the form you want, click the Purchase now option. Select the pricing strategy you like and add your accreditations to register for an bank account.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the file format from the authorized type and obtain it in your system.

- Step 7. Complete, edit and produce or sign the Rhode Island Qualified Domestic Trust Agreement.

Each and every authorized file web template you purchase is the one you have permanently. You may have acces to each and every type you downloaded with your acccount. Click on the My Forms portion and choose a type to produce or obtain once more.

Contend and obtain, and produce the Rhode Island Qualified Domestic Trust Agreement with US Legal Forms. There are thousands of professional and express-specific kinds you may use for the company or person requirements.