Rhode Island Irrevocable Funded Life Insurance Trust with Beneficiaries Having Crummy Right of Withdrawal and First to Die Policy with Survivorship Rider A Rhode Island Irrevocable Funded Life Insurance Trust is a legal arrangement where the granter (policyholder) transfers ownership of a life insurance policy into an irrevocable trust. This trust structure offers various benefits for estate planning purposes, such as providing tax advantages and protecting assets from creditors. In this particular type of trust, beneficiaries are granted a Crummy right of withdrawal, which allows them to withdraw a limited amount of funds from the trust each year. This feature ensures that the trust qualifies for the annual gift tax exclusion, making it a valuable estate planning tool. A First to Die Policy refers to a life insurance policy that covers two or more individuals, typically spouses or partners. In the event of the first insured person's death, the policy pays out the death benefit to the surviving insured(s). This type of policy is often used to provide financial support for the surviving spouse or partner, ensuring that they have the necessary funds to maintain their lifestyle or cover financial obligations. Additionally, a Survivorship Rider is an additional provision that can be added to a life insurance policy. With this rider, the death benefit is paid out upon the death of the second insured person. This rider is commonly used in estate planning to provide liquidity and funds for estate taxes, ensuring that beneficiaries receive their intended inheritance. Different variations of Rhode Island Irrevocable Funded Life Insurance Trusts with Beneficiaries Having Crummy Right of Withdrawal and First to Die Policies with Survivorship Riders may include: 1. Conditional Survivorship Trust: This variation allows for certain conditions to be met before the trust assets are distributed to beneficiaries. For example, the surviving insured(s) may need to reach a certain age or fulfill specific requirements. 2. Charitable Irrevocable Funded Life Insurance Trust: With this type of trust, a portion or the entirety of the policy's death benefit is directed towards a charitable organization. This allows the granter to support a cause that aligns with their philanthropic goals while potentially benefiting from tax deductions. 3. Dynasty Trust: A Dynasty Trust is designed to provide long-term wealth preservation for multiple generations. By establishing this type of trust, the granter can ensure that their assets, including life insurance policies, continue to provide financial security for their family for years to come. The trust may be structured in a way that the Crummy withdrawal rights extend to subsequent generations. 4. Family Limited Partnership Trust: This form of trust combines the benefits of a limited partnership with the asset protection features of a trust. A Family Limited Partnership Trust can hold life insurance policies with First to Die and Survivorship Riders, while providing various tax advantages and asset management opportunities for the family. In conclusion, a Rhode Island Irrevocable Funded Life Insurance Trust with Beneficiaries Having Crummy Right of Withdrawal and First to Die Policy with Survivorship Rider is a powerful estate planning tool that allows for tax-efficient wealth transfer and asset protection. By exploring different variations of this trust structure, individuals can tailor the arrangement to their specific goals and circumstances.

Rhode Island Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider

Description

How to fill out Rhode Island Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

Have you been within a place where you will need paperwork for either enterprise or personal reasons almost every day? There are plenty of lawful document layouts accessible on the Internet, but discovering types you can rely isn`t straightforward. US Legal Forms gives a huge number of type layouts, much like the Rhode Island Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider, that are published to fulfill state and federal requirements.

Should you be presently knowledgeable about US Legal Forms web site and possess a merchant account, merely log in. Following that, you may download the Rhode Island Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider format.

Unless you offer an accounts and want to begin using US Legal Forms, follow these steps:

- Find the type you require and ensure it is to the proper city/region.

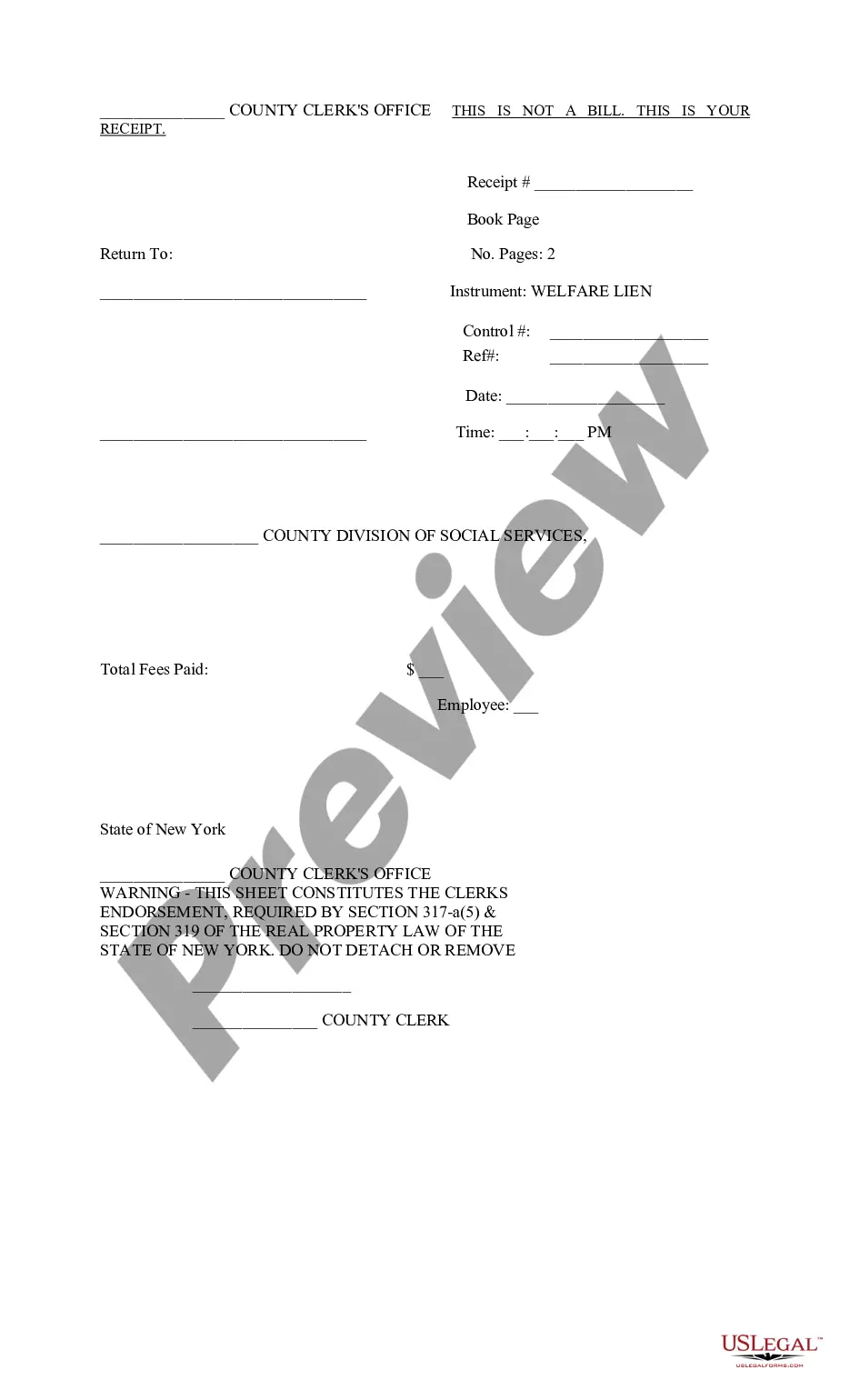

- Take advantage of the Review switch to review the form.

- Read the information to ensure that you have selected the proper type.

- If the type isn`t what you`re seeking, use the Look for industry to discover the type that suits you and requirements.

- Whenever you obtain the proper type, click Acquire now.

- Pick the costs plan you would like, submit the necessary information and facts to create your money, and pay money for your order making use of your PayPal or bank card.

- Select a handy data file file format and download your backup.

Get all of the document layouts you may have bought in the My Forms menu. You can obtain a further backup of Rhode Island Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider at any time, if possible. Just click on the essential type to download or produce the document format.

Use US Legal Forms, one of the most comprehensive assortment of lawful varieties, in order to save time as well as stay away from errors. The support gives expertly created lawful document layouts which can be used for a selection of reasons. Produce a merchant account on US Legal Forms and start creating your way of life a little easier.