Rhode Island Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Choosing the right legitimate file template could be a have difficulties. Needless to say, there are tons of web templates available on the Internet, but how would you obtain the legitimate type you will need? Make use of the US Legal Forms website. The support delivers thousands of web templates, like the Rhode Island Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, which you can use for enterprise and private demands. Each of the kinds are examined by professionals and meet up with state and federal demands.

When you are previously authorized, log in in your bank account and click on the Download button to have the Rhode Island Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust. Make use of bank account to search with the legitimate kinds you may have purchased formerly. Go to the My Forms tab of your respective bank account and acquire one more backup in the file you will need.

When you are a fresh end user of US Legal Forms, listed here are simple directions so that you can adhere to:

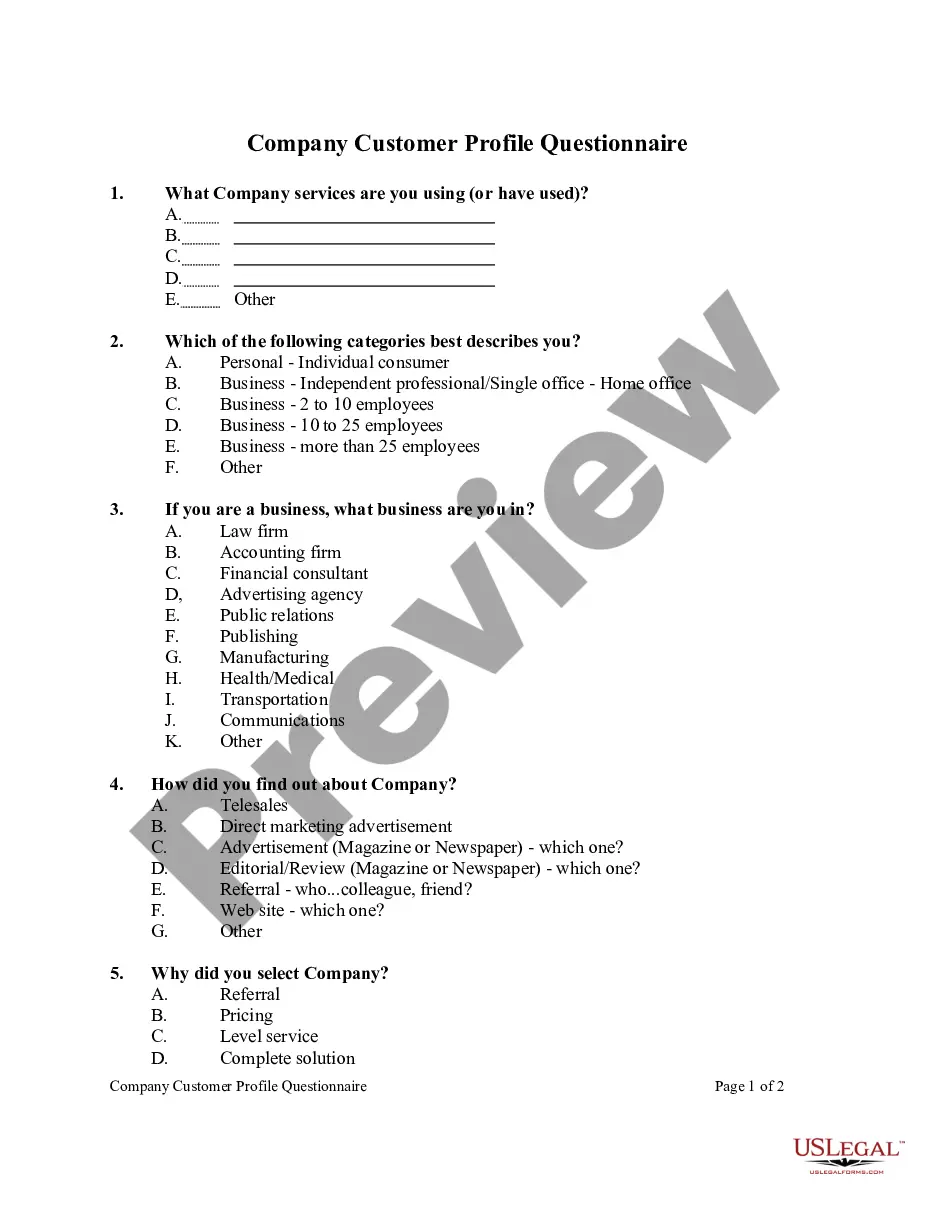

- Initial, make certain you have chosen the proper type for your area/state. You are able to examine the form using the Preview button and browse the form information to make sure this is the best for you.

- If the type fails to meet up with your expectations, use the Seach discipline to obtain the correct type.

- Once you are certain that the form is proper, select the Get now button to have the type.

- Choose the rates plan you desire and enter the essential details. Build your bank account and purchase the order making use of your PayPal bank account or bank card.

- Choose the document formatting and acquire the legitimate file template in your product.

- Comprehensive, modify and print and sign the attained Rhode Island Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

US Legal Forms will be the most significant local library of legitimate kinds in which you can find numerous file web templates. Make use of the company to acquire skillfully-created papers that adhere to status demands.

Form popularity

FAQ

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

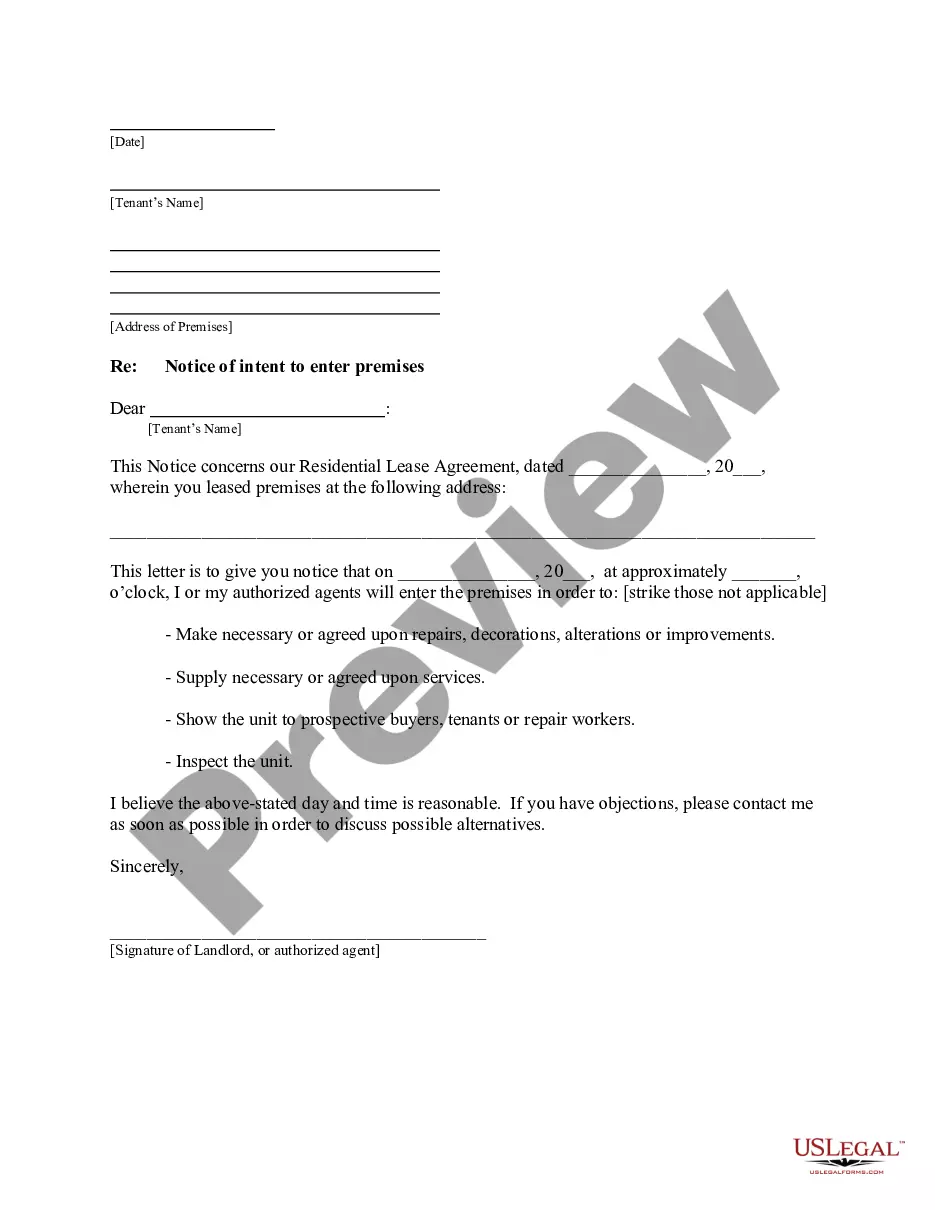

For those using life insurance to fund a trust, be sure you have made that clear via beneficiary designations. If the parents pass away, the life insurance policies would pay out to the trust. The designated trustee would then manage the trust assets on behalf of the minor children.

Is an irrevocable life insurance trust (ILIT) a grantor trust? A13. Usually, yes. Most ILITs are grantor trusts since these trust instruments typically provide that income may be applied toward the payment of premiums on policies insuring the grantor's life (or the grantor's spouse's life).

The revocable trust can be used to own the life insurance or be the beneficiary of the life insurance. The benefit of the revocable trust holding the life insurance is that if you were to become incapacitated, your successor trustee will be able to keep administering the life insurance policy on your behalf.

The grantor can also establish an irrevocable life insurance trust (usually a separate trust) to provide liquidity to the heirs if the he/she dies during the term of the GRAT.

GRATs may provide payments for a term of years or for the life of the Grantor.

A grantor retained annuity trust is a type of irrevocable gifting trust that allows a grantor or trustmaker to potentially pass a significant amount of wealth to the next generation with little or no gift tax cost. GRATs are established for a specific number of years.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

Trust-owned life insurance is a type of life insurance housed inside a trust. TOLI is commonly used by individuals as a tool for estate planning purposes. The assets bequeathed to beneficiaries that are housed within the trust can sidestep onerous tax obligations.