Rhode Island Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement in which the trust or transfers assets into a trust for the benefit of a chosen beneficiary that may include themselves. This type of trust provides the trust or with income that becomes payable to them after a specified period of time. The trust or relinquishes control of the assets upon creation of the trust, thus making it irrevocable. The Rhode Island law allows for different types of Irrevocable Trusts for the benefit of the trust or, each designed to cater to specific needs and circumstances. Some variations of these trusts include: 1. Rhode Island Asset Protection Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: This type of trust serves as a means to protect the trust or's assets from creditors and lawsuits while allowing them to receive income after a predetermined period. It enables the trust or to secure their wealth for the future, ensuring financial stability while still enjoying the benefits of income. 2. Rhode Island Special Needs Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: This particular trust is established to provide financial support and care for individuals with special needs or disabilities. The income generated from the trust allows the trust or to maintain their standard of living while ensuring that their loved one's special needs are adequately met. 3. Rhode Island Charitable Remainder Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: This type of trust allows the trust or to donate assets to a charitable organization while retaining an income stream from those assets for a specified period. It offers tax advantages, philanthropic fulfillment, and the ability to maintain a source of income. 4. Rhode Island Dynasty Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: This trust is established to provide long-term wealth preservation for future generations within a family. By transferring assets to the trust, the trust or ensures that their loved ones receive income after the specified period, avoiding estate taxes and protecting family wealth for an extended time. In summary, the Rhode Island Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal instrument offering various types of trusts to meet individual needs. Whether seeking asset protection, caring for a loved one with special needs, supporting charitable causes, or preserving wealth for future generations, these trusts provide the means to achieve these goals while enjoying income payments after the specified time.

Rhode Island Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

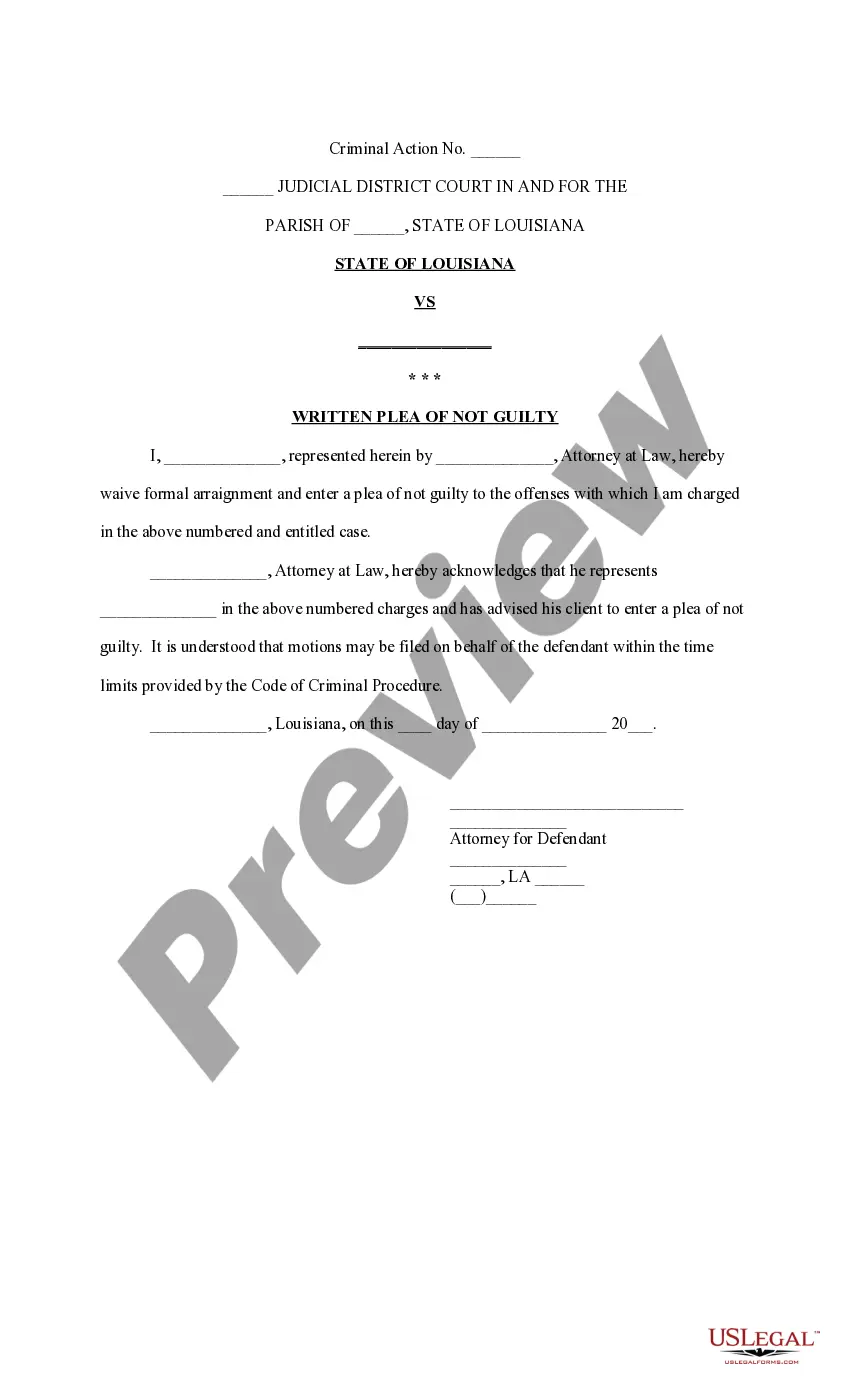

How to fill out Rhode Island Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

Are you presently in the situation that you need papers for either business or individual functions just about every working day? There are tons of lawful file layouts accessible on the Internet, but locating versions you can rely on isn`t effortless. US Legal Forms offers a huge number of type layouts, just like the Rhode Island Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, which are written to fulfill federal and state requirements.

In case you are presently informed about US Legal Forms internet site and also have a free account, simply log in. Following that, you are able to obtain the Rhode Island Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time format.

If you do not offer an accounts and need to begin to use US Legal Forms, adopt these measures:

- Obtain the type you will need and ensure it is for the correct area/region.

- Use the Review key to examine the shape.

- Browse the outline to ensure that you have chosen the proper type.

- In case the type isn`t what you`re searching for, utilize the Research industry to discover the type that meets your requirements and requirements.

- When you get the correct type, click Purchase now.

- Opt for the prices plan you would like, fill out the necessary details to generate your money, and buy the transaction with your PayPal or charge card.

- Decide on a practical document format and obtain your duplicate.

Locate all the file layouts you may have bought in the My Forms food list. You may get a additional duplicate of Rhode Island Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time whenever, if required. Just select the needed type to obtain or printing the file format.

Use US Legal Forms, one of the most considerable assortment of lawful kinds, in order to save some time and prevent errors. The support offers expertly manufactured lawful file layouts which can be used for a range of functions. Generate a free account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

After the grantor of an irrevocable trust dies, the trust continues to exist until the successor trustee distributes all the assets. The successor trustee is also responsible for managing the assets left to a minor, with the assets going into the child's sub-trust.

Retained Interest Trusts This is a trust where a grantor makes an irrevocable transfer of assets but reserves the right to receive income or enjoyment of those assets for a period of time. When the trust then subsequently terminates, the assets are passed on to others.

A credit shelter trust, also known as a bypass trust or a family trust, is a trust fund that allows the trustor to grant the recipients an amount of assets or funds up to the estate-tax exemption.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).