Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization is a formal notification issued by a company in Rhode Island to inform its stockholders about an upcoming special meeting. This gathering of stockholders is specifically organized to discuss and vote on a proposed recapitalization plan. Recapitalization refers to a corporate restructuring strategy aimed at altering a company's capital structure, most commonly involving a change in the company's debt-equity ratio. This process can include various actions like issuing new shares, retiring outstanding shares, issuing debt securities, or altering existing debt terms. Different types of Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization might include: 1. Common Stock Recapitalization: This type of recapitalization involves a change in the number of common shares outstanding and their associated rights and privileges. Shareholders will be asked to vote on proposed changes to the company's capital structure, which may impact their ownership and voting rights. 2. Preferred Stock Recapitalization: In some cases, a company may propose recapitalization specifically related to its preferred stock. This can involve modifying the terms, dividends, or other features associated with the preferred shares. Holders of preferred stock will receive a notice to attend the special meeting and participate in the decision-making process. 3. Debt-to-Equity Recapitalization: When a company aims to reduce its debt burden, it may propose a debt-to-equity recapitalization. Shareholders will be presented with a plan to convert a portion of the company's outstanding debt into equity, potentially diluting their ownership stake. This type of recapitalization is designed to improve the company's financial health and reduce its interest obligations. 4. Merger or Acquisition Recapitalization: If a company is pursuing a merger or acquisition, a recapitalization plan may be devised to support the transaction. Stockholders will receive a notice highlighting the proposed changes in the capital structure necessary to facilitate the deal. This may include issuing new shares, exchanging existing shares, or altering the financial arrangements between acquiring and target companies. The Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization is a crucial document that outlines the purpose and details of the meeting. It provides stockholders with an opportunity to review and assess the proposed changes before casting their votes. Stockholders' active participation and decision-making through this meeting help shape the future financial structure of the company.

Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

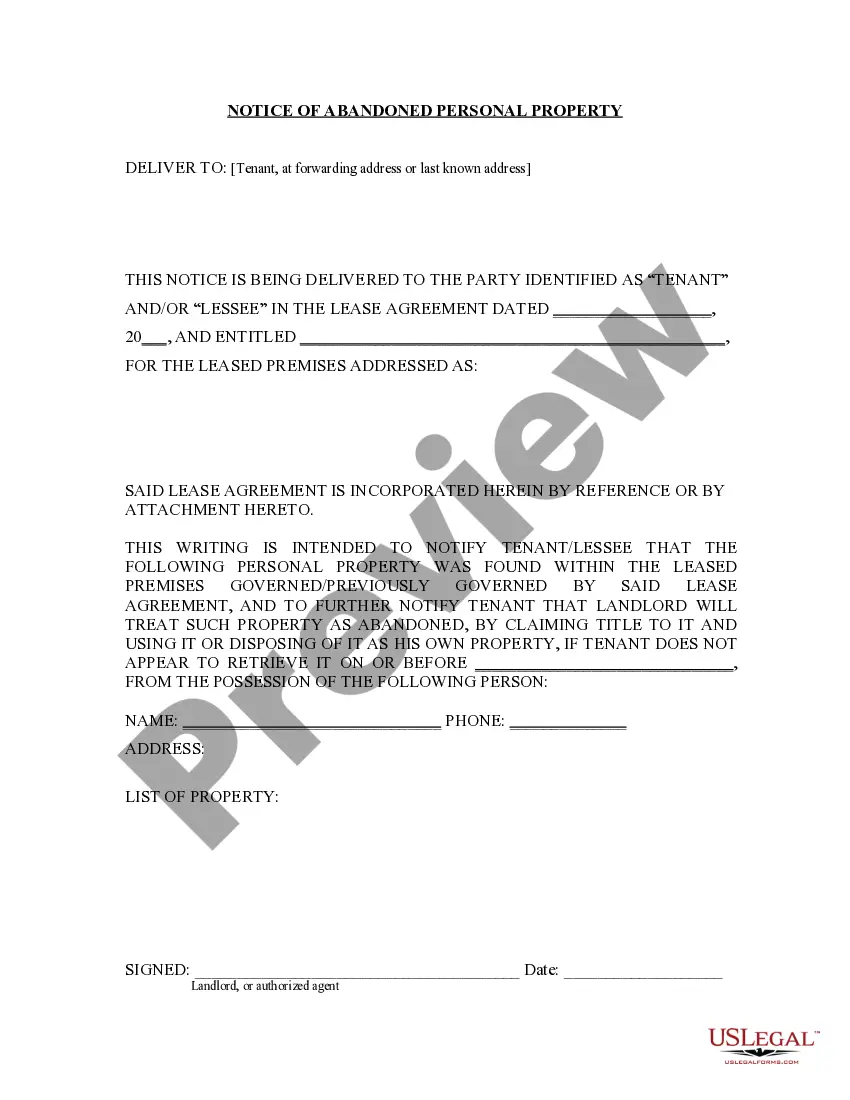

How to fill out Rhode Island Notice Of Special Stockholders' Meeting To Consider Recapitalization?

US Legal Forms - one of several most significant libraries of lawful forms in America - offers a variety of lawful record web templates you can obtain or printing. While using web site, you can get a large number of forms for enterprise and person purposes, categorized by types, states, or keywords.You can find the newest versions of forms such as the Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization in seconds.

If you have a monthly subscription, log in and obtain Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization from your US Legal Forms local library. The Obtain button will show up on every single type you view. You have accessibility to all in the past saved forms in the My Forms tab of your account.

If you would like use US Legal Forms the very first time, allow me to share straightforward guidelines to obtain began:

- Be sure you have selected the right type for your personal town/area. Click on the Preview button to examine the form`s information. See the type outline to ensure that you have chosen the right type.

- If the type doesn`t satisfy your needs, use the Search field towards the top of the monitor to get the one who does.

- In case you are pleased with the shape, verify your option by clicking the Get now button. Then, pick the costs program you want and offer your accreditations to sign up for an account.

- Method the financial transaction. Use your bank card or PayPal account to accomplish the financial transaction.

- Select the format and obtain the shape on your own gadget.

- Make modifications. Fill out, edit and printing and indicator the saved Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization.

Every template you put into your account lacks an expiration date and is also your own permanently. So, if you would like obtain or printing another version, just go to the My Forms section and then click in the type you want.

Obtain access to the Rhode Island Notice of Special Stockholders' Meeting to Consider Recapitalization with US Legal Forms, one of the most comprehensive local library of lawful record web templates. Use a large number of skilled and status-specific web templates that meet your company or person requirements and needs.