Rhode Island Inquiry of Credit Cardholder Concerning Billing Error is a legal procedure that allows credit cardholders in Rhode Island to dispute any errors or discrepancies found on their credit card bills. It is essential to address these concerns promptly to protect your rights as a consumer and ensure accurate billing. When facing a billing error, Rhode Island credit cardholders have the right to request an inquiry from their credit card company. This inquiry will investigate the disputed charge(s) and provide a resolution within a reasonable time frame. It is crucial to understand the different types of Rhode Island inquiries of credit cardholder concerning billing errors to effectively navigate the dispute process. There are several common types of billing errors that Rhode Island credit cardholders may encounter: 1. Unauthorized Charges: These occur when a cardholder identifies charges on their credit card statement that they did not authorize or make. Unauthorized charges can result from identity theft, stolen card details, or fraudulent activities. 2. Incorrect Charge Amounts: This type of billing error involves inaccurately billed amounts. It may include double charges, incorrect currency conversions, incorrect sales tax calculations, or unexpected fees or surcharges. 3. Merchandise or Service Issues: Sometimes, credit cardholders may discover discrepancies in goods or services received. These billing errors can involve non-delivery, damaged merchandise, incomplete services, or unfulfilled warranties. 4. Billing Disputes: Billing disputes arise when credit cardholders challenge the accuracy of charges made by merchants. These disputes may involve overcharges, recurring charges for cancelled subscriptions, or services not provided as agreed. To initiate a Rhode Island Inquiry of Credit Cardholder Concerning Billing Error, follow these steps: 1. Act Promptly: Notify your credit card company immediately upon discovering any billing error. Delaying your notification might result in reduced legal protection or limited time to rectify the issue. 2. Gather Documentation: Collect all relevant documents to support your claim. This may include credit card statements, receipts, correspondence with the merchant, and any other evidence. 3. Draft a Dispute Letter: Write a concise and clear dispute letter to your credit card company, detailing the nature of the error, the disputed charges, and the desired resolution. Ensure to include all essential information, such as your account number, contact details, and a copy of the supporting documentation. 4. Send the Dispute Letter: Send the dispute letter using a traceable method, such as certified mail with a return receipt request. Retain copies of all correspondence for your records. 5. Follow Up: Allow the credit card company a reasonable time to investigate and respond. In Rhode Island, federal laws stipulate that the credit card company must acknowledge your complaint within 30 days and resolve it within two billing cycles (not exceeding 90 days). It is crucial to stay proactive throughout the Rhode Island Inquiry of Credit Cardholder Concerning Billing Error process. If you are unsatisfied with the credit card company's resolution, or they fail to respond within the specified timeframe, you can escalate your claim to the Rhode Island Department of Business Regulation (DBR) or seek legal advice to protect your rights. Remember, Rhode Island credit cardholders have legal rights to dispute billing errors and should take immediate action. By understanding the different types of billing errors and following the necessary steps, you can successfully resolve credit card billing discrepancies and safeguard your financial interests.

Rhode Island Inquiry of Credit Cardholder Concerning Billing Error

Description

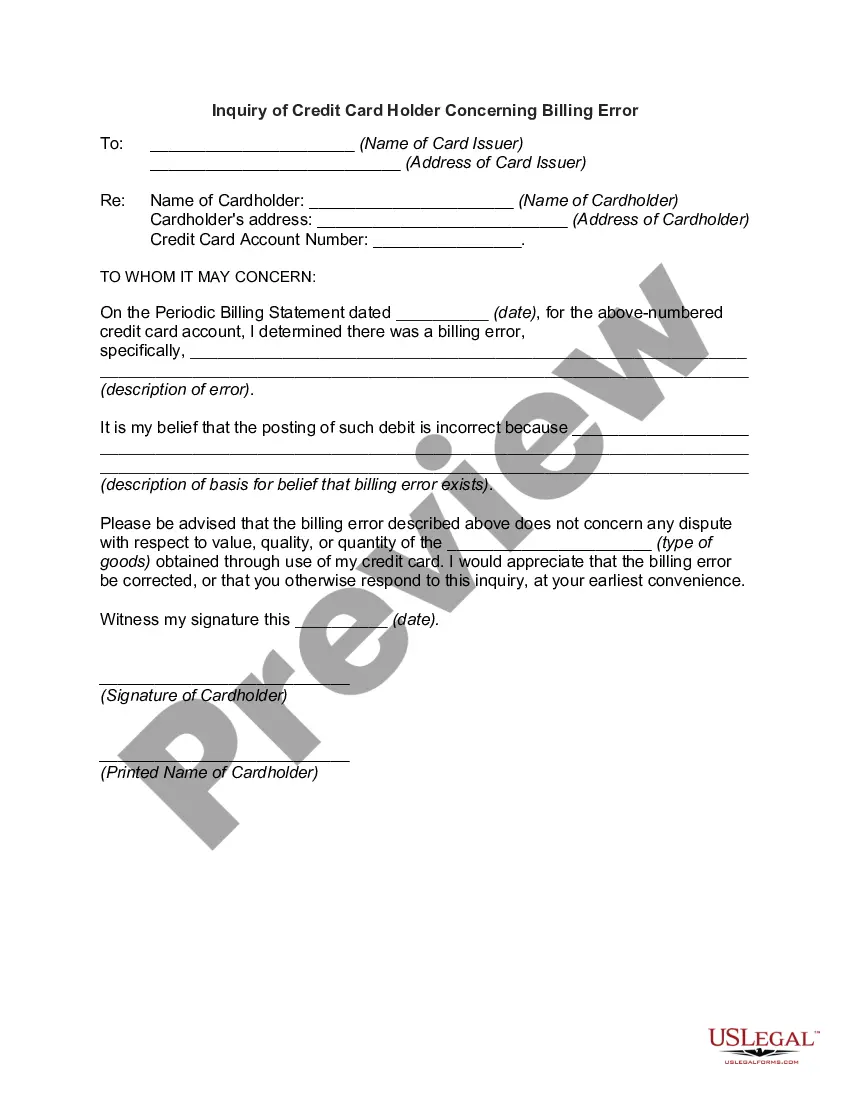

How to fill out Rhode Island Inquiry Of Credit Cardholder Concerning Billing Error?

US Legal Forms - among the largest libraries of legal kinds in the States - gives a wide array of legal file web templates you can download or printing. Utilizing the internet site, you can find thousands of kinds for business and individual uses, categorized by types, states, or key phrases.You can get the most up-to-date models of kinds just like the Rhode Island Inquiry of Credit Cardholder Concerning Billing Error within minutes.

If you already have a subscription, log in and download Rhode Island Inquiry of Credit Cardholder Concerning Billing Error from your US Legal Forms library. The Download switch can look on every single form you perspective. You gain access to all earlier acquired kinds from the My Forms tab of your profile.

If you wish to use US Legal Forms initially, listed below are basic directions to obtain began:

- Make sure you have selected the proper form to your city/county. Go through the Preview switch to analyze the form`s content material. Browse the form outline to actually have chosen the right form.

- If the form doesn`t fit your specifications, take advantage of the Lookup field on top of the screen to discover the one that does.

- When you are happy with the shape, confirm your decision by visiting the Get now switch. Then, choose the rates program you like and provide your accreditations to sign up for an profile.

- Process the purchase. Utilize your Visa or Mastercard or PayPal profile to perform the purchase.

- Pick the formatting and download the shape on your device.

- Make changes. Fill out, revise and printing and indicator the acquired Rhode Island Inquiry of Credit Cardholder Concerning Billing Error.

Every single template you put into your money does not have an expiration date and is your own property eternally. So, in order to download or printing another backup, just visit the My Forms area and click in the form you want.

Get access to the Rhode Island Inquiry of Credit Cardholder Concerning Billing Error with US Legal Forms, the most extensive library of legal file web templates. Use thousands of skilled and state-certain web templates that meet up with your company or individual requires and specifications.