Rhode Island Breakdown of Savings for Budget and Emergency Fund: A Comprehensive Overview Introduction: In this article, we will delve into the concept of saving funds to create a budget and emergency fund in Rhode Island. Rhode Island, being the smallest state in the United States, provides unique opportunities and challenges when it comes to managing personal finances. We will explore the breakdown of savings, emphasizing its importance, different types of savings, and how to allocate funds for both budgetary needs and unexpected emergencies. Importance of Savings in Rhode Island: Saving funds is crucial for Rhode Island residents as it helps maintain financial stability and cope with unexpected situations. Whether it's a sudden medical expense, a vehicle repair, or temporary unemployment, having an emergency fund can make all the difference in staying afloat and avoiding financial turmoil. Moreover, creating a sound budget using savings allows individuals and families to efficiently manage their income, plan for future expenses, and attain their financial goals. Breakdown of Savings: 1. Emergency Fund: An emergency fund is a designated reserve that helps cover unforeseen expenses. It should ideally cover at least three to six months of essential living expenses. In Rhode Island, this may include housing costs (mortgage or rent), utilities, transportation, food, and any other crucial expenses. Setting aside a portion of your savings for an emergency fund is of utmost importance to ensure financial security during unexpected events. 2. Short-Term Savings: Short-term savings refers to funds set aside for upcoming expenses within a few months to a year. These could be planned events such as vacations, home renovations, or purchasing new appliances. Allocating a portion of your income towards short-term savings enables you to avoid accumulating debt or disrupting your long-term financial plans. 3. Long-Term Savings: Long-term savings are aimed at achieving larger financial goals such as buying a house, ensuring a comfortable retirement, or funding a child's education. Contributing regularly to long-term savings accounts such as a 401(k), IRA, or other investment instruments ensures a secure future, even in a state like Rhode Island where the cost of living can be relatively high. 4. Rhode Island Budget Allocation: While savings serve as a safety net, budgeting ensures disciplined financial management. Create a budget by considering your monthly income and expenses. In Rhode Island, it is important to account for housing costs, healthcare expenses, transportation, groceries, taxes, and entertainment. Analyze your spending habits and cut down on non-essential expenses or find ways to save on essentials. Allocating a specific portion of your income to each expenditure category will help eliminate financial stress and foster responsible spending habits. Conclusion: Saving funds and creating a breakdown of savings in Rhode Island is vital for maintaining financial stability and being prepared for unexpected situations. Prioritizing an emergency fund, short-term savings, and long-term savings empowers individuals and families to have a safety net while also working towards achieving their financial goals. By diligently budgeting and wisely allocating funds, Rhode Island residents can navigate the challenges of managing their personal finances and secure a financially sound future for themselves.

Rhode Island Breakdown of Savings for Budget and Emergency Fund

Description

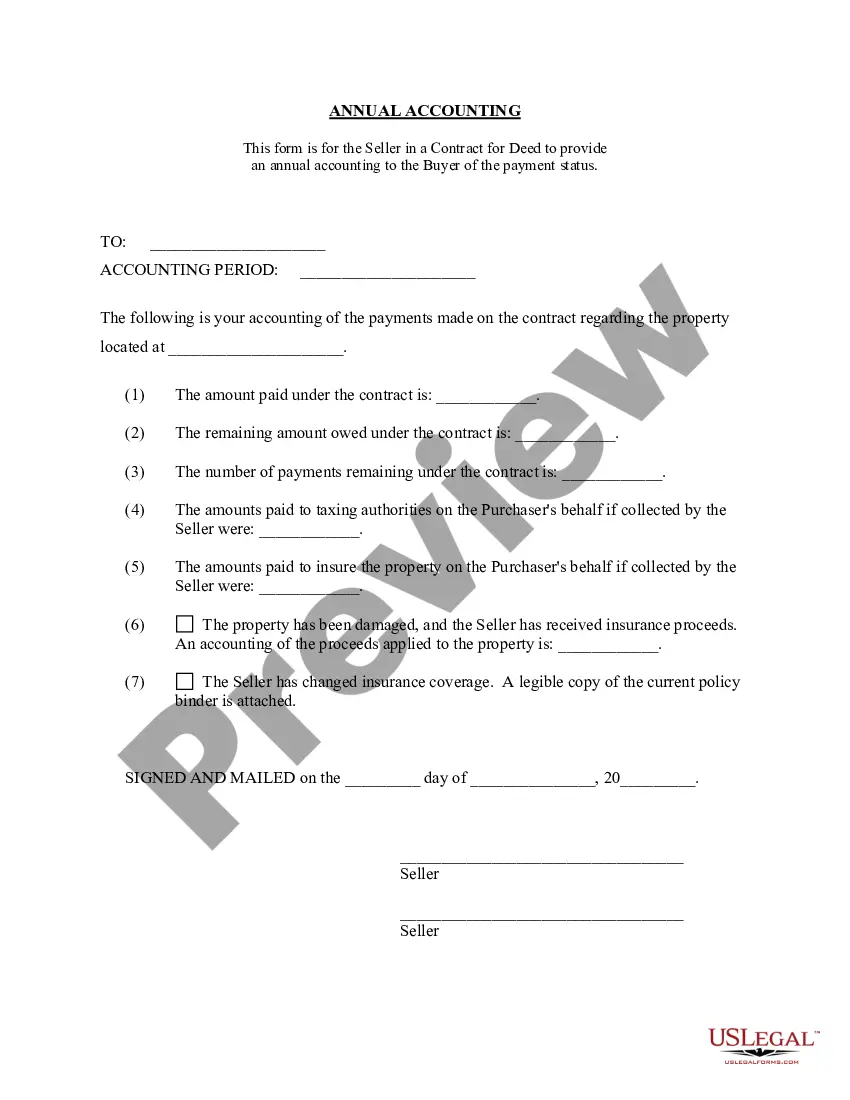

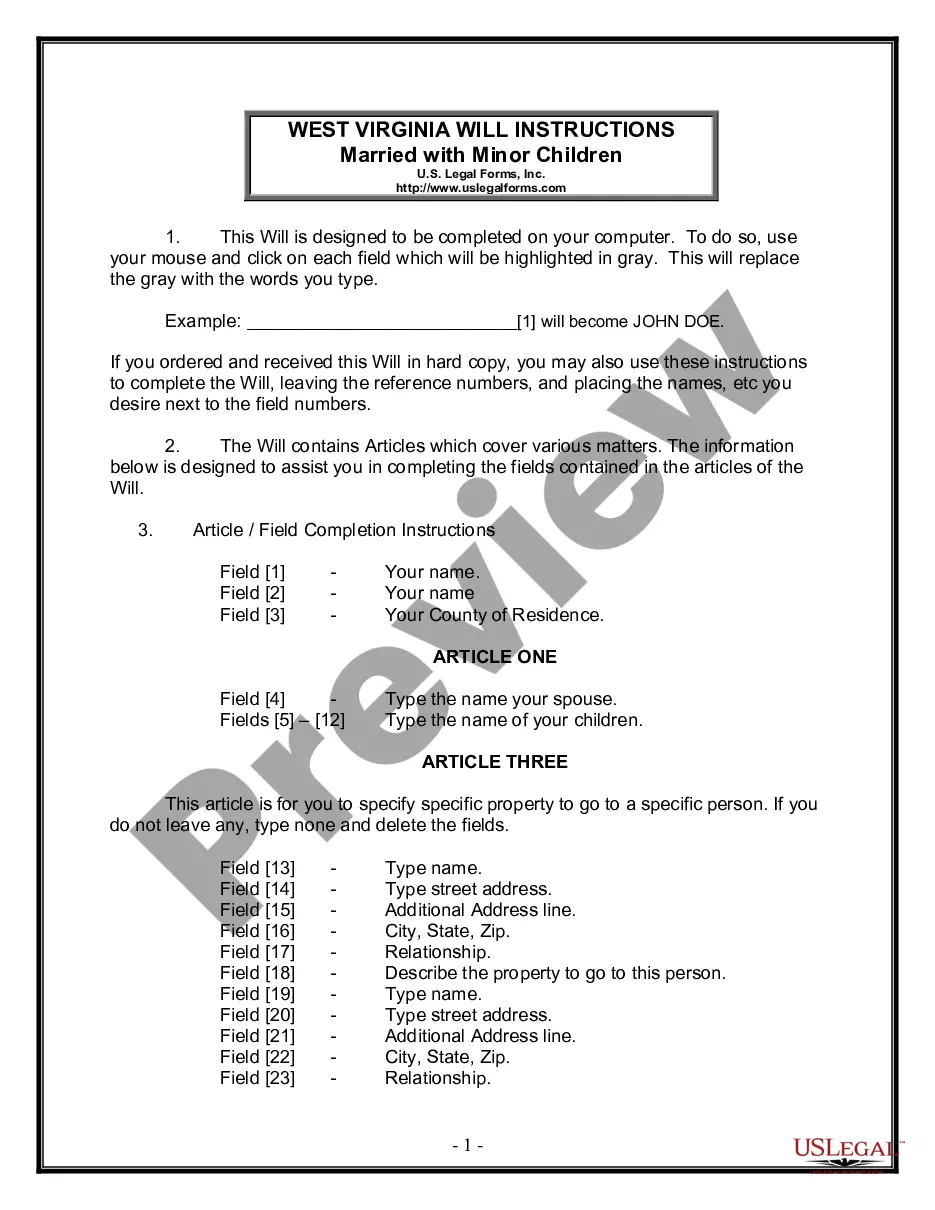

How to fill out Rhode Island Breakdown Of Savings For Budget And Emergency Fund?

Choosing the right lawful document format could be a have difficulties. Needless to say, there are a variety of templates available on the net, but how would you get the lawful form you require? Use the US Legal Forms website. The support gives 1000s of templates, like the Rhode Island Breakdown of Savings for Budget and Emergency Fund, that you can use for company and personal needs. All of the types are checked out by pros and meet up with federal and state requirements.

If you are presently registered, log in to the account and click on the Obtain key to have the Rhode Island Breakdown of Savings for Budget and Emergency Fund. Make use of your account to look from the lawful types you possess bought formerly. Proceed to the My Forms tab of the account and acquire an additional duplicate of your document you require.

If you are a whole new customer of US Legal Forms, listed here are straightforward guidelines that you can stick to:

- Very first, make sure you have chosen the proper form for your personal area/state. You may examine the form while using Preview key and look at the form information to guarantee this is the best for you.

- In the event the form does not meet up with your requirements, use the Seach field to discover the right form.

- When you are positive that the form is acceptable, click on the Buy now key to have the form.

- Select the pricing program you need and enter in the needed information. Create your account and purchase an order utilizing your PayPal account or charge card.

- Choose the file structure and obtain the lawful document format to the device.

- Full, revise and print and indicator the obtained Rhode Island Breakdown of Savings for Budget and Emergency Fund.

US Legal Forms is definitely the greatest library of lawful types in which you can find a variety of document templates. Use the service to obtain appropriately-created documents that stick to status requirements.