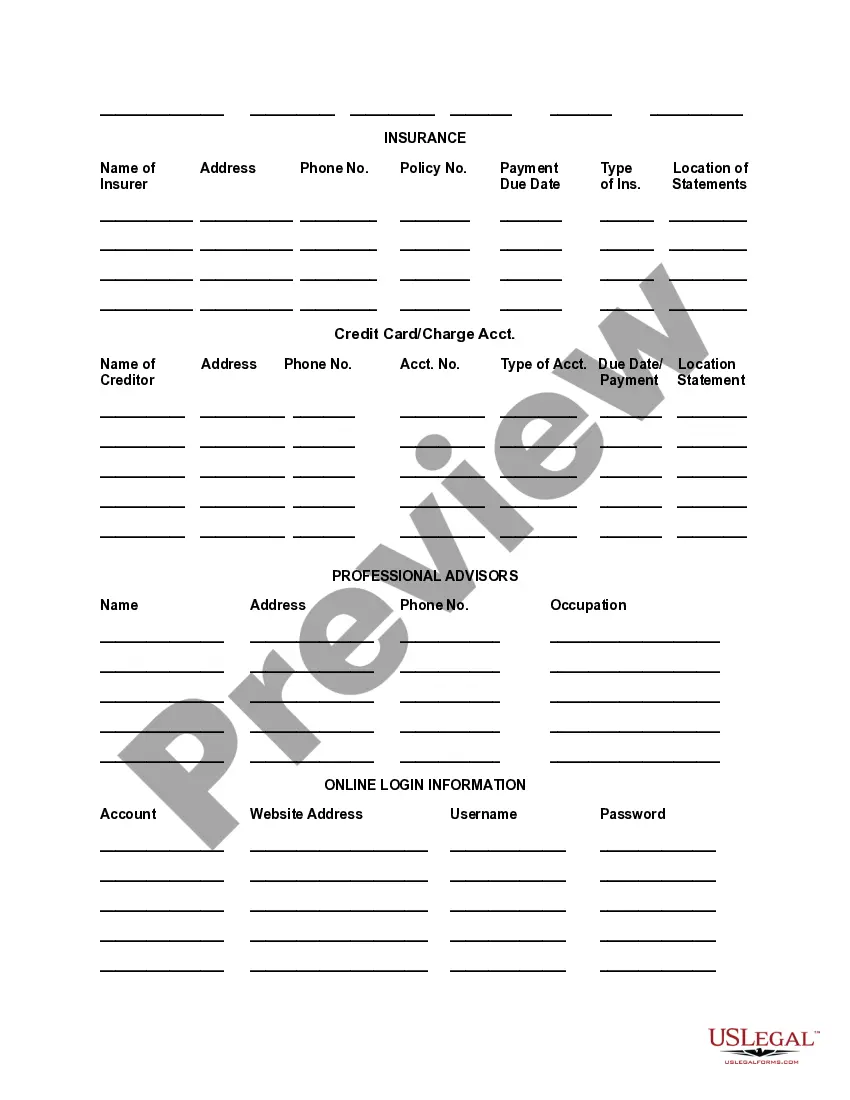

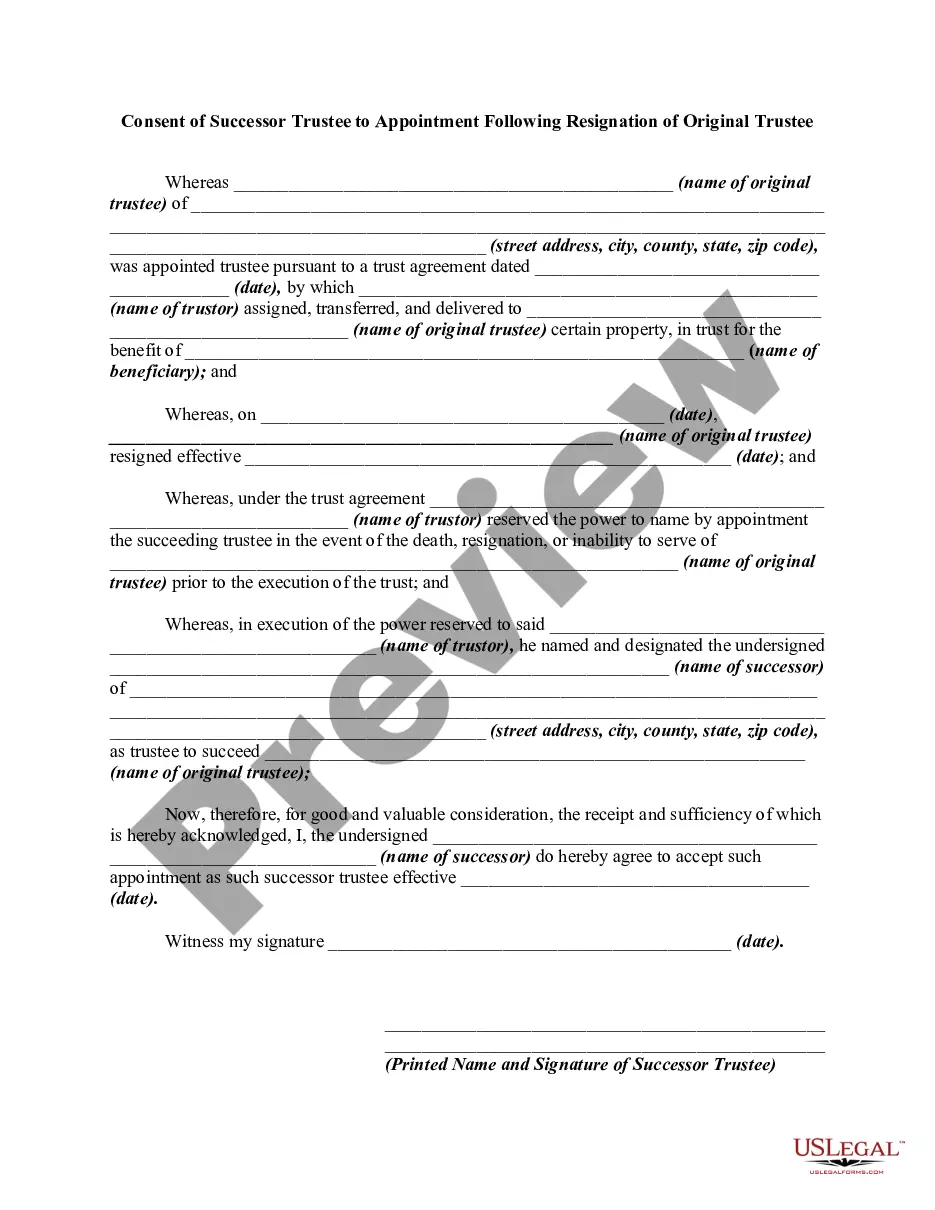

Rhode Island Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

If you need to finalize, download, or create legal document templates, utilize US Legal Forms, the leading collection of legal documents available online.

Employ the website's user-friendly and convenient search feature to find the documents you need.

A range of templates for business and personal purposes are organized by categories and titles, or keywords.

Step 4. Once you have found the document you need, click the Get now button. Choose the pricing plan that suits you and enter your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, edit, and print or sign the Rhode Island Personal Financial Information Organizer. Every legal document template you acquire is yours indefinitely. You have access to every document you obtained in your account. Choose the My documents section and select a form to print or download again.

- Utilize US Legal Forms to locate the Rhode Island Personal Financial Information Organizer with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Rhode Island Personal Financial Information Organizer.

- You can also retrieve forms you previously obtained under the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the document's details. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document template.