Rhode Island Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Jury Instruction - 10.10.6 Section 6672 Penalty?

Discovering the right authorized papers design can be a have a problem. Of course, there are plenty of layouts available on the Internet, but how would you obtain the authorized develop you will need? Utilize the US Legal Forms web site. The assistance gives a large number of layouts, like the Rhode Island Jury Instruction - 10.10.6 Section 6672 Penalty, which you can use for company and private needs. Every one of the types are examined by pros and fulfill state and federal specifications.

In case you are already signed up, log in for your profile and click on the Down load button to obtain the Rhode Island Jury Instruction - 10.10.6 Section 6672 Penalty. Utilize your profile to check with the authorized types you might have acquired earlier. Check out the My Forms tab of your profile and obtain yet another duplicate in the papers you will need.

In case you are a fresh end user of US Legal Forms, listed here are basic recommendations that you can adhere to:

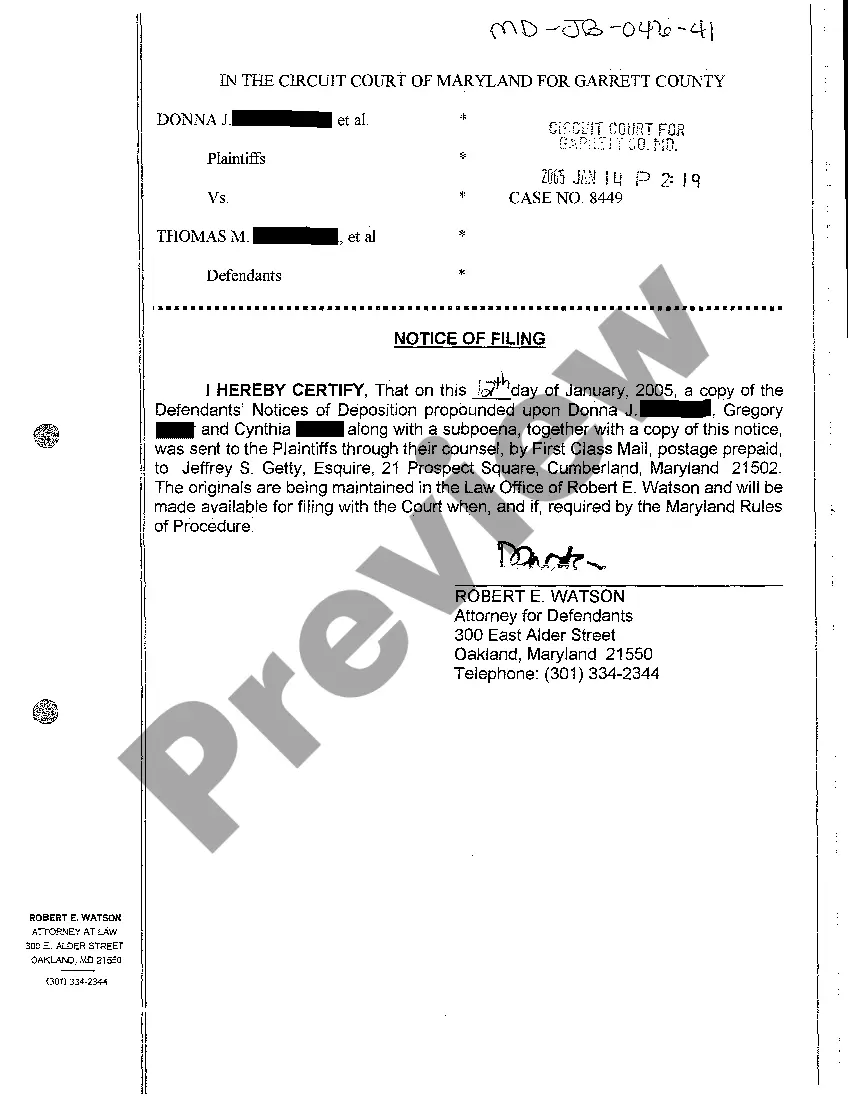

- Initial, be sure you have selected the right develop for your town/area. You are able to look over the shape making use of the Preview button and study the shape information to ensure it is the right one for you.

- In the event the develop fails to fulfill your requirements, make use of the Seach discipline to find the proper develop.

- When you are certain that the shape is proper, click the Get now button to obtain the develop.

- Select the rates program you desire and enter the required information and facts. Create your profile and purchase an order with your PayPal profile or credit card.

- Select the document format and obtain the authorized papers design for your gadget.

- Complete, edit and printing and sign the acquired Rhode Island Jury Instruction - 10.10.6 Section 6672 Penalty.

US Legal Forms is definitely the largest local library of authorized types for which you can find different papers layouts. Utilize the company to obtain professionally-made paperwork that adhere to state specifications.