A Rhode Island Master Finance Lease Agreement is a legally binding contract designed for businesses in Rhode Island that want to lease equipment or asset financing options. It allows businesses to acquire the necessary equipment, machinery, or other assets they need without the hefty upfront costs associated with purchasing. The Rhode Island Master Finance Lease Agreement typically outlines the terms and conditions of the lease, including the payment schedule, duration of the lease, interest rates, and any additional fees or charges. It provides the lessor (the financing company) with the necessary legal protections and rights, while also ensuring that the lessee (the business) benefits from the use of the equipment during the lease term. There are different types of Rhode Island Master Finance Lease Agreements available, depending on the specific needs and requirements of the business: 1. Fixed-Term Lease: This type of lease agreement has a predetermined duration, often ranging from 12 months to several years. It provides stability and predictability for both the lessor and lessee. 2. Fair Market Value (FMV) Lease: In this lease agreement, the lessee has the option to purchase the equipment at its current fair market value at the end of the lease term. This type of lease works well for businesses that anticipate the need for equipment upgrades or replacements. 3. Dollar Buyout Lease: With this lease, the lessee has the option to purchase the equipment at the end of the lease term for a predetermined amount, usually $1. This type of lease is often used when the lessee intends to keep the equipment at the end of the lease. 4. Capital Lease: A capital lease is similar to a loan, where the lessee assumes ownership of the equipment and accounts for it as a capital asset on their financial statements. This type of lease is often used when the lessee intends to keep the equipment in the long term and wants to take depreciation benefits. Rhode Island Master Finance Lease Agreements provide businesses in Rhode Island the flexibility to acquire essential equipment without tying up capital. It is crucial for businesses to carefully review and understand the terms and conditions of the lease agreement before entering into any financial commitment. Consulting with legal and financial professionals can help ensure that the lease agreement aligns with the business's specific needs and goals.

Rhode Island Master Finance Lease Agreement

Description

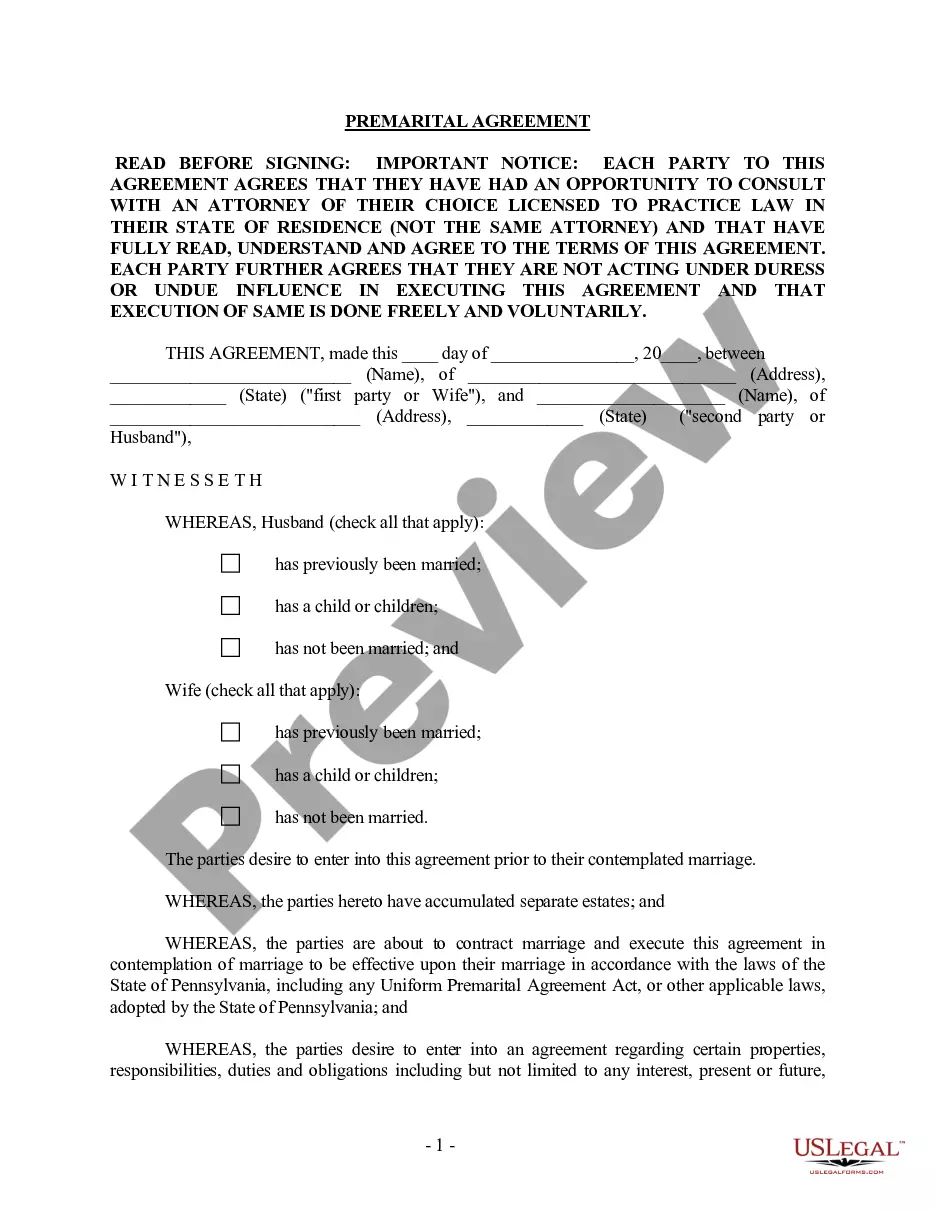

How to fill out Rhode Island Master Finance Lease Agreement?

If you want to total, download, or print out legitimate file web templates, use US Legal Forms, the largest assortment of legitimate types, that can be found on-line. Utilize the site`s easy and hassle-free look for to find the paperwork you need. Numerous web templates for business and personal uses are categorized by classes and claims, or key phrases. Use US Legal Forms to find the Rhode Island Master Finance Lease Agreement within a handful of mouse clicks.

If you are presently a US Legal Forms client, log in in your bank account and click on the Obtain key to obtain the Rhode Island Master Finance Lease Agreement. You may also entry types you earlier delivered electronically within the My Forms tab of the bank account.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the form for your right town/region.

- Step 2. Use the Preview method to look through the form`s content. Never neglect to read through the information.

- Step 3. If you are not satisfied using the kind, use the Search discipline near the top of the display to find other types of the legitimate kind design.

- Step 4. Upon having discovered the form you need, click the Acquire now key. Pick the costs program you like and add your references to register on an bank account.

- Step 5. Approach the transaction. You should use your charge card or PayPal bank account to perform the transaction.

- Step 6. Find the format of the legitimate kind and download it on the product.

- Step 7. Complete, modify and print out or indication the Rhode Island Master Finance Lease Agreement.

Every single legitimate file design you buy is the one you have forever. You might have acces to every kind you delivered electronically within your acccount. Go through the My Forms portion and pick a kind to print out or download yet again.

Remain competitive and download, and print out the Rhode Island Master Finance Lease Agreement with US Legal Forms. There are many expert and condition-certain types you may use for your personal business or personal needs.

Form popularity

FAQ

12 Things You Need to Understand About LeasesLandlord Contact Info. Who is your point of contact for the property?Break Lease Clause.Repairs on Your Rental.Property Maintenance.Are Pets Allowed?Automatic Lease Renewal.Additional Fees Associated with the Rent.Home Owner's Association.More items...

A lease is a legal, binding contract outlining the terms under which one party agrees to rent property owned by another party. It guarantees the tenant or lessee use of the property and guarantees the property owner or landlord regular payments for a specified period in exchange.

The three main types of leasing are finance leasing, operating leasing and contract hire.Finance leasing.Operating leasing.Contract hire.

File a copy of the signed lease agreement with the Office of the County Registrar (known as the County Recorder or Deed Registry in some states) in the county where the rental property resides. The office may charge a nominal filing fee for registration, which you must pay at the time of filing.

Most leases and rental agreements include a clause in which the tenant agrees that the premises are in habitable (livable) condition and promises to alert the landlord to any defective or dangerous condition. Tenant's repair and maintenance responsibilities.

A primary tenant is a tenant who has a direct relationship with the landlord while the other subtenants do not. Primary tenants are often referred to as master tenants. This might be someone who has moved out and brought in a new tenant under a Sublease Agreement, but remains legally responsible for the lease.

A written lease agreement must contain:The names and addresses of both parties;The description of the property;The rental amount and reasonable escalation;The frequency of rental payments, i.e. monthly;The amount of the deposit;The lease period;The notice period for termination of contract;More items...

These are eight clauses that a landlord should include in a lease agreement in California:Security Deposits.Specific Payment Requirements.Late Rent Fees.Rent Increases.Notice of Entry.Rental Agreement Disclosures.Gas and Electricity Disclosure.Recreational Marijuana and Rentals.

A master lease agreement is legal document where you lease an income-producing property as a single tenant-landlord and sublease to two or more tenants to produce income. One common example are shopping malls, which have many stores renting space from one landlord.

10 THINGS EVERY RENTAL AGREEMENT SHOULD INCLUDE10 THINGS EVERY RENTAL AGREEMENT SHOULD INCLUDE. Category Advice.Tenant Information.Period of Tenancy.Limits on Numbers of Tenants.Rental Amount and Conditions.Other Amounts Due.Restrictions on Illegal or Unacceptable Activity on the Property.Access.More items...?