Rhode Island Credit Approval Form

Category:

State:

Multi-State

Control #:

US-13284BG

Format:

Word;

Rich Text

Instant download

Description

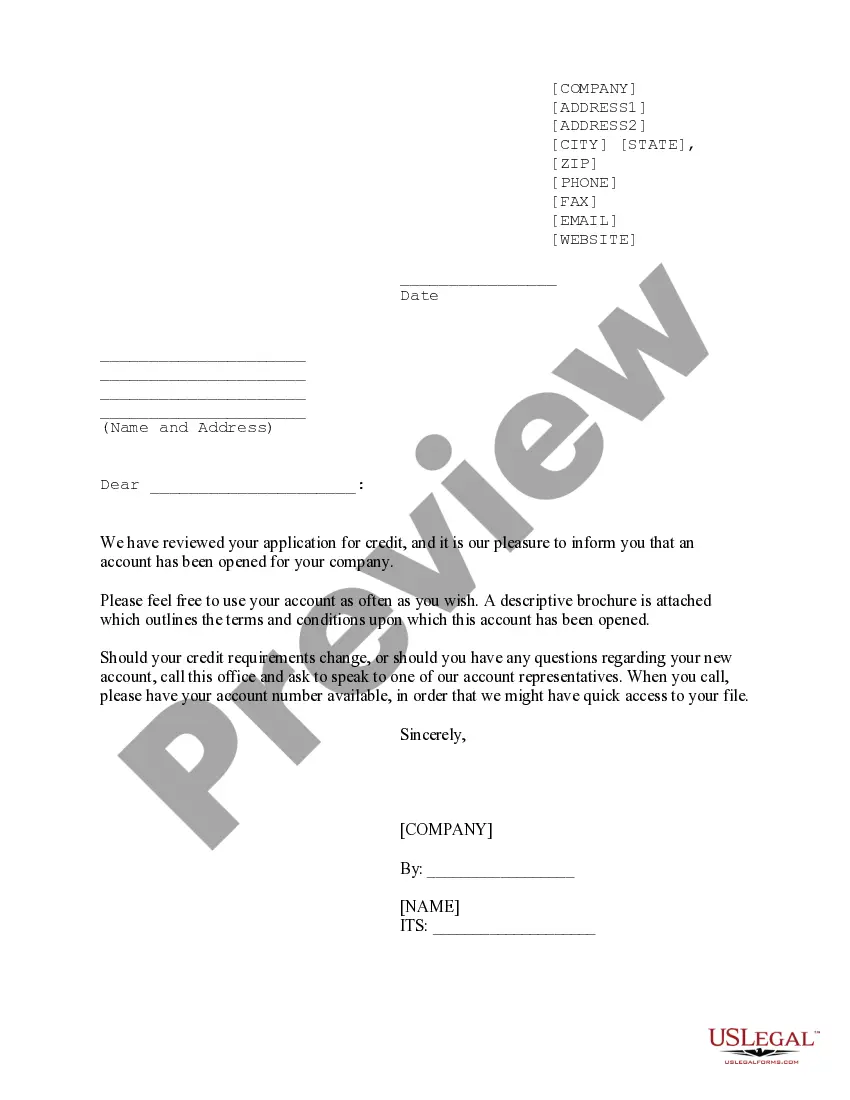

Credit approval is the process a business or an individual undergoes to become eligible for a loan or pay for goods and services over an extended period.

How to fill out Credit Approval Form?

Are you in a situation where you frequently require documents for business or specific needs.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, including the Rhode Island Credit Approval Form, that comply with federal and state regulations.

Pick a convenient format and download your version.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Rhode Island Credit Approval Form anytime, if necessary. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Rhode Island Credit Approval Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is appropriate for your city/state.

- Use the Preview button to review the document.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs.

- Once you locate the correct form, click Purchase now.

- Choose the pricing plan you prefer, fill out the required information to create your account, and pay for the order using your PayPal or credit card.