Rhode Island Agreement for Sale of Assets of Corporation is a legal contract that outlines the terms and conditions under which a corporation intends to sell its assets to another party. This agreement serves as a comprehensive document detailing the transfer of assets and ensures that both the selling corporation and the buyer are protected throughout the process. In Rhode Island, there are various types of Agreements for Sale of Assets of Corporation available, tailored to specific circumstances and requirements. These include: 1. Asset Purchase Agreement: This is the most common type of agreement used when a corporation wishes to sell a specific set of assets to another entity. It typically includes provisions for the transfer of assets such as real estate, intellectual property, equipment, contracts, and inventory. 2. Stock Purchase Agreement: This agreement involves the sale of the corporation's stock to a buyer, effectively transferring ownership of the entire corporation. The buyer assumes control of the corporation, including its assets and liabilities. 3. Merger Agreement: In some cases, the Agreement for Sale of Assets of Corporation may take the form of a merger agreement. This type of agreement combines two corporations into a single entity, wherein one corporation's assets are consolidated or merged with another. Regardless of the specific type, a Rhode Island Agreement for Sale of Assets of Corporation generally includes the following key elements: 1. Identification of the Parties: The agreement starts by identifying the selling corporation and the buyer, along with their respective addresses and contact information. 2. Description of Assets: The agreement provides a detailed description of the assets being sold, including their value, condition, and any specific terms or conditions associated with their transfer. 3. Purchase Price and Payment Terms: This section outlines the agreed-upon purchase price for the assets and the method of payment, whether it is a lump sum, installments, or a combination of both. It may also include provisions for adjustments to the purchase price based on various factors like inventory valuation or contingent liabilities. 4. Representations and Warranties: Both parties provide declarations regarding the accuracy and completeness of the information provided, ensuring that there are no hidden liabilities or undisclosed issues with the assets. 5. Conditions of Closing: The agreement specifies the conditions that need to be fulfilled for the transaction to be completed, such as obtaining necessary approvals, consents, or waivers. 6. Indemnification and Limitation of Liability: This section outlines the rights and responsibilities of both parties in case of any claims, damages, or losses arising from the sale of assets. 7. Governing Law and Jurisdiction: The agreement states that it is governed by the laws of Rhode Island and specifies the jurisdiction where any disputes or legal actions should be resolved. It is crucial to consult with a qualified attorney to draft or review a Rhode Island Agreement for Sale of Assets of Corporation, as it is a legally binding document that protects the interests of all parties involved.

Rhode Island Agreement for Sale of Assets of Corporation

Description

How to fill out Agreement For Sale Of Assets Of Corporation?

If you require to sum up, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Take advantage of the site’s user-friendly and efficient search function to locate the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to find the Rhode Island Agreement for Sale of Assets of Corporation with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you obtained within your account.

Be proactive and download, and print the Rhode Island Agreement for Sale of Assets of Corporation with US Legal Forms. There are numerous professional and state-specific forms available to meet your business or personal needs.

- If you are already a US Legal Forms subscriber, Log In to your account and click on the Download button to access the Rhode Island Agreement for Sale of Assets of Corporation.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s contents. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Rhode Island Agreement for Sale of Assets of Corporation.

Form popularity

FAQ

The statute of limitations in Rhode Island varies depending on the type of case. For most contract disputes, including those involving a Rhode Island Agreement for Sale of Assets of Corporation, you generally have ten years. Familiarizing yourself with these timelines helps ensure you take action promptly if needed.

The statute of limitations for written contracts in Rhode Island is ten years. This period starts when the contract is breached. Understanding this timeline is essential when dealing with any legal agreement, including a Rhode Island Agreement for Sale of Assets of Corporation, to avoid losing the right to seek legal recourse.

In Rhode Island, you typically have ten years to file a lawsuit after a breach of contract. However, the timing can depend on the specific terms of the agreement, including any statutes involved. In the context of a Rhode Island Agreement for Sale of Assets of Corporation, it's vital to consult legal guidance to ensure your claims are timely and valid.

To start an S Corporation in Rhode Island, you must first file Articles of Incorporation with the state. After approval, you should apply for S Corporation status from the IRS by submitting Form 2553. By aligning your structure with a Rhode Island Agreement for Sale of Assets of Corporation, you can ensure that your corporation meets all operational needs and legal requirements.

The approval for selling all the assets of a corporation typically requires a majority vote from the board of directors. Additionally, shareholders may need to approve the sale depending on the corporation's bylaws. When drafting a Rhode Island Agreement for Sale of Assets of Corporation, ensure that you follow the appropriate governance procedures for a smooth transaction.

A contract cannot override the statute of limitations set by law. In Rhode Island, certain time limits apply to legal actions, including those related to asset sales. Even with a Rhode Island Agreement for Sale of Assets of Corporation, you must file claims within the specified time frame. It's crucial to understand these limits to protect your rights.

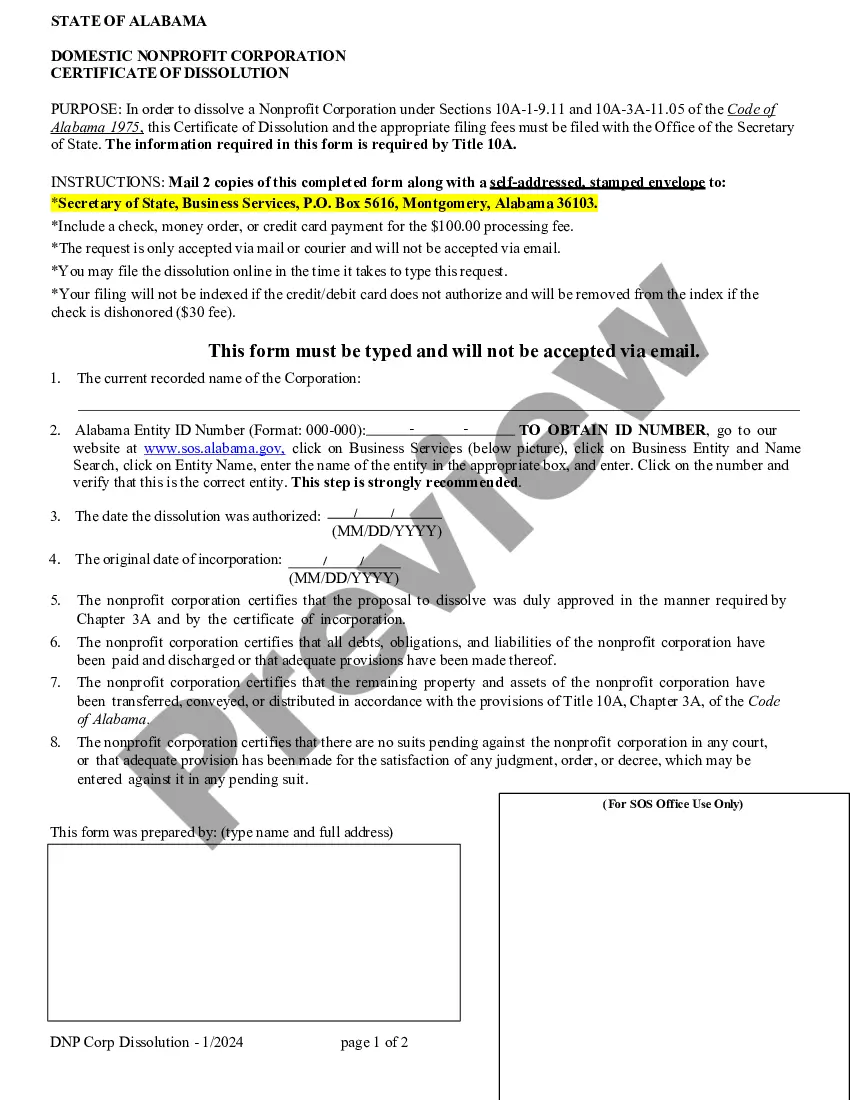

To dissolve a business in Rhode Island, you must file a certificate of dissolution with the Secretary of State. This process ensures that all financial obligations, including taxes and debts, are settled before officially closing your business. If you have held assets, such as those represented by the Rhode Island Agreement for Sale of Assets of Corporation, it is essential to address these matters before dissolution. For an easy navigation of this process, explore the resources available on the UsLegalForms platform.

Yes, Rhode Island participates in the Streamlined Sales Tax (SST) agreement, which aims to simplify sales tax compliance for businesses. This status can impact the way your LLC operates, especially regarding sales transactions and asset sales detailed in documents like the Rhode Island Agreement for Sale of Assets of Corporation. Staying informed about SST regulations can help you navigate sales tax requirements effectively. You can find resources on the UsLegalForms platform to assist you with compliance-related documents.

An operating agreement for Rhode Island is a legal document that defines the internal structure and operation of an LLC. This agreement outlines the rights and responsibilities of the members, along with the processes for profit sharing and management. When dealing with transactions like the Rhode Island Agreement for Sale of Assets of Corporation, having a well-defined operating agreement can protect your interests. You may find templates and resources useful on the UsLegalForms platform tailored for Rhode Island.

Yes, Rhode Island imposes an estate tax on the transfer of estates valued above a certain threshold. Understanding how this tax applies can influence business planning, especially when considering asset sales, such as those covered by the Rhode Island Agreement for Sale of Assets of Corporation. Accurate knowledge of these taxes can help you prepare better for succession planning. For personalized guidance, consider consulting with a tax professional familiar with Rhode Island laws.

Interesting Questions

More info

Select the appropriate section from the list below. Taxing Office Search The official state tax filing page for Rhode Island. Search New or Used Vehicles for registration. Taxing Office Fees Register fees and obtain tax assessment documents, check the status of your application. Select the appropriate section from the list below. Taxing Office Licensing Apply for licensing of motor vehicles. Select the appropriate section from the list below. New or Used Vehicles — Apply for registration of the vehicle(s) you'd like to register, pay a fee and obtain the vehicle(s) registration documents. Driver License — Apply for a license to drive a motor vehicle. Select the appropriate section from the list below. Motor Vehicle — Application to register, pay, renew a license and obtain the registration documents and vehicle inspection forms from the DMV. Vehicle Inspection — Application to obtain a vehicle inspection. Select the appropriate section from the list below.