Rhode Island Conflict of Interest Disclosure of Director of Corporation refers to the legal requirement by the state of Rhode Island for directors of corporations to disclose any potential conflicts of interest that may arise between their personal interests and their duties as a director. This disclosure helps ensure transparency, accountability, and the avoidance of any unethical or illegal actions by directors that could lead to harm or financial loss to the corporation or its stakeholders. Directors of corporations in Rhode Island are legally obligated to act in the best interests of the corporation and its shareholders. They are expected to make decisions that are fair, impartial, and free from personal gain or conflicts of interest. However, it is recognized that conflicts of interest may still arise due to personal affiliations, financial interests, or other professional engagements that could compromise a director's ability to act impartially. The Rhode Island Conflict of Interest Disclosure of Director of Corporation requires directors to provide a comprehensive statement detailing any situations, relationships, or financial interests that could potentially interfere with their objective decision-making. This disclosure is typically made at the regular meetings of the board of directors or when a conflict of interest arises. Failure to make adequate disclosures can result in legal consequences and may lead to substantial penalties or removal from the position of director. Examples of situations that would require a Rhode Island Conflict of Interest Disclosure of Director of Corporation include: 1. Financial Interests: Directors must disclose any direct or indirect financial interests they have in transactions, contracts, or arrangements related to the corporation. This includes ownership of shares or other securities, involvement in competing businesses, or any financial benefits that may be derived from specific decisions. 2. Family Relationships: Directors must disclose any familial relationships they have with other directors, executives, or employees of the corporation. This includes immediate family members such as spouses, children, parents, siblings, or in-laws. 3. Outside Associations: Directors must disclose any board memberships, consulting agreements, or other professional relationships they have with other organizations or entities that could potentially create a conflict of interest. This ensures transparency and prevents any biased decision-making that could favor their personal affiliations. 4. Personal Investments: Directors must disclose any personal investments or financial transactions that may directly or indirectly impact the corporation or its business. This includes investments in competitors, suppliers, or customers of the corporation. By implementing the Rhode Island Conflict of Interest Disclosure of Director of Corporation, the state aims to safeguard the interests of corporations, shareholders, and stakeholders. The disclosure allows for the identification and proactive management of conflicts of interest to ensure that directors act in the best interests of the corporation and its constituents. It promotes transparency, accountability, and ethical decision-making, which are essential for the effective governance and operation of corporations in Rhode Island.

Rhode Island Conflict of Interest Disclosure of Director of Corporation

Description

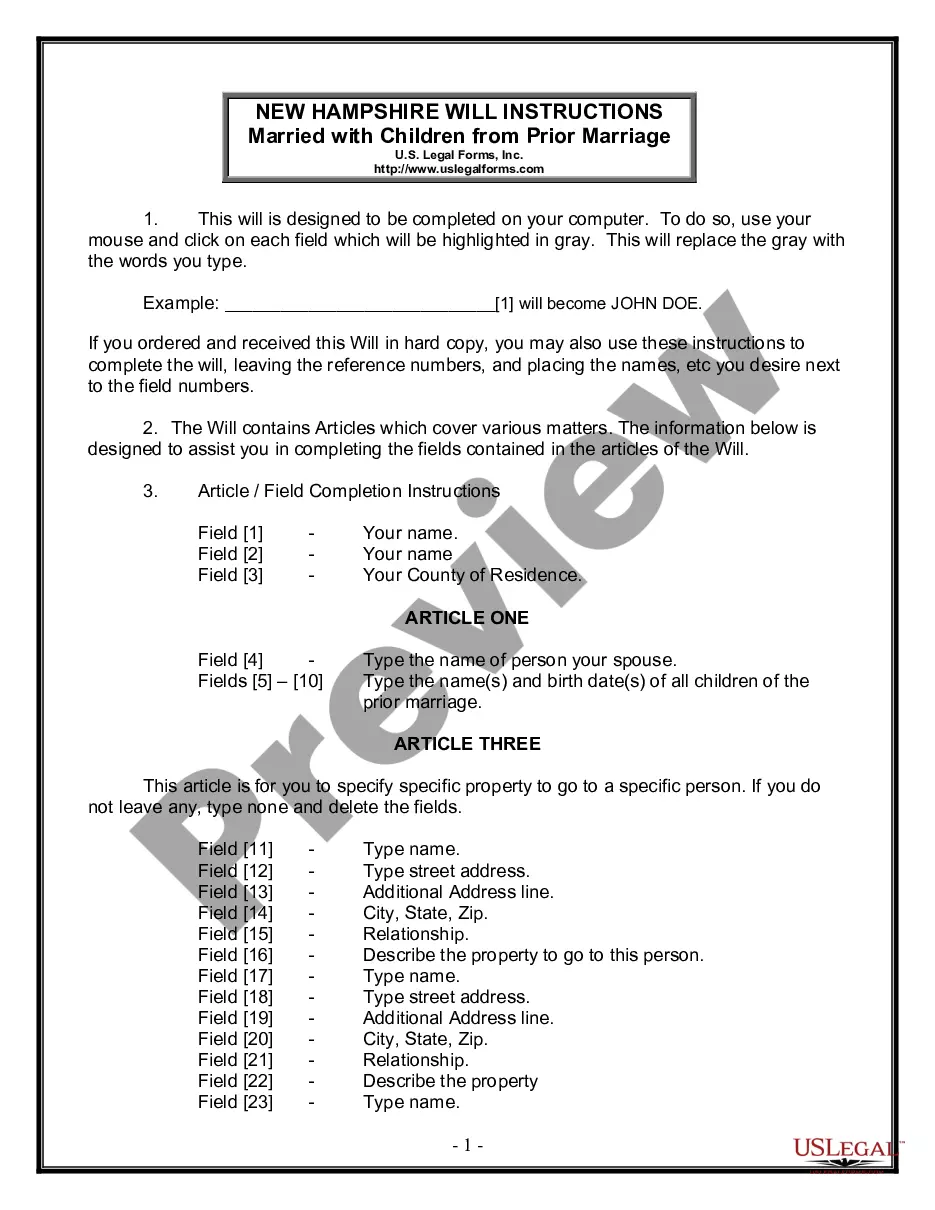

How to fill out Rhode Island Conflict Of Interest Disclosure Of Director Of Corporation?

Are you presently in the situation that you need to have files for either enterprise or person purposes almost every time? There are tons of legal document themes available on the net, but locating types you can rely on isn`t easy. US Legal Forms delivers a large number of form themes, like the Rhode Island Conflict of Interest Disclosure of Director of Corporation, that happen to be published in order to meet state and federal specifications.

When you are previously knowledgeable about US Legal Forms internet site and also have an account, just log in. Next, you are able to download the Rhode Island Conflict of Interest Disclosure of Director of Corporation design.

Unless you offer an account and want to begin to use US Legal Forms, follow these steps:

- Obtain the form you require and ensure it is for that proper area/area.

- Take advantage of the Review key to review the form.

- Look at the outline to actually have selected the right form.

- If the form isn`t what you`re trying to find, take advantage of the Search industry to find the form that suits you and specifications.

- Whenever you obtain the proper form, click on Purchase now.

- Choose the prices plan you desire, complete the desired info to make your bank account, and buy an order using your PayPal or charge card.

- Decide on a convenient file formatting and download your backup.

Discover each of the document themes you possess bought in the My Forms food list. You can obtain a more backup of Rhode Island Conflict of Interest Disclosure of Director of Corporation at any time, if required. Just click the necessary form to download or produce the document design.

Use US Legal Forms, one of the most substantial variety of legal forms, in order to save time as well as avoid blunders. The service delivers appropriately produced legal document themes that can be used for a selection of purposes. Produce an account on US Legal Forms and initiate producing your daily life easier.