Rhode Island Credit Application: A Comprehensive Guide to Accessing Credit in the State Introduction: The Rhode Island Credit Application is a crucial document that individuals and businesses in Rhode Island utilize when seeking credit from financial institutions, credit unions, or other lending entities. This comprehensive guide aims to provide a detailed description of what the Rhode Island Credit Application entails, its usage, and relevant keywords associated with it. Additionally, we will explore any specific types of credit applications that exist in the state. Description: The Rhode Island Credit Application is a formal request for credit that individuals, small businesses, or corporations must submit to financial institutions when they require financial assistance. This application serves as a means for lenders to assess the creditworthiness and repayment capacity of potential borrowers. By evaluating various financial factors, such as income, debt-to-income ratio, credit history, and employment stability, lenders can make informed decisions regarding the approval and terms of credit. Keywords: 1. Rhode Island Credit Application: The primary keyword that encompasses the entire topic of this guide. 2. Credit application form: The document individuals and businesses need to complete to apply for credit. 3. Lending institutions: Financial entities responsible for receiving and reviewing credit applications. 4. Creditworthiness: A measure of an individual's or business's ability to repay borrowed funds. 5. Repayment capacity: The prospective borrower's ability to make timely payments based on their income and existing financial obligations. 6. Income verification: The assessment process where lenders confirm the applicant's income to determine eligibility for credit. 7. Debt-to-income ratio: The proportion of a person's monthly income that goes toward servicing existing debts. 8. Credit history: An individual's past performance in repaying credit obligations. 9. Employment stability: The length and consistency of a borrower's employment history. 10. Approval process: The stages involved in the lender's decision-making process regarding the credit application. Types of Rhode Island Credit Application: While there is no specific categorization of credit applications unique to Rhode Island, the state follows general credit application procedures prevalent nationwide. Therefore, variations can arise depending on the type of financing individuals or businesses seek. Some common types of Rhode Island credit applications include: 1. Personal Credit Application: Used by individuals seeking personal loans, credit cards, automotive loans, or other forms of personal credit. 2. Business Credit Application: Designed specifically for businesses and corporations requiring credit facilities, such as lines of credit, commercial loans, or business credit cards. 3. Mortgage Application: When purchasing or refinancing real estate property, a mortgage application is essential to secure a mortgage loan. Conclusion: The Rhode Island Credit Application is a crucial gateway for accessing credit in the state. By submitting a comprehensive credit application, borrowers provide lenders with the necessary information to evaluate their creditworthiness and repayment capacity. Understanding the keywords associated with credit applications can assist applicants in comprehending and fulfilling the requirements set by lenders. While different types of credit applications exist in Rhode Island, personal credit applications, business credit applications, and mortgage applications are among the most common.

Rhode Island Credit Application

Description

How to fill out Rhode Island Credit Application?

Choosing the right authorized file design can be quite a have difficulties. Naturally, there are plenty of themes accessible on the Internet, but how would you obtain the authorized type you will need? Take advantage of the US Legal Forms website. The support offers a large number of themes, for example the Rhode Island Credit Application, that you can use for business and personal requires. Every one of the forms are checked out by pros and meet state and federal specifications.

If you are previously signed up, log in to the account and click the Obtain button to have the Rhode Island Credit Application. Use your account to search throughout the authorized forms you might have ordered formerly. Check out the My Forms tab of your own account and get yet another duplicate of the file you will need.

If you are a fresh end user of US Legal Forms, listed below are easy recommendations that you can stick to:

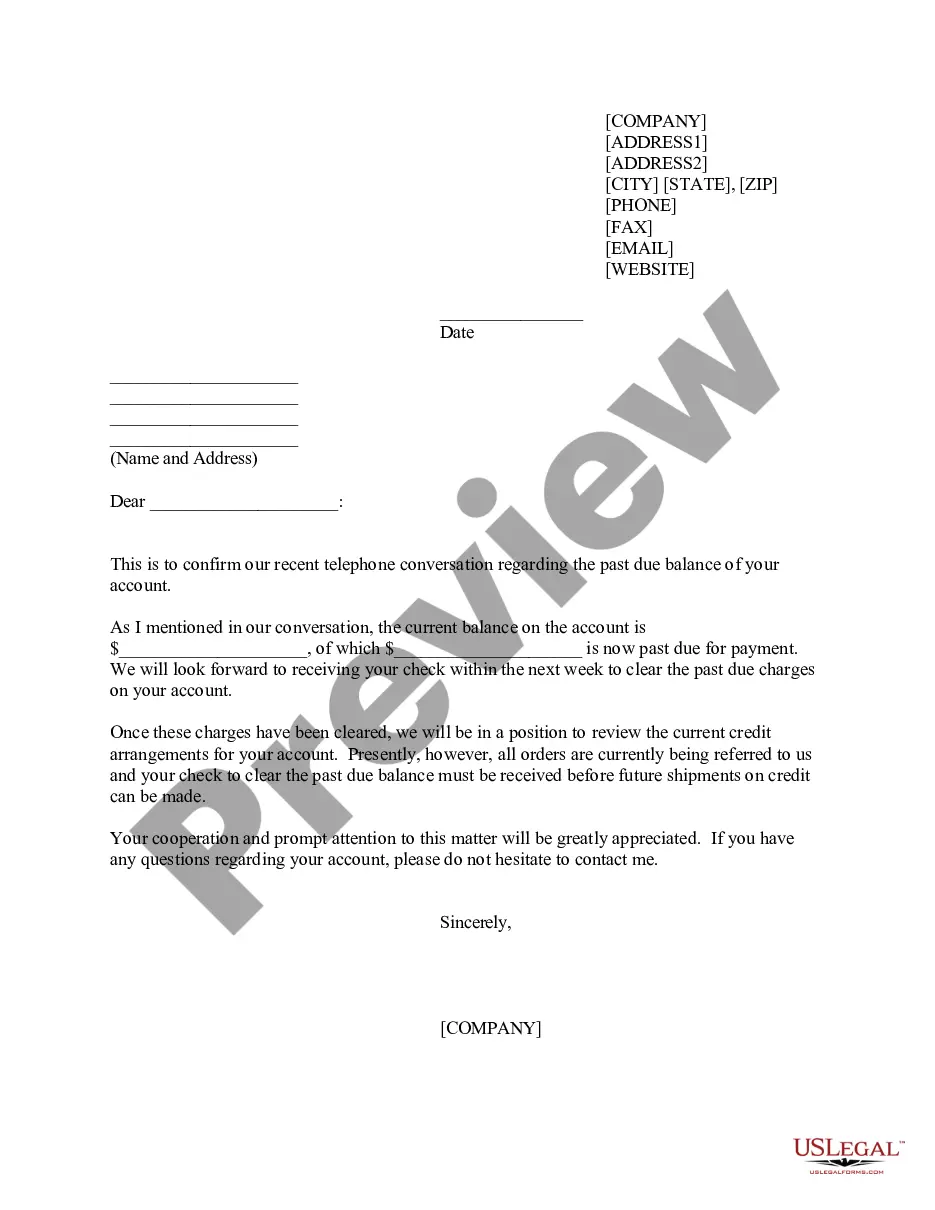

- Very first, make sure you have selected the correct type for your personal area/county. You are able to check out the form using the Preview button and look at the form outline to ensure this is basically the best for you.

- In the event the type does not meet your preferences, take advantage of the Seach industry to discover the right type.

- Once you are certain the form is proper, click the Buy now button to have the type.

- Select the prices prepare you want and enter the essential details. Make your account and purchase the transaction making use of your PayPal account or bank card.

- Choose the document formatting and down load the authorized file design to the system.

- Complete, revise and printing and sign the received Rhode Island Credit Application.

US Legal Forms will be the greatest local library of authorized forms for which you can see numerous file themes. Take advantage of the service to down load professionally-manufactured documents that stick to state specifications.