Rhode Island Assignment of Profits of Business is a legal document that allows business owners or individuals to transfer or assign their business profits to another person or entity. This assignment can be a strategic decision made to benefit both parties involved. With an Assignment of Profits, the assignor relinquishes their rights to receive the business profits, and these rights are transferred to the assignee. The Assignment of Profits in Rhode Island is governed by applicable state laws, ensuring that both parties adhere to the legal requirements and obligations. This document outlines the terms and conditions of the assignment, including the duration, scope, and specific details of profit distribution. Keywords: Rhode Island, Assignment of Profits of Business, legal document, transfer, assign, business profits, strategic decision, rights, assignor, assignee, governed by law, terms and conditions, profit distribution. Different types of Rhode Island Assignment of Profits of Business may include: 1. Absolute Assignment of Profits: This occurs when the assignor transfers all of their rights and interests in business profits to the assignee permanently. The assignee becomes the sole beneficiary of the assigned profits. 2. Conditional Assignment of Profits: In this type of assignment, the assignor transfers their rights to business profits under specific conditions or for a limited duration. The assignee receives the profits based on the fulfillment of these conditions or until the specified duration expires. 3. Partial Assignment of Profits: This type of assignment involves the assignor transferring only a portion or percentage of their business profits to the assignee. The remaining portion continues to be received by the assignor as per the agreement. 4. Revocable Assignment of Profits: A revocable assignment allows the assignor to terminate or cancel the assignment at any time, with or without cause. This type of assignment gives the assignor more flexibility and control over the transferred profits. 5. Irrevocable Assignment of Profits: In contrast to the revocable assignment, an irrevocable assignment cannot be terminated or canceled by the assignor once it is made. The assignee has secure rights to the assigned profits, and the assignor cannot revoke the transfer. Remember, before entering into any Assignment of Profits agreement, it is essential to seek professional legal advice to ensure compliance with Rhode Island laws and protection of the interests of all parties involved.

Rhode Island Assignment of Profits of Business

Description

How to fill out Rhode Island Assignment Of Profits Of Business?

You may devote hrs on the web looking for the authorized record design that suits the state and federal requirements you want. US Legal Forms provides thousands of authorized varieties which are evaluated by experts. You can actually down load or produce the Rhode Island Assignment of Profits of Business from our services.

If you currently have a US Legal Forms accounts, it is possible to log in and click on the Down load key. Afterward, it is possible to full, edit, produce, or indication the Rhode Island Assignment of Profits of Business. Every authorized record design you acquire is yours for a long time. To get one more backup of the obtained form, go to the My Forms tab and click on the corresponding key.

If you use the US Legal Forms website initially, keep to the simple recommendations below:

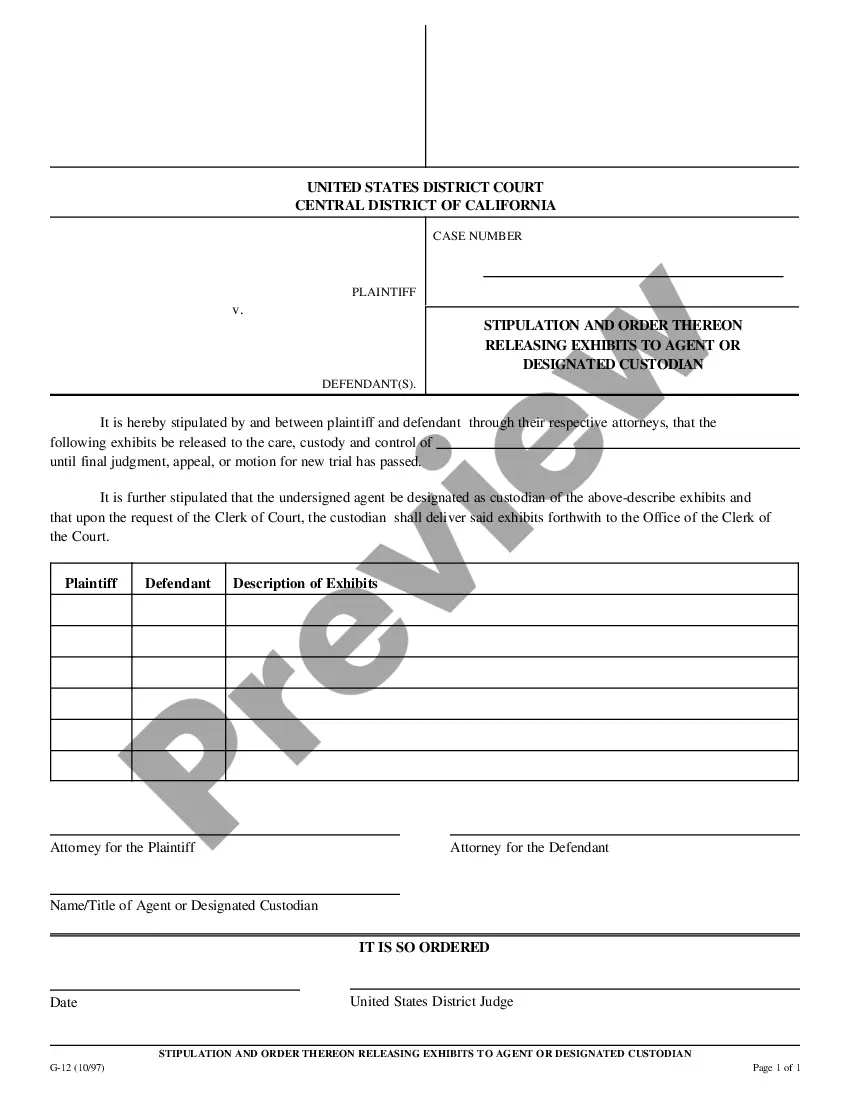

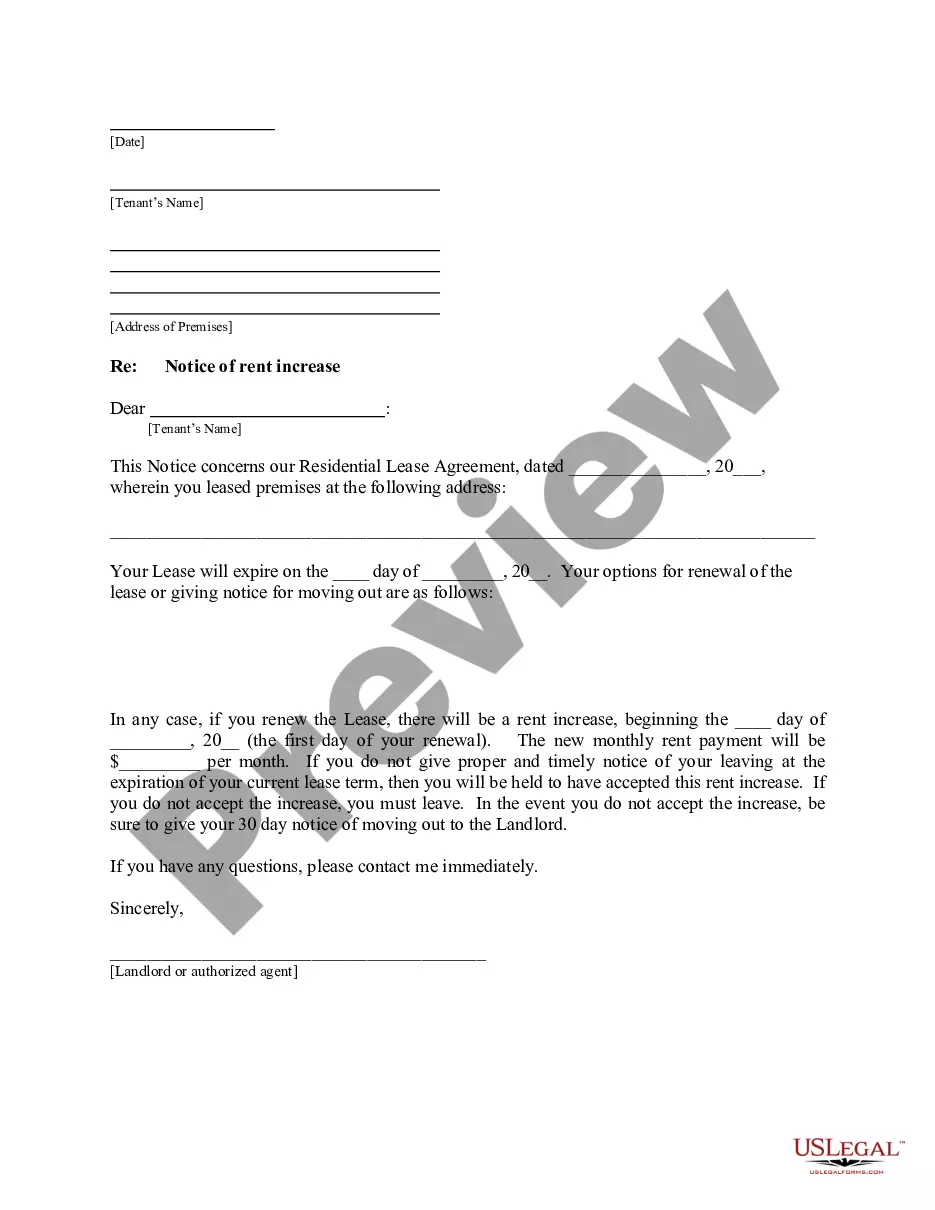

- Initially, make certain you have selected the right record design for the state/city of your liking. Read the form outline to make sure you have picked the right form. If readily available, take advantage of the Review key to look throughout the record design too.

- If you would like get one more version from the form, take advantage of the Research area to discover the design that suits you and requirements.

- After you have found the design you would like, click Buy now to move forward.

- Find the rates plan you would like, type your qualifications, and register for an account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal accounts to pay for the authorized form.

- Find the structure from the record and down load it for your device.

- Make changes for your record if possible. You may full, edit and indication and produce Rhode Island Assignment of Profits of Business.

Down load and produce thousands of record layouts while using US Legal Forms Internet site, which offers the most important selection of authorized varieties. Use professional and state-certain layouts to deal with your company or person requirements.