Rhode Island Yearly Expenses: A Comprehensive Overview of the Different Types and Key Factors Introduction: Rhode Island, located in the New England region of the United States, is the smallest state in terms of land area. Known as the "Ocean State," it offers a unique blend of historical significance, scenic beauty, and a thriving economy. When considering living or relocating to Rhode Island, understanding its yearly expenses is crucial. This detailed description explores the various types of expenses, helping you gain a comprehensive understanding of the financial aspects associated with residing in the state. 1. Housing Expenses: Housing expenses form a significant portion of yearly expenditure for Rhode Island residents. This category includes rent or mortgage payments, homeowners or renters insurance, property taxes, utilities (such as electricity, gas, water, and sewage), and maintenance fees. The cost may vary depending on factors like location, square footage, and the type of accommodation (apartment, condo, house, etc.). 2. Transportation Expenses: Transportation costs are a crucial consideration while planning your yearly expenses in Rhode Island. It includes expenses related to owning a car, such as car payments, insurance premiums, fuel costs, regular maintenance, repairs, parking fees, and tolls. Public transportation options, such as bus or train fares, monthly passes, and occasional taxi or ride-share expenditures, should also be considered. 3. Health Insurance and Medical Expenses: Maintaining adequate health insurance coverage is essential, and Rhode Island residents can explore various options available through individual plans, employers, or government programs like Medicaid. Yearly expenses should account for health insurance premiums, co-payments, deductibles, and any out-of-pocket medical costs not covered by insurance, such as prescriptions, dental care, vision care, and medical emergencies. 4. Education Expenses: For individuals with children or pursuing higher education, Rhode Island offers various education-related expenses. These include tuition fees for public or private schools, college/university tuition and fees, textbooks and supplies, extracurricular activities, and specialized programs like music lessons or sports coaching. Additionally, saving for future education expenses, such as college savings plans or 529 accounts, should be factored into yearly budgets. 5. Food and Groceries: Allocating a portion of yearly budget for food and groceries is necessary. This category covers expenses related to weekly grocery shopping, dining out, take-out or delivery services, and occasional indulgences like coffee or snacks. Costs may differ based on dietary preferences, the number of family members, and the frequency of eating outside. 6. Entertainment and Recreation: Rhode Island offers an array of entertainment and recreational activities. Expenses in this category can include visits to museums, concerts, theaters, sports events, theme parks, fitness clubs, recreational memberships, and outdoor activities like boating, fishing, or hiking. Dining out, attending festivals, or exploring tourist attractions should also be considered as part of yearly entertainment expenditures. 7. Taxes: While not an expense category per se, being aware of Rhode Island's taxes is vital for budgeting and financial planning. The state has income tax, sales tax, property tax, and various other taxes, all of which contribute to the overall yearly expenses. Familiarize yourself with the tax laws, exemptions, and credits to ensure accurate financial planning. Conclusion: Understanding the yearly expenses in Rhode Island is crucial for making informed financial decisions and planning for a comfortable lifestyle. This description has highlighted various expense categories such as housing, transportation, healthcare, education, food, entertainment, and taxes. By considering these factors, you can create a more comprehensive budget tailored to your specific needs and circumstances when living in the beautiful state of Rhode Island.

Rhode Island Yearly Expenses

Description

How to fill out Rhode Island Yearly Expenses?

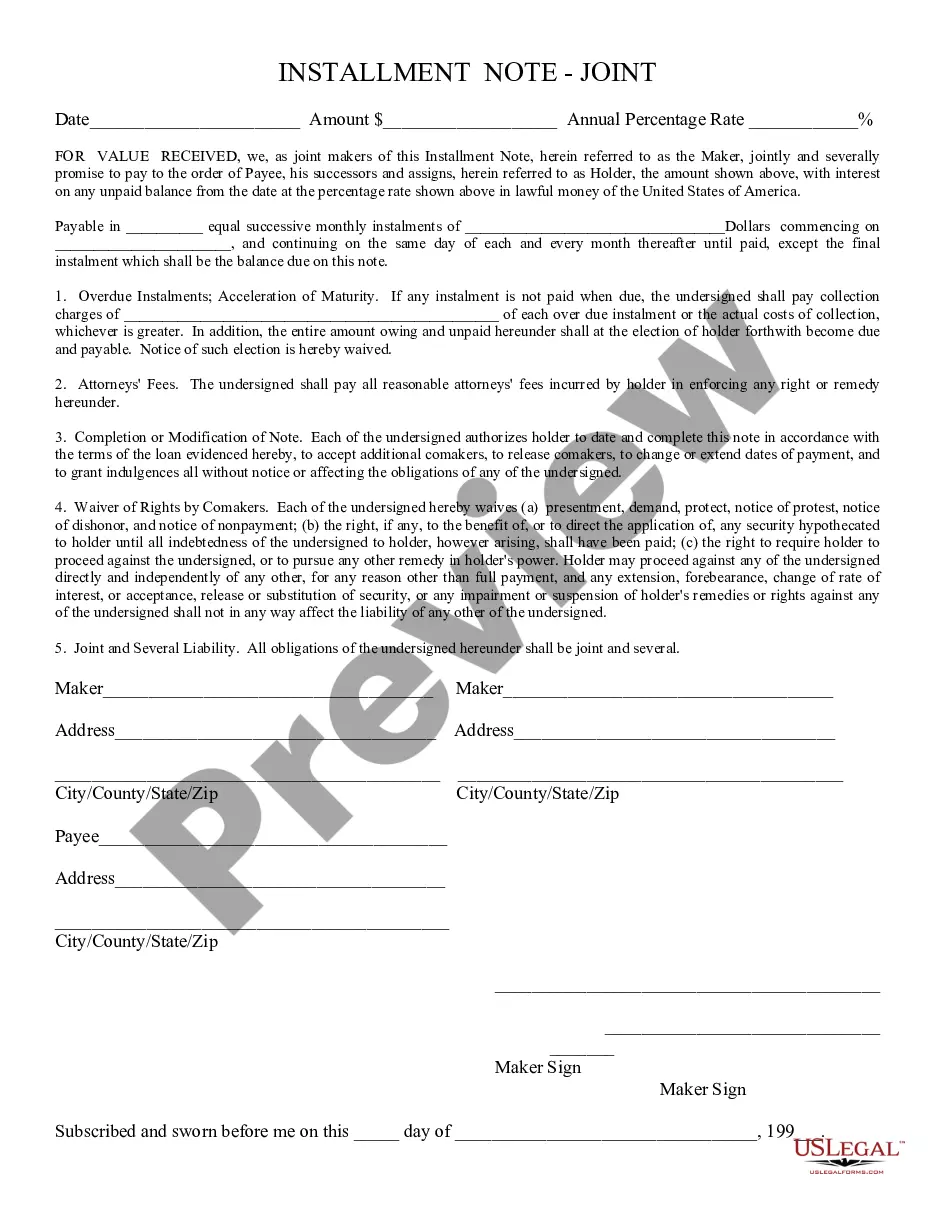

You are able to commit time on-line searching for the authorized document web template that meets the federal and state requirements you require. US Legal Forms gives a large number of authorized forms that happen to be reviewed by professionals. It is possible to down load or print the Rhode Island Yearly Expenses from your support.

If you currently have a US Legal Forms profile, you can log in and click the Download option. Next, you can full, change, print, or sign the Rhode Island Yearly Expenses. Every authorized document web template you buy is your own forever. To obtain another version associated with a acquired form, proceed to the My Forms tab and click the related option.

Should you use the US Legal Forms internet site the first time, follow the simple directions beneath:

- Very first, make sure that you have selected the best document web template for your region/metropolis that you pick. Read the form explanation to ensure you have picked out the right form. If offered, utilize the Preview option to check with the document web template as well.

- If you want to find another variation from the form, utilize the Lookup discipline to discover the web template that suits you and requirements.

- Upon having discovered the web template you need, click on Buy now to carry on.

- Select the prices program you need, type in your references, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You may use your charge card or PayPal profile to cover the authorized form.

- Select the format from the document and down load it in your system.

- Make changes in your document if possible. You are able to full, change and sign and print Rhode Island Yearly Expenses.

Download and print a large number of document layouts while using US Legal Forms site, which provides the biggest selection of authorized forms. Use professional and condition-specific layouts to handle your business or specific requires.