Rhode Island Returned Items Report is a comprehensive document that provides detailed information about returned items in the state of Rhode Island. This report serves as an essential resource for businesses, retailers, and consumers alike to understand the frequency, nature, and reasons behind returned items. The Rhode Island Returned Items Report is designed to offer valuable insights into the patterns and trends associated with returned items, helping businesses make informed decisions regarding their inventory management and customer satisfaction. It provides statistical data on returned items, including the total number of returns, the types of products frequently returned, and the average return rate. Different types of Rhode Island Returned Items Reports may exist based on various criteria, such as sector-specific reports that focus on specific industries, such as electronics, clothing, or household goods. These sector-specific reports provide detailed information tailored to a particular industry, including product-specific return rates, reasons for returns, and customer feedback. The Rhode Island Returned Items Report is designed to assist businesses in identifying common reasons for returns, enabling them to take preventive measures to reduce return rates and improve customer experiences. By analyzing the data provided in the report, businesses can identify potential areas of improvement in product quality, packaging, or customer service. Additionally, the Rhode Island Returned Items Report may include information about regional variations in return rates, allowing businesses to target specific regions with customized strategies and tailor their product offerings accordingly. This targeted approach helps businesses reduce returns and maximize customer satisfaction. The Rhode Island Returned Items Report is a valuable resource for consumers as well. By understanding the statistical data and reasons behind product returns, consumers can make more informed purchasing decisions, ensuring better experiences and reducing the likelihood of product dissatisfaction. In summary, the Rhode Island Returned Items Report is a comprehensive and informative document that sheds light on the frequency, types, and reasons behind returned items in Rhode Island. It serves as a crucial resource for businesses, retailers, and consumers, offering insights to improve inventory management, customer satisfaction, and informed decision-making.

Rhode Island Returned Items Report

Description

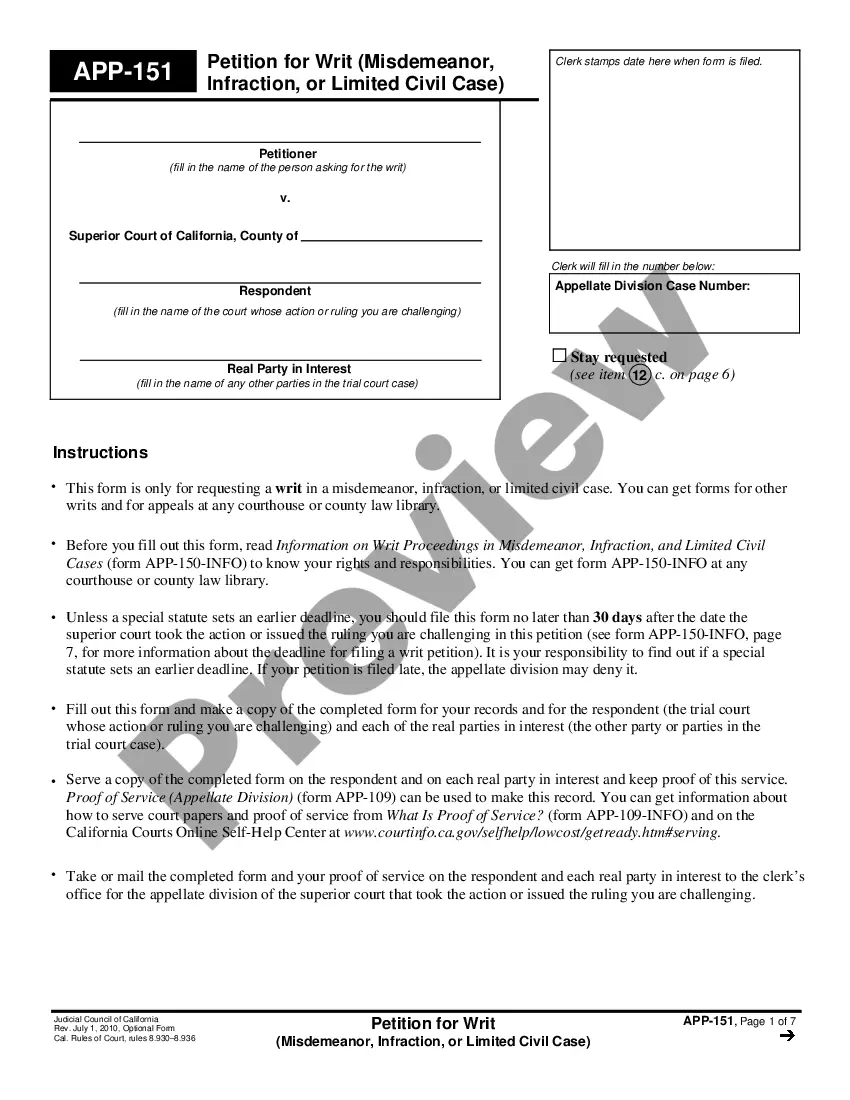

How to fill out Rhode Island Returned Items Report?

Choosing the right authorized record format can be a have difficulties. Naturally, there are tons of layouts accessible on the Internet, but how can you obtain the authorized kind you want? Make use of the US Legal Forms site. The services provides a huge number of layouts, for example the Rhode Island Returned Items Report, which you can use for business and personal requires. All of the varieties are checked by experts and fulfill federal and state demands.

In case you are previously registered, log in for your accounts and click on the Acquire option to have the Rhode Island Returned Items Report. Make use of accounts to appear with the authorized varieties you possess acquired in the past. Go to the My Forms tab of your own accounts and have another backup in the record you want.

In case you are a new user of US Legal Forms, here are basic directions for you to stick to:

- Initially, be sure you have selected the appropriate kind for your area/county. You can check out the shape utilizing the Preview option and look at the shape description to guarantee it is the right one for you.

- In case the kind will not fulfill your requirements, make use of the Seach area to get the appropriate kind.

- Once you are sure that the shape is proper, click the Get now option to have the kind.

- Pick the pricing strategy you need and type in the necessary details. Design your accounts and buy an order with your PayPal accounts or charge card.

- Pick the data file file format and acquire the authorized record format for your gadget.

- Comprehensive, modify and print out and sign the attained Rhode Island Returned Items Report.

US Legal Forms is the largest catalogue of authorized varieties in which you can see numerous record layouts. Make use of the company to acquire appropriately-made files that stick to condition demands.

Form popularity

FAQ

What Is Form RI-1041 Schedule W? This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. The document is a supplement to Form RI-1041, Fiduciary Income Tax Return.

They will include important information such as where to file, what to attach to the return (i.e. W-2s, 1099s, etc.), refund or balance due, information about estimated tax payments, etc. Note. File your return, schedules, and other attachments on standard size paper.

How to File and Pay Sales Tax in Rhode IslandFile online File online at the Rhode Island Division of Taxation.File by mail You can use the Rhode Island Streamlined Sales Tax Return and file and pay through the mail, though you must file and pay online if your tax liability in the previous year was $200 or more.More items...

Rhode Island Residents If you are a Rhode Island resident and filed a federal tax return or you are an individual and your income exceeded the federal exceptions, you are required to file a Rhode Island resident tax return using Form RI-1040.

In case you expect a RI tax refund, you will need to file or e-File your RI tax return in order to receive your tax refund money. If you owe RI income taxes, you will either have to submit a RI tax return or extension by the April 18, 2022 tax deadline in order to avoid late filing penalties.

With Online Taxes at OLT.com, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if you meet any of the following requirements: Your federal adjusted gross income for 2021 was between $16,000 and $73,000; or.

Every part-year individual who was a resident for a period of less than 12 months is required to file a Rhode Island return if he or she is required to file a federal return.

What is IRS Form Schedule 2? Form 1040 Schedule 2 includes two parts: "Tax" and "Other Taxes." Taxpayers who need to complete this form include: High-income taxpayers who owe alternative minimum tax (AMT) Taxpayers who need to repay a portion of a tax credit for the health insurance marketplace.

Instructions for Schedule W Withholding Tax Schedule. Schedule W is designed to report State of Michigan income tax withholding. Schedule W enables us to process your individual income tax return more efficiently. Include the completed Schedule W with your return.

Rhode Island Income Tax Withholding Certificate (RI-W4)