Rhode Island Acceptance of Election in a Limited Liability Company LLC

Description

How to fill out Acceptance Of Election In A Limited Liability Company LLC?

It is possible to commit hrs on-line trying to find the lawful papers design which fits the federal and state demands you want. US Legal Forms supplies a huge number of lawful kinds which are analyzed by specialists. You can easily download or printing the Rhode Island Acceptance of Election in a Limited Liability Company LLC from my services.

If you already have a US Legal Forms account, it is possible to log in and then click the Obtain switch. After that, it is possible to comprehensive, modify, printing, or indicator the Rhode Island Acceptance of Election in a Limited Liability Company LLC. Every single lawful papers design you get is your own for a long time. To have one more duplicate for any obtained kind, proceed to the My Forms tab and then click the related switch.

If you are using the US Legal Forms site the first time, keep to the basic recommendations below:

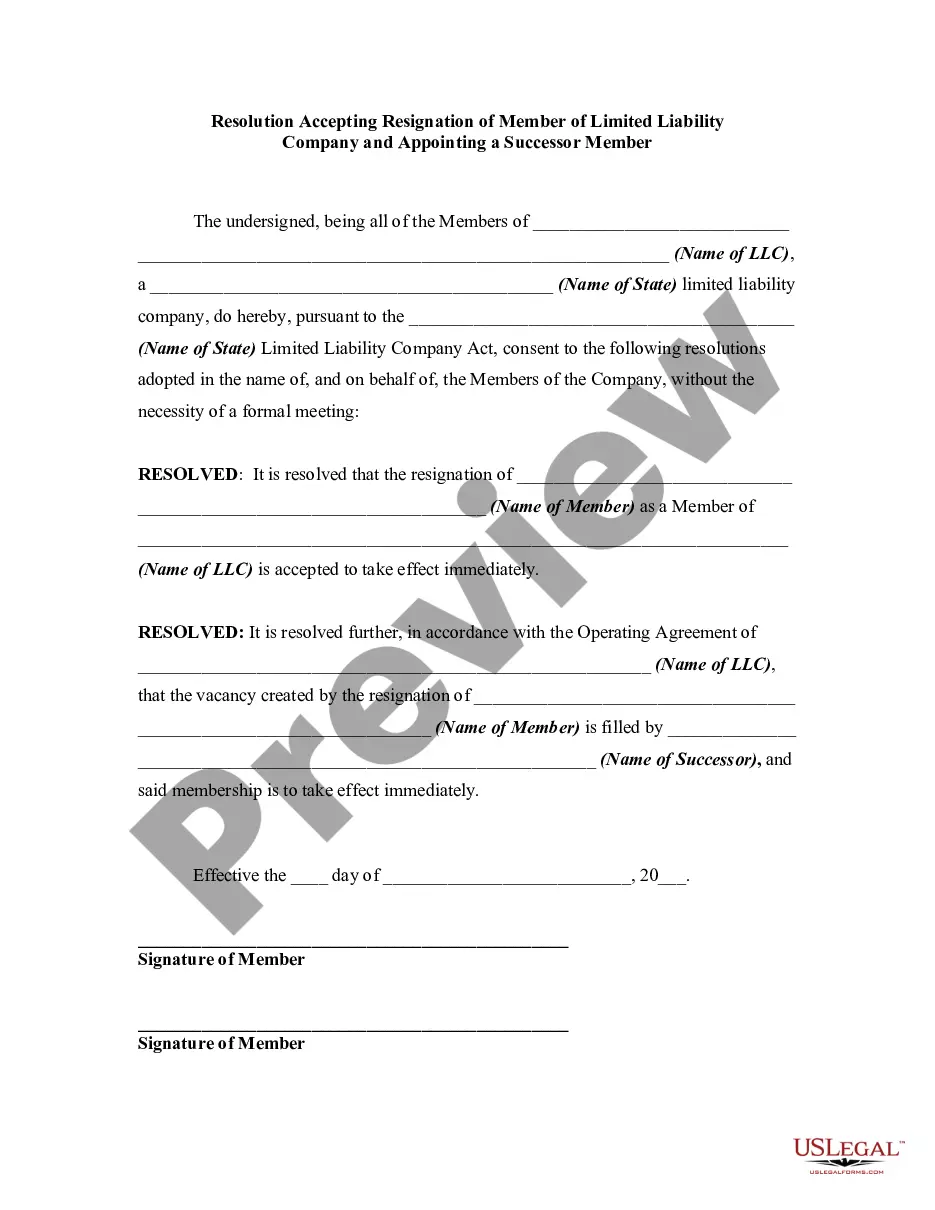

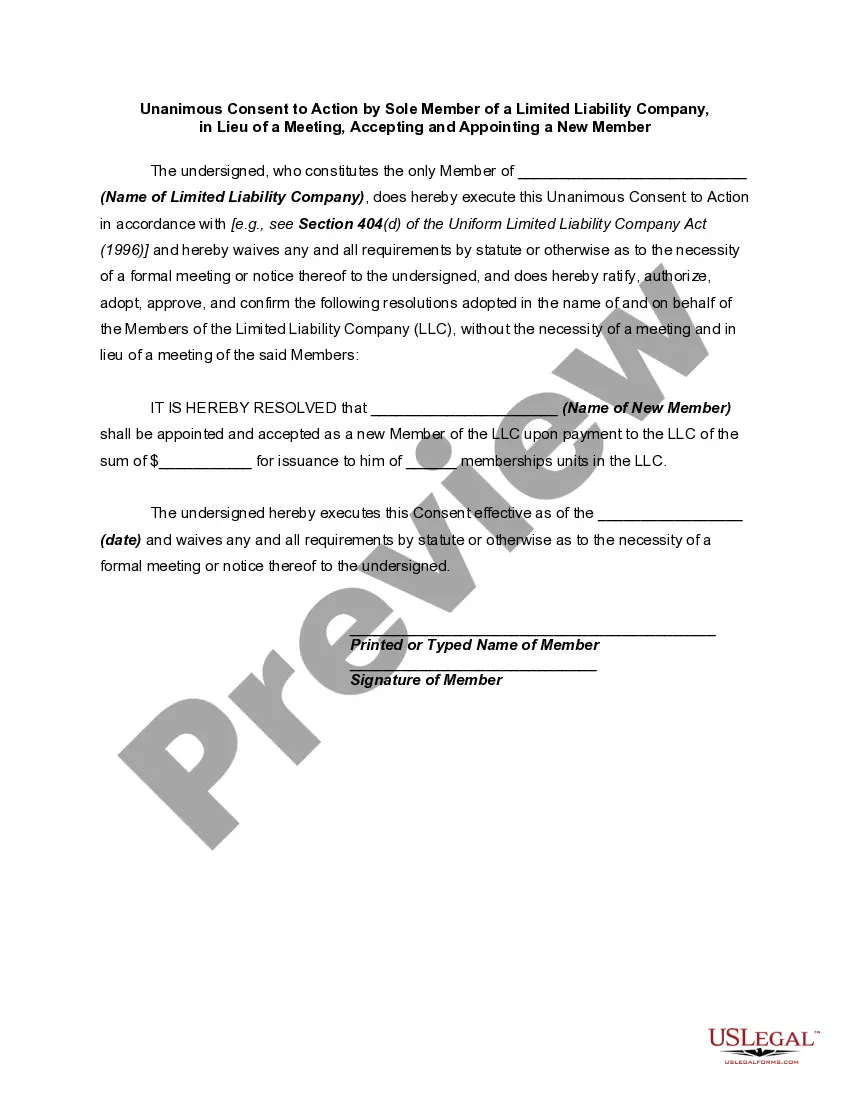

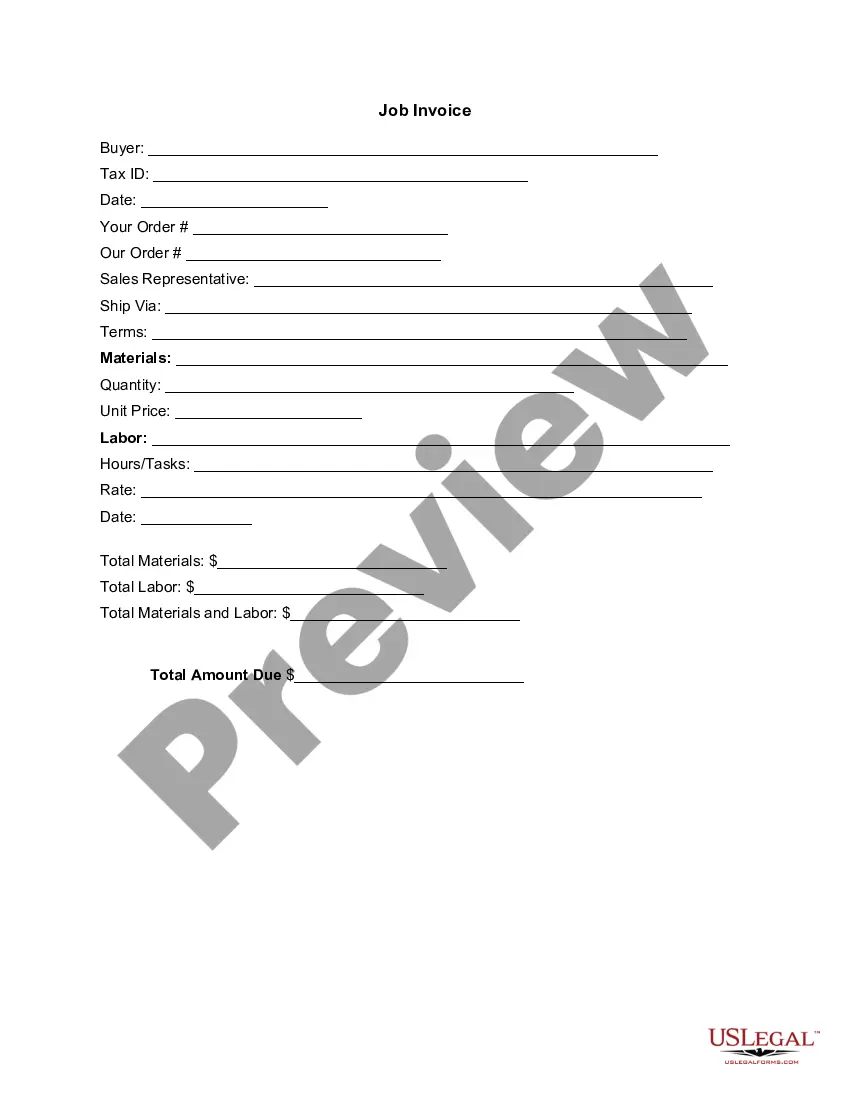

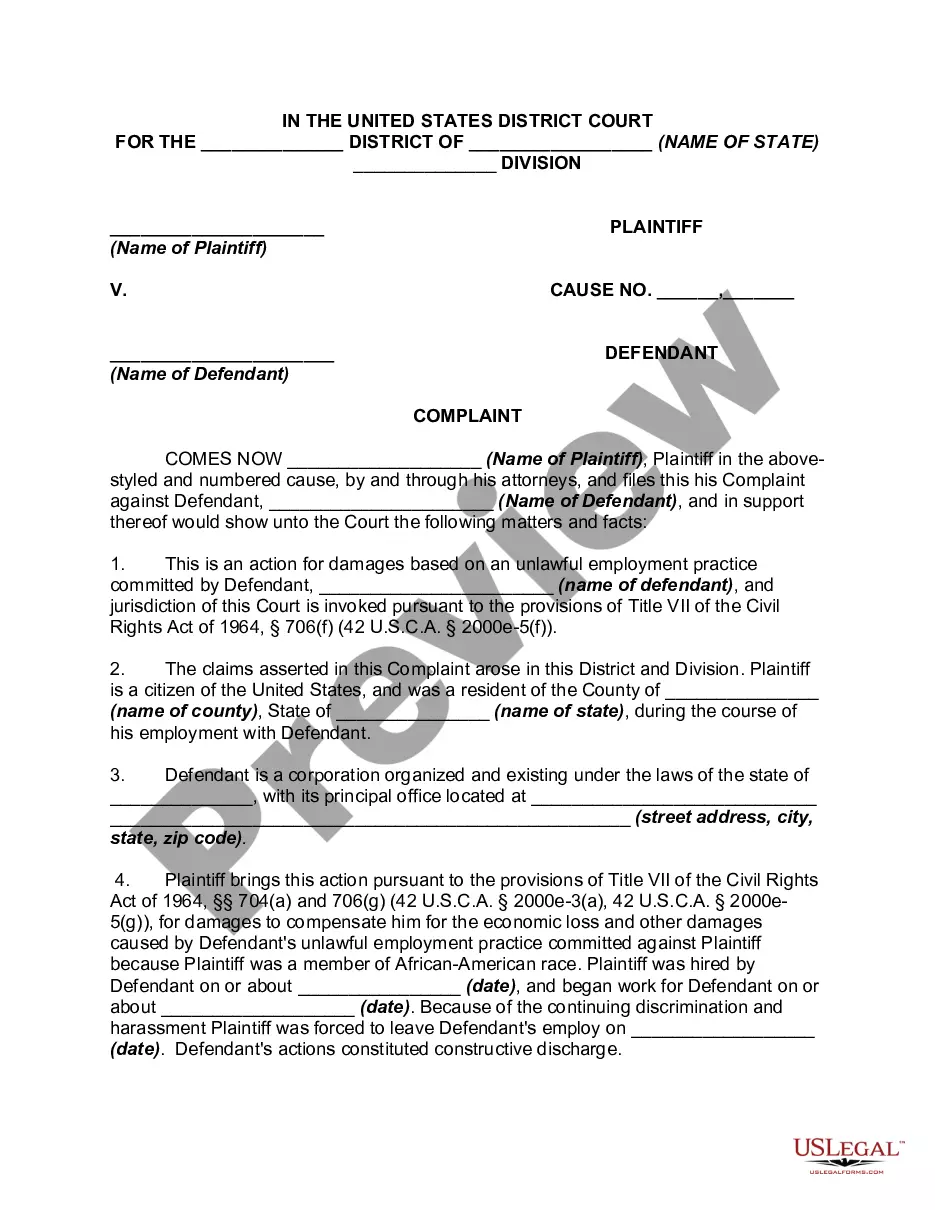

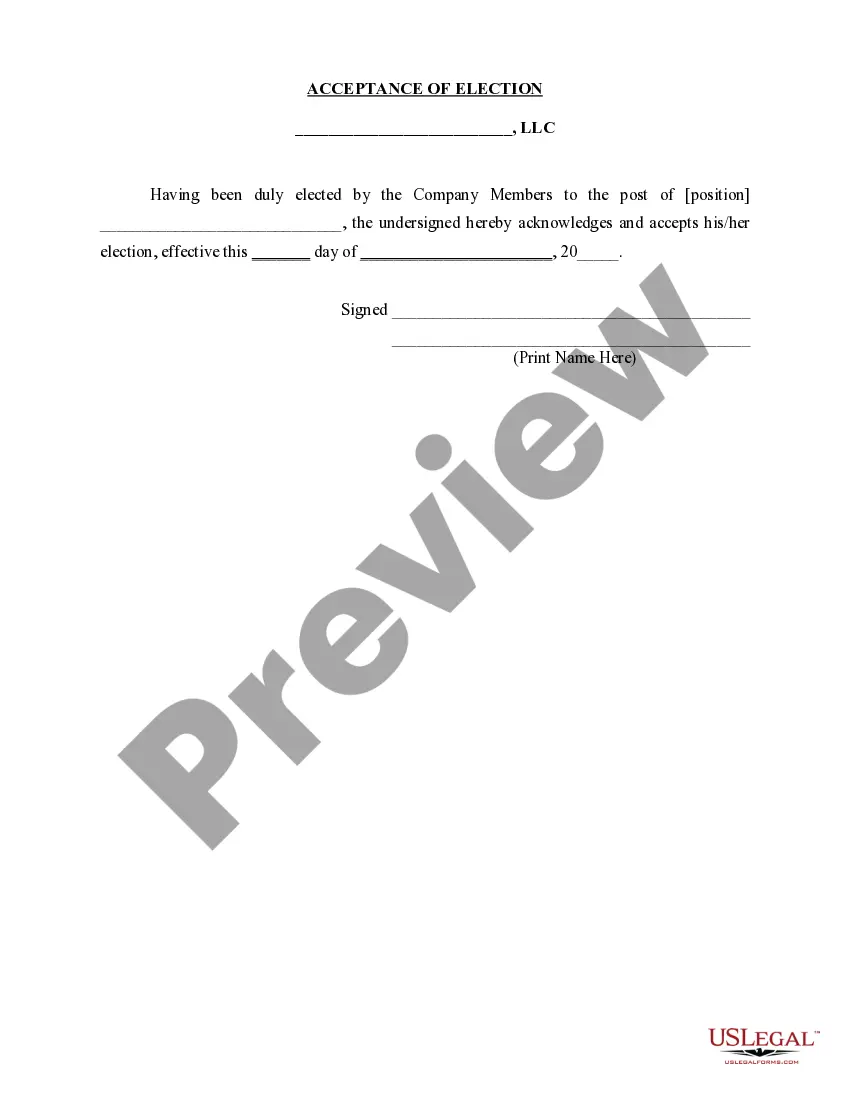

- Initial, make certain you have chosen the best papers design for your area/city of your liking. Read the kind description to make sure you have picked out the correct kind. If accessible, make use of the Review switch to check with the papers design as well.

- In order to get one more edition in the kind, make use of the Search field to obtain the design that fits your needs and demands.

- When you have identified the design you need, click Purchase now to carry on.

- Select the pricing plan you need, type your references, and sign up for your account on US Legal Forms.

- Total the transaction. You can utilize your charge card or PayPal account to pay for the lawful kind.

- Select the file format in the papers and download it in your gadget.

- Make alterations in your papers if required. It is possible to comprehensive, modify and indicator and printing Rhode Island Acceptance of Election in a Limited Liability Company LLC.

Obtain and printing a huge number of papers themes making use of the US Legal Forms site, that provides the most important variety of lawful kinds. Use skilled and condition-certain themes to tackle your company or personal needs.

Form popularity

FAQ

The cost for domestic and foreign LLCs is $150. Make your checks or money orders payable to the RI Department of State. Foreign businesses trying to establish an LLC must include a Certificate of Good Standing or Letter of Status. This document must be dated within 60 days of the date of your completed LLC paperwork.

Unlike the Rhode Island Articles of Organization, an operating agreement is an internal document that you don't need to file with Rhode Island's Division of Business Services. However, the operating agreement is one of your LLC's most important documents, and it's worth putting the effort into creating a strong one.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

The following sections cover the steps you will need to do to maintain the good standing of your Rhode Island LLC. Create an LLC Operating Agreement. ... Get an Employer Identification Number (EIN) ... Submit an Annual Report. ... Pay the Corporate Tax, if Applicable.

Rhode Island LLC Processing Times Normal LLC processing time:Expedited LLC:Rhode Island LLC by mail:3-4 business days (plus mail time)Not availableRhode Island LLC online:3-4 business daysNot available

LLCs, LLPs, LPs, Partnerships and SMLLCs: Limited liability companies not treated as a corporation on the federal level, limited liability partnerships, general partnerships, and single member limited liability companies are required to file an annual tax return using Form RI-1065.

Regardless of how your LLC is structured or how much income you make, you'll need to pay a minimum of $400 to the Rhode Island Division of Taxation. Partnerships, disregarded entities, and S corporations pay the minimum business corporation tax of $400. Regular corporations pay $400 or more, depending on their profits.

Every entity registered with the RI Department of State is legally required to have both a registered agent and a registered office on file.