Rhode Island Authorization of Consumer Report

Description

How to fill out Authorization Of Consumer Report?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template options, such as the Rhode Island Authorization of Consumer Report, designed to comply with federal and state regulations.

Once you identify the appropriate form, simply click Get now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Rhode Island Authorization of Consumer Report template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

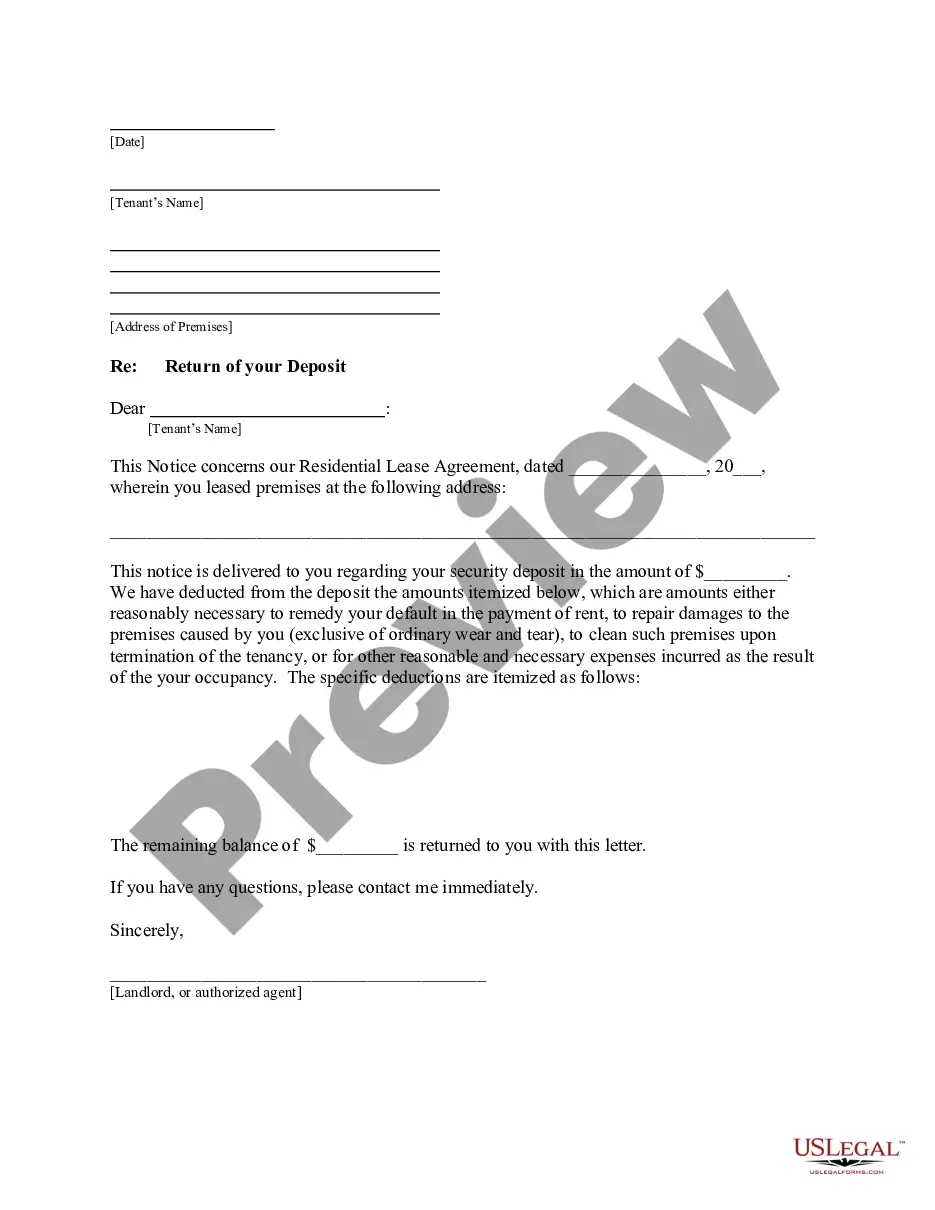

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the right document.

- If the form isn’t what you’re looking for, use the Search field to locate the form that meets your requirements.

Form popularity

FAQ

Checking Your Rhode Island BCI in Person When appearing, the individual must present a valid photo identification and a check/money order made payable to "BCI" in the amount of $5.00. Acceptable photo identification includes: (1) a State Issued Drivers License, (2) a State Issued Identification Card, or (3) a Passport.

Consumer Credit ReportFiles of information about your debt levels, repayment history, and assumed creditworthiness are housed with credit bureaus, especially with the three major ones: Experian, Equifax, and TransUnion.

Cost = $35.00 (check or money order/cash is not accepted) Driver's license. Student ID. State ID.

Hard Inquiries That information frequently, but does not always, include a Social Security number. In response to a hard inquiry, Experian generally sells a complete consumer report (a/k/a credit report) to the potential creditor.

A consumer credit report is a record of a credit history from a number of sources, such as banks, credit card companies and collection agencies. Information from a credit report is used to determine their credit score, which is important when applying for different types of loans or credit cards.

A credit report will document which accounts are in good standing, if any debts are past due, and other information about your financial history. A credit report, however, is a type of consumer report. A consumer report is a broader report that contains personal identifying information beyond credit.

Credit reporting companies, also known as credit bureaus or consumer reporting agencies, are companies that compile and sell credit reports. Credit reporting companies collect credit account information about your borrowing and repayment history including: The original amount of a loan. The credit limit on a credit

Examples of types of information that may qualify as CR include: arrest, convictions, judgements, and bankruptcies; criminal histories, education, and licenses held by consumers; drug tests (if provided by an intermediary to an employer but not when a drug lab provides the result directly to the employer)

To get a background check by mail from our Office, you will need to mail the following:A signed and notarized release form.A copy of a valid form of photo identification.Check or money order for $5.00, payable to BCI. Credit cards and cash not accepted by mail.Self-addressed, stamped return envelope.More items...?

Invasive BCIs entail substantial costs for initial implantation, plus the cost of ongoing technical support. Although the initial costs of noninvasive BCI systems are relatively modest (eg, $5,000-$10,000), they too require some measure of ongoing technical support.