Rhode Island Employment Firm Audit

Description

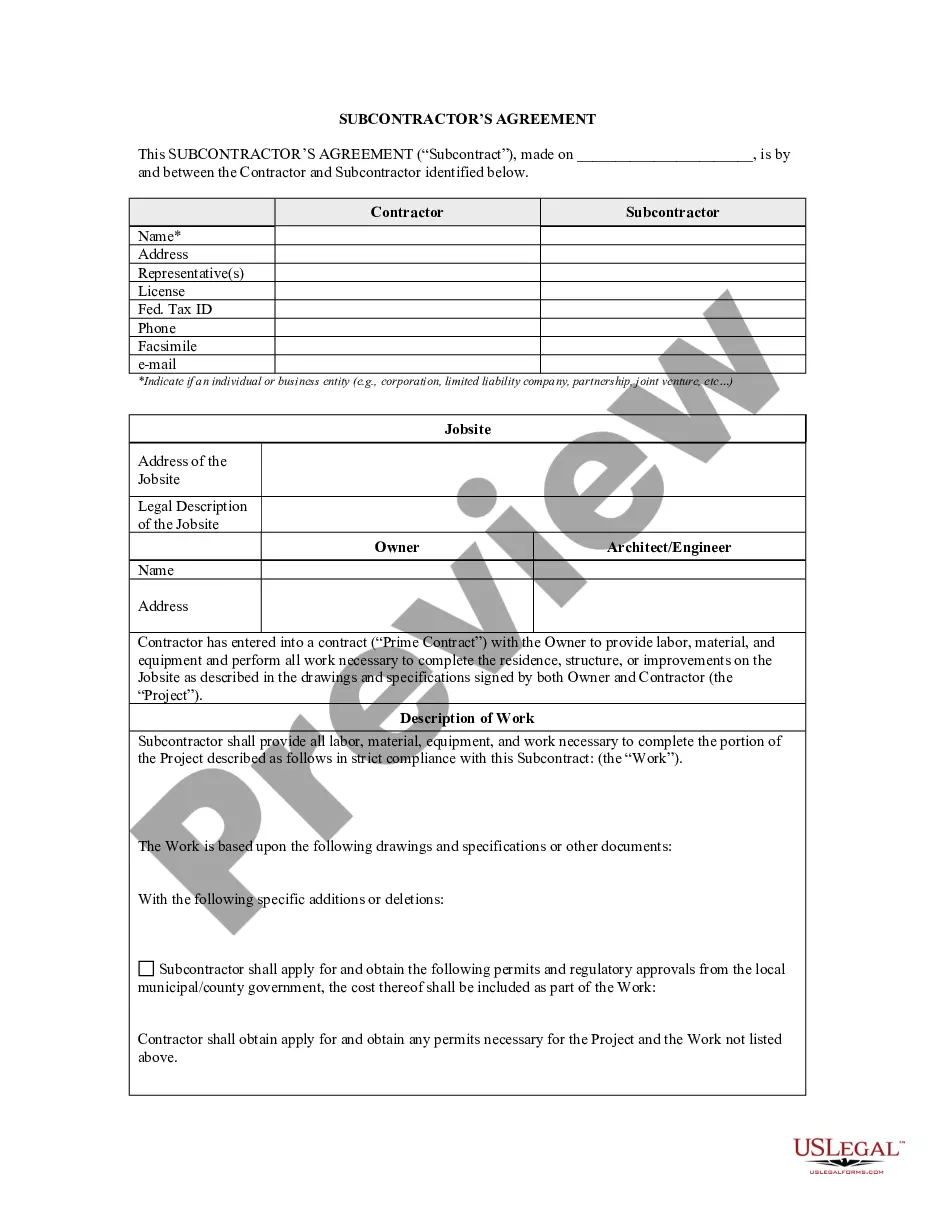

How to fill out Employment Firm Audit?

Are you presently in the location from which you need documents for either business or personal activities almost every day? There are numerous legal document templates accessible online, but locating ones you can rely on is not simple.

US Legal Forms provides thousands of document templates, such as the Rhode Island Employment Agency Audit, designed to fulfill state and federal requirements.

If you are already familiar with the US Legal Forms site and possess an account, simply Log In. Then, you can obtain the Rhode Island Employment Agency Audit template.

Access all of the document templates you have purchased in the My documents list. You can obtain another copy of the Rhode Island Employment Agency Audit whenever needed. Simply follow the necessary document to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Acquire the document you need and make sure it is for the correct city/county.

- Utilize the Preview button to examine the form.

- Review the details to confirm that you have selected the correct document.

- If the document is not what you are looking for, use the Search section to find the document that suits you and your requirements.

- Once you find the appropriate document, click Purchase now.

- Select the pricing plan you desire, enter the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

In order to sign audit reports and be granted Responsible Individual (RI) status within a firm of Registered Auditors you must: hold the Audit Qualification. hold a valid Practising Certificate.

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

In essence, an HR audit involves identifying issues and finding solutions to problems before they become unmanageable. It is an opportunity to assess what an organization is doing right, as well as how things might be done differently, more efficiently or at a reduced cost.

Registered Auditor Each person responsible for audits and signing audit reports in the audit firm must be a Responsible Individual (RI).

The current officeholder is Dennis Hoyle.

A job audit is a formal procedure in which a compensation professional meets with the manager and employee to discuss and explore the position's current responsibilities.

Definition. A cash register audit (also called a register reconciliation or just "counting down the register") is a process by which you compare the sales records of the day with the amount of money in cash, checks and credit receipts you took in.

A member of ICAEW can act as a UK statutory auditor ('responsible individual' or 'RI') ie, sign a UK company audit report only if they: hold an appropriate qualification under the Companies Act 2006; and. hold an ICAEW practising certificate (PC); and.

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

Qualifying as a Registered Auditor requires you to first qualify as a Chartered Accountant (SA) and usually takes a minimum of 8 ½ years but can be done in 7 A½ years if you are able to qualify as a Chartered Accountant (SA) within 6 years.