Rhode Island Travel Expense Reimbursement Form

Description

How to fill out Travel Expense Reimbursement Form?

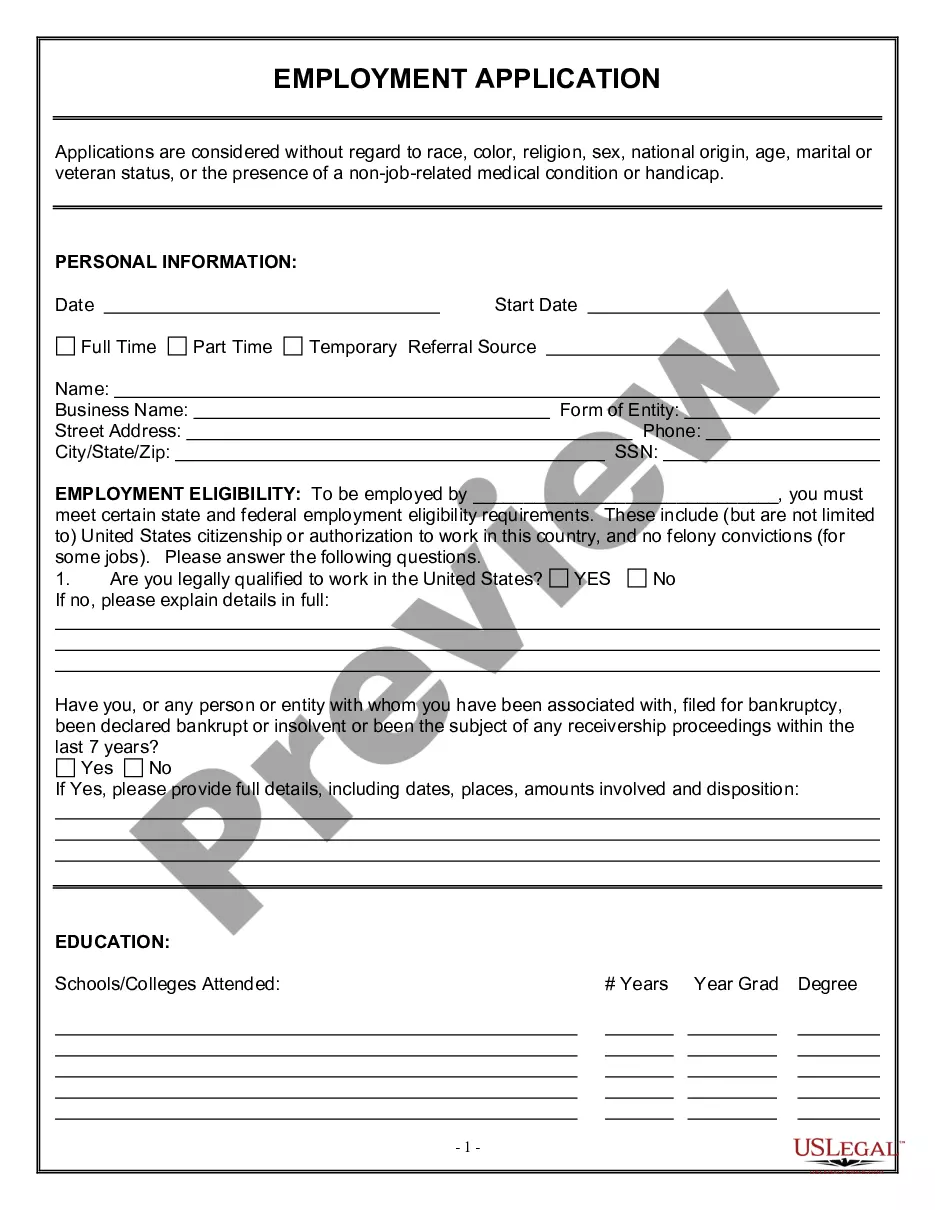

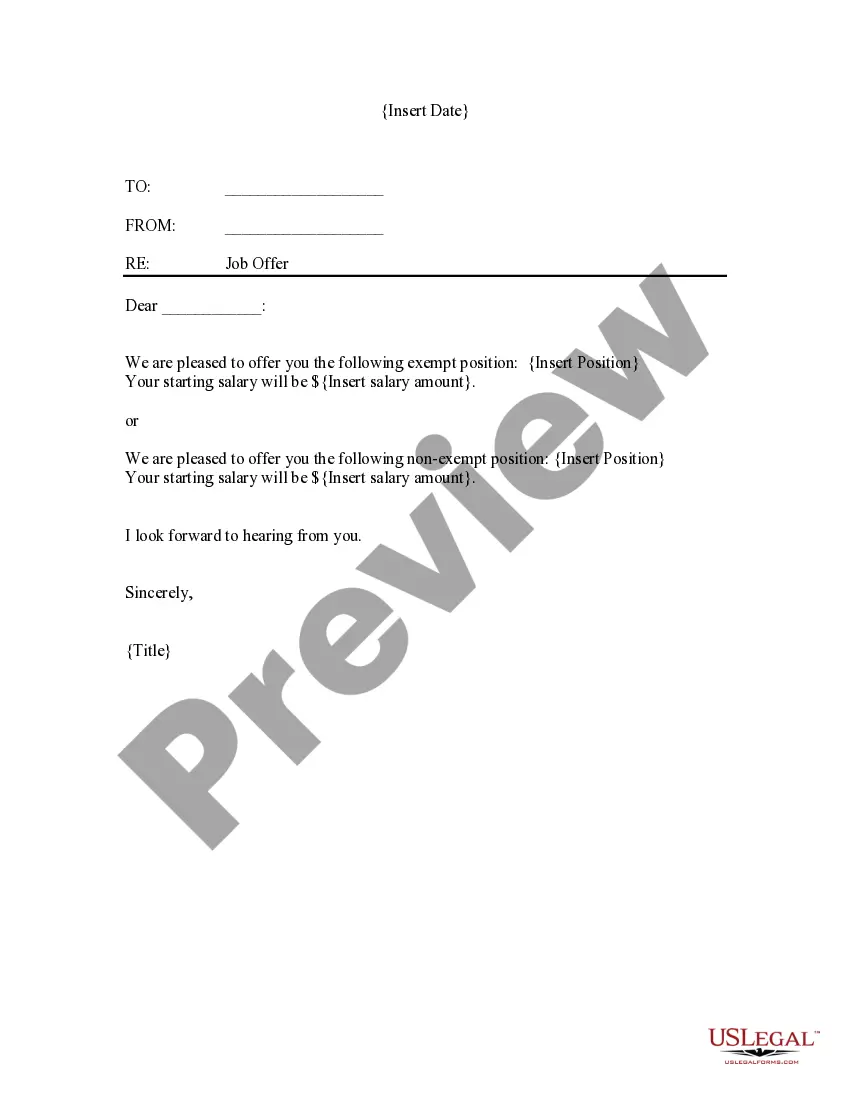

It is feasible to invest hours online trying to locate the valid document template that meets the federal and state requirements you desire.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can actually obtain or print the Rhode Island Travel Expense Reimbursement Form from your service.

If available, use the Review option to browse the document template as well. To find another version of the form, utilize the Search field to discover the template that fits your needs and specifications.

- If you possess a US Legal Forms account, you can sign in and select the Obtain option.

- After that, you can fill out, modify, print, or sign the Rhode Island Travel Expense Reimbursement Form.

- Every valid document template you purchase is yours indefinitely.

- To obtain an additional copy of any acquired form, navigate to the My documents tab and click the relevant option.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your region/area of choice.

- Review the form information to confirm you have chosen the right form.

Form popularity

FAQ

This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent. I am attaching a copy of the (cab booking/ hotel reservation/ ticket/ invoice/ boarding pass) for your reference.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

Dear Sir/Madam, It is to request you that (Employee/Higher Authority name), the Manager Supplies (Job Designation) and two of his teammates, (Mate name 1) and (Mate name 2) had gone to 9Area and City name) for official audit (Travel purpose) on our retailer (Company/Institute name).

Respected Sir/Madam, This is to bring in your notice, that my name is (Name), and I am from (Department). My ID Number is (ID Number). I am writing this letter to present before you the expenses done on (Date) for (Mention the details of expenses).

Reimbursable travel expenses include the ordinary expenses of public or private transportation as well as unusual costs due to special circumstances.

In 2021, the standard mileage reimbursement for business-related driving is 58.5 cents per mile driven. This number is based on an annual study of the fixed and variable costs of operating a vehicle.

While unreimbursed work-related travel expenses generally are deductible on a taxpayer's individual tax return (subject to a 50% limit for meals and entertainment) as a miscellaneous itemized deduction, many employees won't be able to benefit from the deduction.

Within 30 days of completion of a trip, the traveler must submit a travel reimbursement form and supporting documentation to obtain reimbursement of expenses. An individual may not approve his or her own travel or reimbursement.

Under California labor laws, you are entitled to reimbursement for travel expenses or losses that are directly related to your job.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable