Rhode Island Confirmation of Orally Accepted Employment Offer from Applicant to Company — Exempt or Nonexempt Positions: A Comprehensive Guide In the state of Rhode Island, when a potential employer extends a job offer to an applicant, it is essential to confirm their acceptance in writing, particularly when it comes to exempt or nonexempt positions. This confirmation letter serves as an official record and clarifies the terms and conditions of employment, ensuring that both parties are on the same page. Let's delve into the details of what this confirmation entails, its importance, and the different types of positions it applies to. Types of Positions: 1. Exempt Positions: Exempt positions typically include executive, administrative, professional, and certain computer-related or creative job roles. These employees are exempt from the minimum wage and overtime provisions outlined in the Fair Labor Standards Act (FLEA) and are typically salaried employees. Examples of exempt positions may include managers, doctors, lawyers, engineers, and accountants. 2. Nonexempt Positions: Nonexempt positions, on the other hand, are eligible for overtime pay and must receive at least the federal minimum wage for every hour worked. These positions typically involve manual or non-executive work and may be paid on an hourly basis. Examples of nonexempt positions include clerical workers, customer service representatives, technicians, and production staff. Importance of Confirmation: Confirming an orally accepted job offer is crucial for both the applicant and the company. It helps in establishing clear lines of communication, ensuring a mutual understanding of the terms, conditions, and expectations of employment. This confirmation provides legal protection for both parties and acts as a reference point in case any disputes arise in the future. Key Content for Rhode Island Confirmation of Orally Accepted Employment Offer: 1. Heading: Start with a descriptive heading such as "Confirmation of Orally Accepted Employment Offer" followed by the date of the letter. 2. Contact Information: Include the full name, address, phone number, and email address of both the applicant and the company. 3. Job Title and Description: Clearly state the job title and provide a brief overview of the position's key responsibilities, reporting structure, and any unique aspects of the role. 4. Start Date and Schedule: Specify the agreed-upon start date and working schedule, such as full-time, part-time, temporary, or permanent. 5. Compensation and Benefits: Outline the salary, payment frequency, and any additional benefits or perks associated with the position, such as healthcare, retirement plans, or vacation days. 6. Exempt or Nonexempt Classification: Clearly indicate whether the position is exempt or nonexempt, ensuring the applicant understands the implications regarding overtime eligibility and payment. 7. At-Will Employment: Include a statement explaining that the employment relationship is "at-will," meaning that either party can terminate the employment at any time, with or without cause or notice. 8. Acceptance Confirmation: Request the applicant to confirm their acceptance of the offer by signing and dating the letter. Provide a deadline for returning the signed confirmation. 9. Contact Information for Queries: Include the contact details of a designated person within the company who can address any questions or concerns the applicant may have. Remember, this is a general framework, and it is advisable to consult with legal professionals or HR experts to ensure compliance with Rhode Island's employment laws and regulations. Taking steps to confirm an orally accepted job offer helps foster transparency, sets expectations, and ensures a smooth transition into employment for both the applicant and the company.

Rhode Island Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions

Description

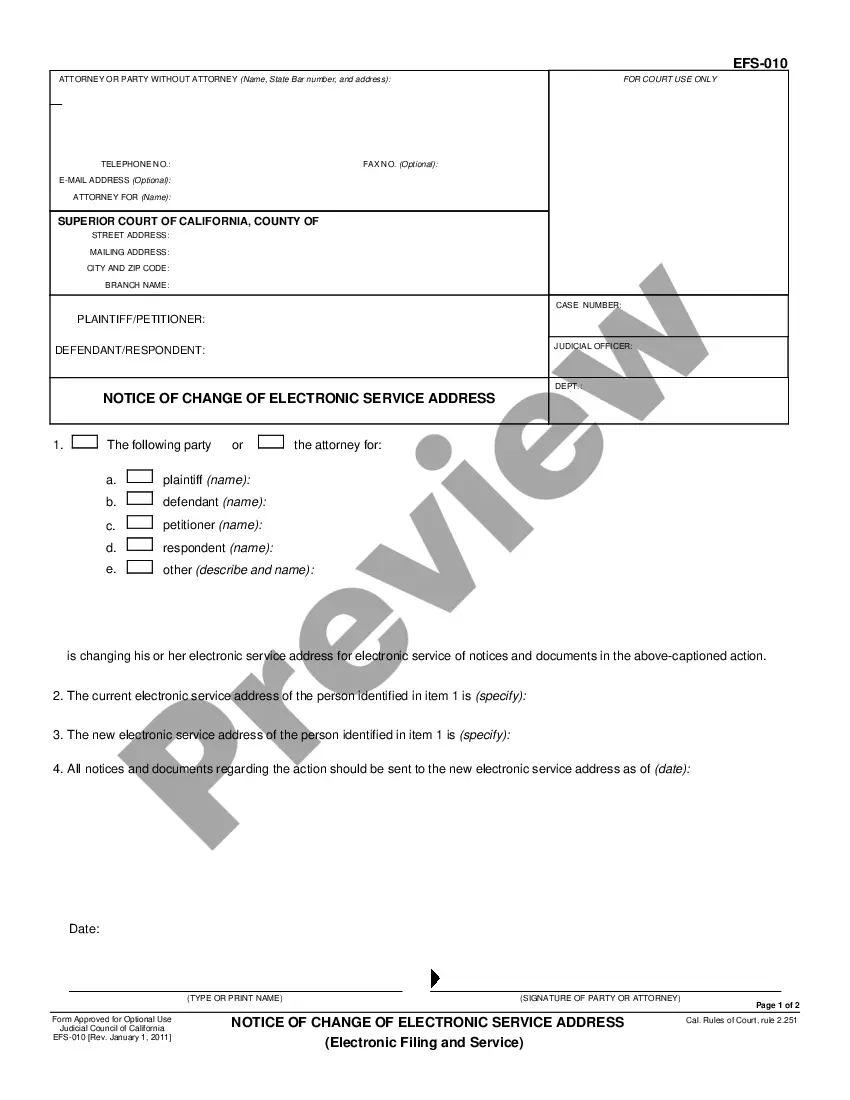

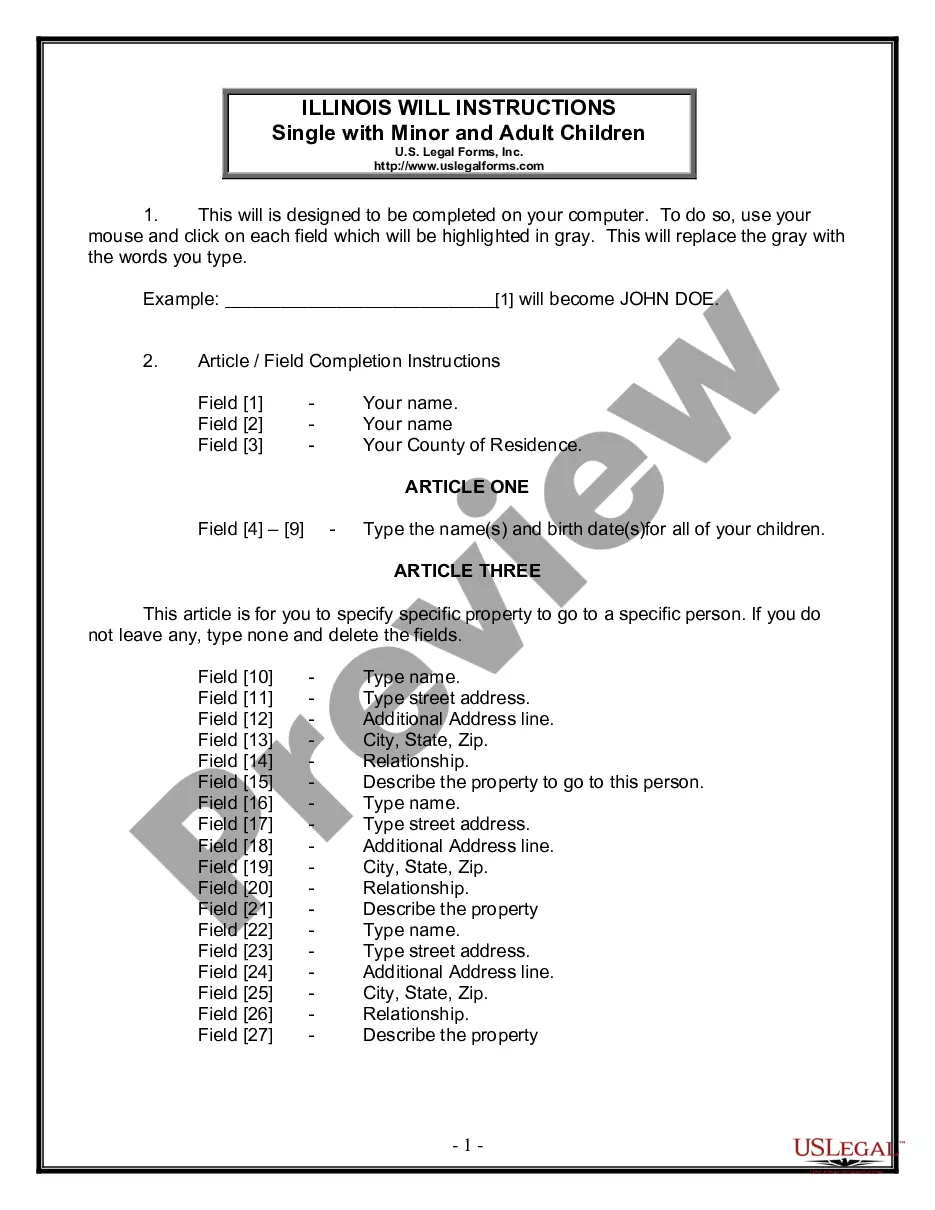

How to fill out Rhode Island Confirmation Of Orally Accepted Employment Offer From Applicant To Company - Exempt Or Nonexempt Positions?

You can devote hours on the Internet trying to find the legal papers template which fits the federal and state requirements you need. US Legal Forms offers thousands of legal types that happen to be reviewed by experts. It is possible to download or produce the Rhode Island Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions from the services.

If you currently have a US Legal Forms accounts, you may log in and click the Download button. Next, you may total, change, produce, or signal the Rhode Island Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions. Each legal papers template you acquire is yours eternally. To have an additional copy associated with a acquired type, proceed to the My Forms tab and click the related button.

If you are using the US Legal Forms internet site the first time, adhere to the simple instructions below:

- Initial, make sure that you have selected the correct papers template for your state/area that you pick. See the type explanation to make sure you have picked the correct type. If offered, make use of the Review button to appear with the papers template too.

- In order to discover an additional version from the type, make use of the Lookup area to obtain the template that fits your needs and requirements.

- After you have located the template you need, click on Buy now to proceed.

- Find the pricing program you need, type in your credentials, and register for a free account on US Legal Forms.

- Full the financial transaction. You should use your charge card or PayPal accounts to purchase the legal type.

- Find the structure from the papers and download it for your device.

- Make adjustments for your papers if needed. You can total, change and signal and produce Rhode Island Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions.

Download and produce thousands of papers layouts making use of the US Legal Forms site, that offers the largest assortment of legal types. Use expert and status-specific layouts to handle your organization or specific demands.

Form popularity

FAQ

Thank you for offering me the position of Name of Position at Name of Company. I am delighted to accept your offer and very excited to begin this journey. As we have previous discussed / As stated in the offer letter, I accept my starting salary of Salary for this position.

Thank you for your offer of Job title at Company name. I am delighted to formally accept the offer, and I am very much looking forward to joining the team. As discussed, my starting salary will be Agreed starting salary, rising to Increased salary following a successful probationary period of 3 months.

Exempt: An individual who is exempt from the overtime provisions of the Fair Labor Standards Act (FLSA) because he or she is classified as an executive, professional, administrative or outside sales employee, and meets the specific criteria for the exemption. Certain computer professionals may also be exempt.

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees. Section 13(a)(1) and Section 13(a)(17) also exempt certain computer employees.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Under the FLSA, workers may be considered nonexempt if they either earn less than the $684 weekly minimum or have limited scope for self-supervision. Take, for example, a maintenance worker who's hired to work 40 hours per week at $18 an hour.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

Exempt professional employees include lawyers, physicians, teachers, architects, registered nurses and other employees performing work requiring advanced education or training. These typically are intellectual jobs requiring specialized education and involving the use of discretion and judgment.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.