Rhode Island Expense Reimbursement Request

Instant download

Description

This Employment & Human Resources form covers the needs of employers of all sizes.

How to fill out Expense Reimbursement Request?

Selecting the appropriate legitimate document template can be challenging.

Without a doubt, there are numerous templates accessible online, but how will you secure the legitimate design you desire? Utilize the US Legal Forms website.

The service offers a vast array of templates, including the Rhode Island Expense Reimbursement Request, which can be utilized for professional and personal purposes.

- All of the forms are verified by specialists and comply with state and federal regulations.

- If you are already registered, Log In to your account and then click the Obtain button to get the Rhode Island Expense Reimbursement Request.

- Leverage your account to review the legitimate templates you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new client of US Legal Forms, here are straightforward instructions for you to follow.

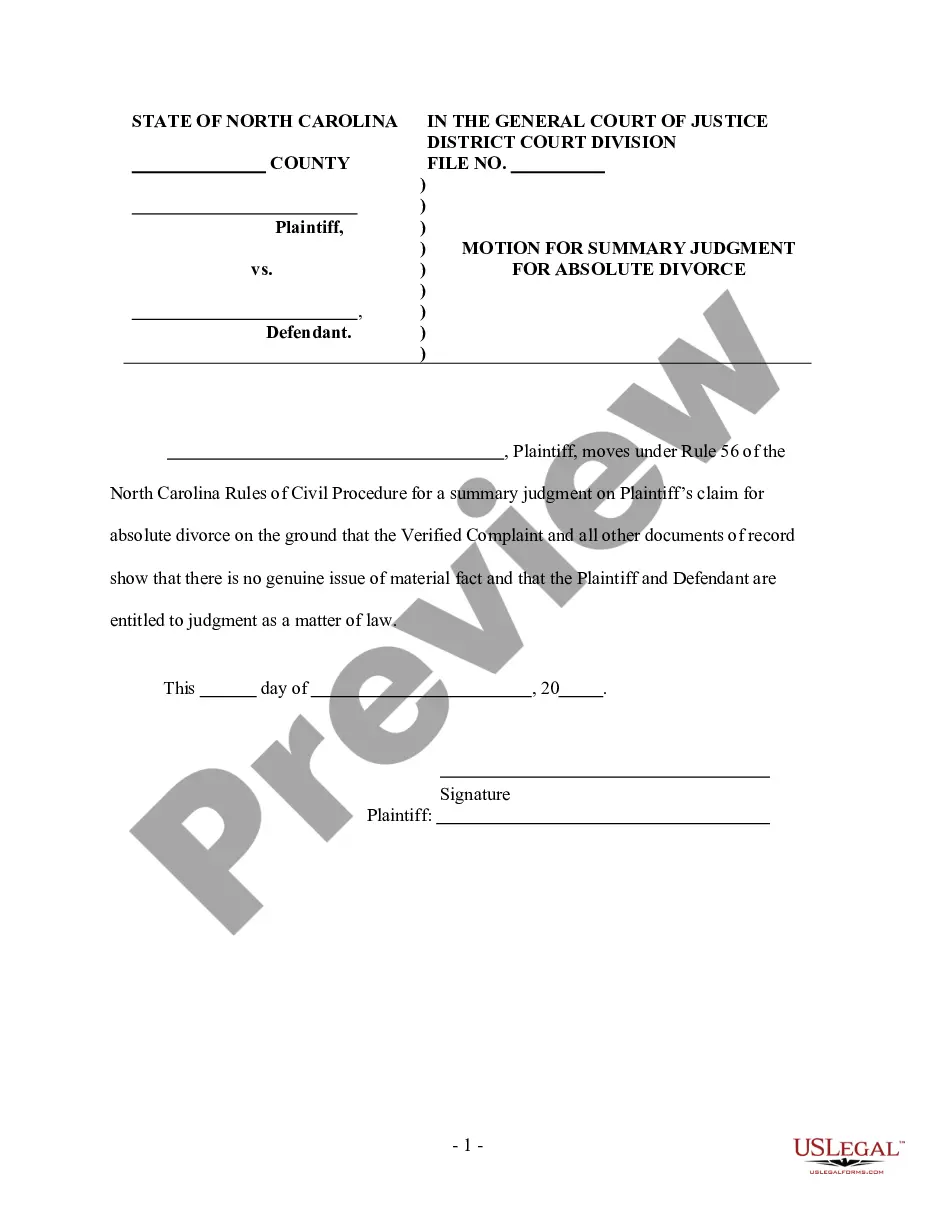

- First, ensure you have selected the correct form for your area/county. You can view the form by using the Review button and read the form description to confirm it is suitable for you.