Rhode Island Department Time Report for Payroll

Description

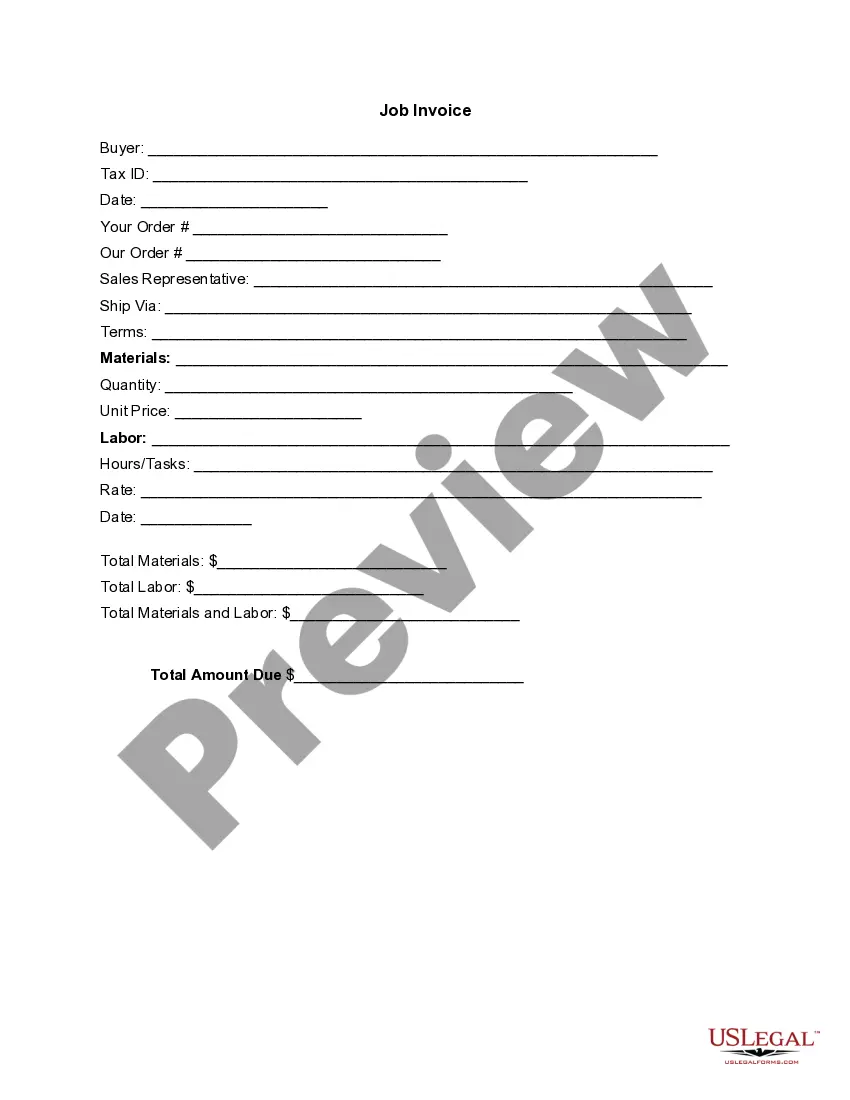

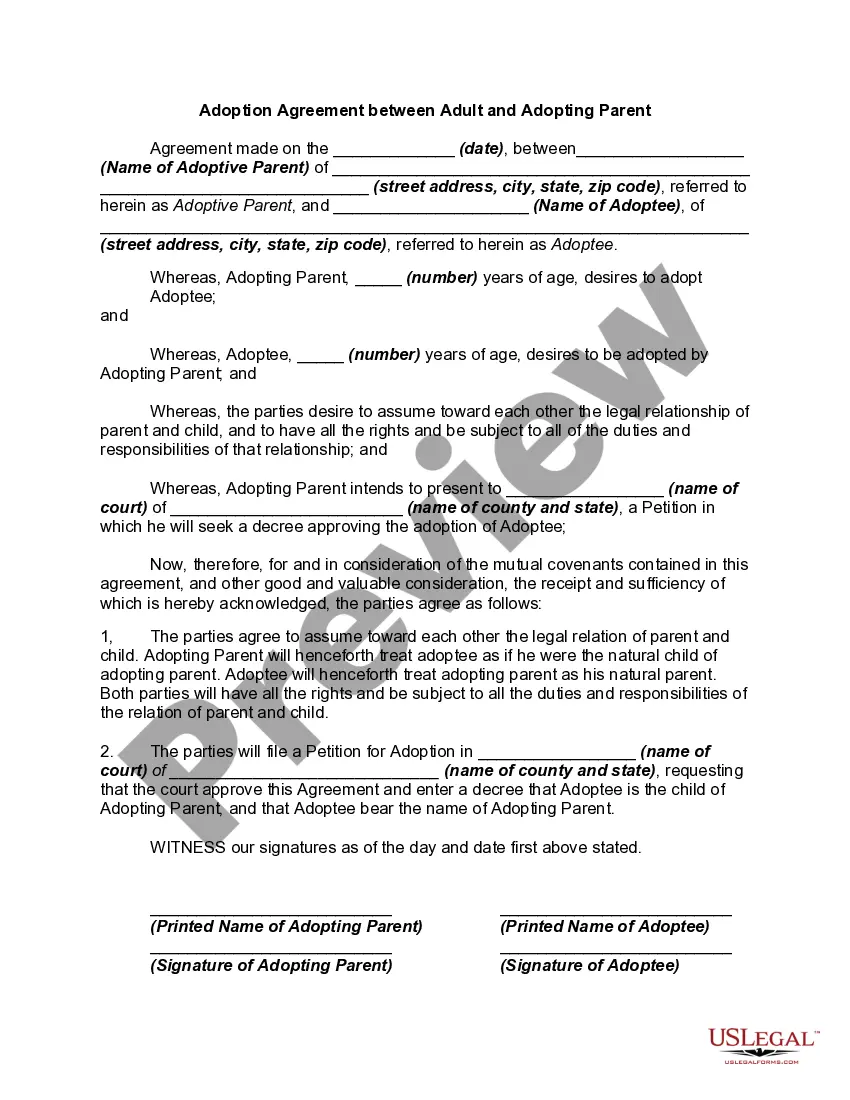

How to fill out Department Time Report For Payroll?

Have you ever encountered a scenario where you require documents for either corporate or personal reasons almost every workday.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a vast array of template designs, such as the Rhode Island Department Time Report for Payroll, which are created to comply with both federal and state regulations.

Once you find the right template, click Buy now.

Select the payment plan you prefer, enter the required information to process your order, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Rhode Island Department Time Report for Payroll template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is suited for your specific city/state.

- Utilize the Review button to verify the document.

- Check the description to confirm that you have chosen the correct template.

- If the template is not what you require, use the Search field to find the document that fits your needs.

Form popularity

FAQ

All California employees who report for work are entitled to be paid for half of their scheduled shifts. The Reporting Time Pay must be at least two hours, but no more than four hours of pay at the employee's regular rate of pay.

A. "Reporting time pay is a form of wages that compensate employees who are scheduled to report to work but who are not put to work or furnished with less than half of their usual or scheduled day's work because of inadequate scheduling or lack of proper notice by the employer.

To discourage employers from delaying final paychecks, California allows an employee to collect a "waiting time penalty" in the amount of his or her daily average wage for every day that the check is late, up to a maximum of 30 days.

If an employer cannot justify not paying an employee on his/her regular payday, then it will be charged with a penalty of: $100 for an initial violation (for each failure to pay each employee), and. $200 for subsequent violations. i

Full-Time in Rhode Island? Unlike most states, Rhode Island does have a law that defines what counts as part-time and full-time employment. In Rhode Island, any employee who works at least 30 hours per week and does not earn less than 150% of the minimum wage is considered full-time.

Reporting time as the name is clear refers to the time which is to be used for reporting. The reporting time refers to the time that a person is required to follow for reaching at a certain place. Reporting time can be used for meetings or any formal events.

Rhode Island Law Requires Meal Breaks Some states require either meal or rest breaks. Rhode Island is one of them: In Rhode Island, employers must give employees a 20-minute meal break for a six-hour shift, and a 30-minute meal break for an eight-hour shift.

Federal Law is not before a.m. or later than p.m. (except p.m. from June 1 through Labor Day). Maximum hours in Rhode Island is 8 hours per day, 40 hours per week. Federal is 3 hours per day (school day), 8 hours non-school day, 18 hours per week (school week) and 40 hours non-school week.

Rhode Island employees are entitled to a 20-minute meal break if they work a six-hour shift. Employees who work an eight-hour shift are entitled to a 30-minute meal break. These breaks are not paid. Employers do not have to provide meal breaks during shifts worked by fewer than three employees.

The federal government created the Fair Labor Standards Act (FLSA) to protect laborers. Each state also sets its own employment laws, but since the FLSA is a federal law, employers nationwide must follow it. The FLSA states that employers must pay their employees promptly for all the hours those employees have worked.