Rhode Island Employee Payroll Records Checklist is a comprehensive tool used by businesses in Rhode Island to ensure they maintain and organize all necessary employee payroll records in compliance with state regulations. This checklist serves as a guide to assist employers with their record-keeping obligations, enabling them to accurately track and maintain important employee payroll information. The Rhode Island Employee Payroll Records Checklist includes various essential aspects that need to be considered when compiling and managing payroll records. These include: 1. Employee Information: — Employee names, addresses, and contact details. — Social Security numbers or employee identification numbers. — Employee start and termination dates— - Job titles and job descriptions. — Classification of employees (full-time, part-time, contractor, etc.). 2. Time and Attendance Records: — Tracking of employee work hours, including start and end times, breaks, and overtime hours. — Documentation of absences, leaves, and vacation time taken. — Attendance records validating attendance and absence time. 3. Compensation Details: — Employee wages or salary rates— - Payment frequency (weekly, biweekly, monthly, etc.). — Deductions for taxes, benefits, contributions, or garnishments. — Overtime hours and rates applied— - Bonus or commission payments made. — Reimbursement records for business expenses. 4. Tax Withholding Documents: — Employee’s W-4 form, including exemptions and tax withholding information. — State and federal tax withholding records. — Reports of payroll taxes deducted and paid to relevant authorities. 5. Benefits and Deductions: — Records of employee benefits, such as health insurance, retirement plans, and savings accounts. — Documentation of deductions made for benefits and contributions. — Periodic statements and reports related to employee benefits. 6. Payroll Registers and Summaries: — Calculation and maintenance of gross wages, net pay, and tax deductions for each pay period. — Payroll summaries for each employee, showcasing itemized earnings and deductions. It is important to note that Rhode Island Employee Payroll Records Checklist may vary depending on the company's size, industry, and specific payroll requirements. Different industries, such as healthcare or retail, may have additional record-keeping obligations unique to their sector. Overall, maintaining Rhode Island Employee Payroll Records Checklist is crucial for businesses as it ensures legal compliance, simplifies tax reporting, facilitates accurate payment, and simplifies auditing processes. By following this checklist, employers can uphold transparency, maintain employee trust, and avoid penalties associated with improper record-keeping.

Rhode Island Employee Payroll Records Checklist

Description

How to fill out Rhode Island Employee Payroll Records Checklist?

Are you in a place that you need to have documents for possibly business or specific functions just about every time? There are a variety of lawful papers templates available on the net, but locating versions you can rely isn`t straightforward. US Legal Forms offers a large number of kind templates, like the Rhode Island Employee Payroll Records Checklist, which are published to fulfill state and federal specifications.

Should you be currently familiar with US Legal Forms web site and possess your account, just log in. Following that, you can down load the Rhode Island Employee Payroll Records Checklist web template.

Unless you provide an account and need to begin using US Legal Forms, adopt these measures:

- Discover the kind you need and make sure it is for your appropriate town/area.

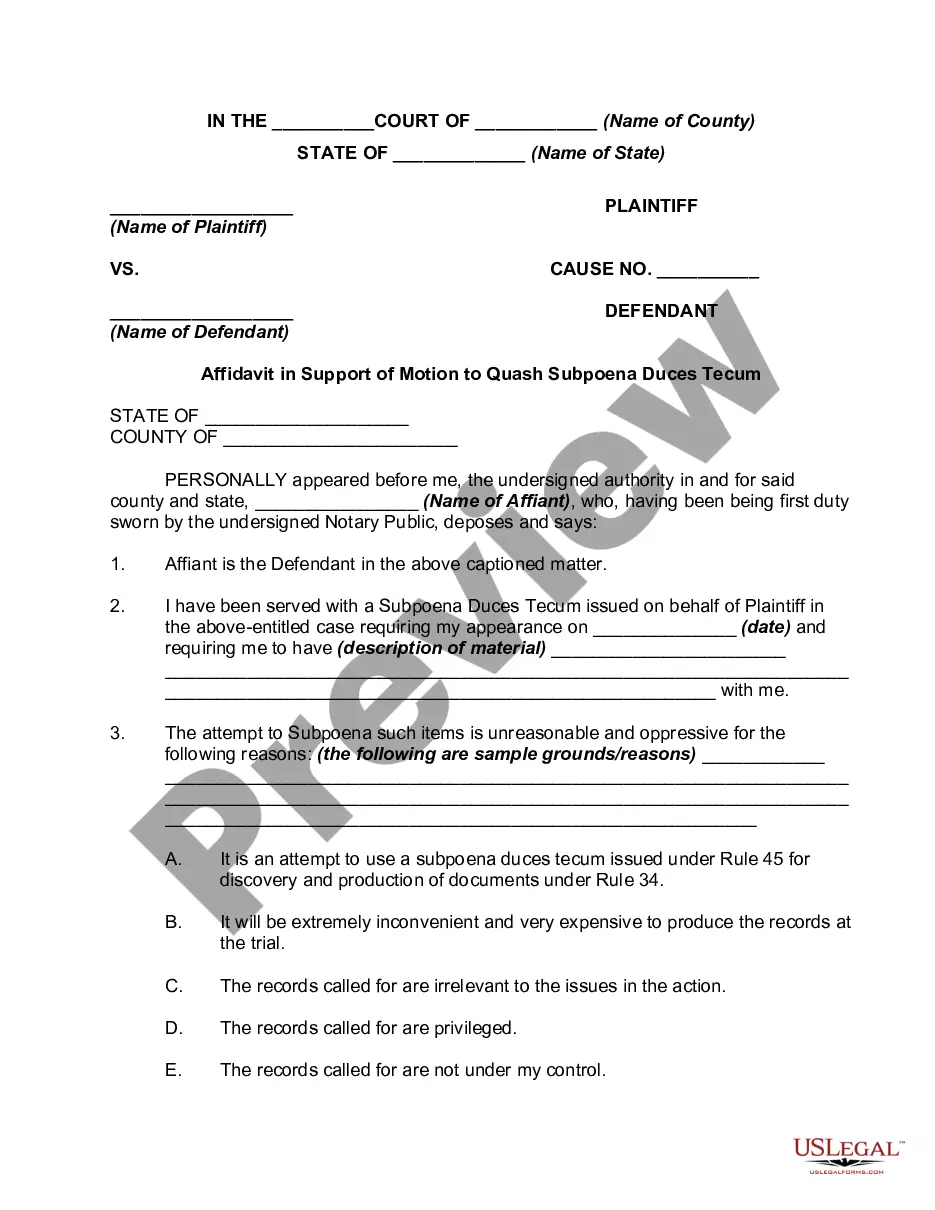

- Utilize the Review button to analyze the form.

- Browse the information to ensure that you have chosen the appropriate kind.

- If the kind isn`t what you are searching for, use the Search industry to obtain the kind that meets your requirements and specifications.

- Once you find the appropriate kind, simply click Acquire now.

- Select the rates prepare you would like, complete the specified info to make your account, and purchase an order with your PayPal or credit card.

- Decide on a practical file file format and down load your copy.

Find all of the papers templates you possess bought in the My Forms food list. You may get a more copy of Rhode Island Employee Payroll Records Checklist whenever, if possible. Just go through the necessary kind to down load or printing the papers web template.

Use US Legal Forms, by far the most substantial assortment of lawful types, to conserve time and stay away from blunders. The assistance offers skillfully produced lawful papers templates which can be used for a range of functions. Make your account on US Legal Forms and initiate generating your life a little easier.