Rhode Island Employee Notice to Correct IRCA Compliance

Description

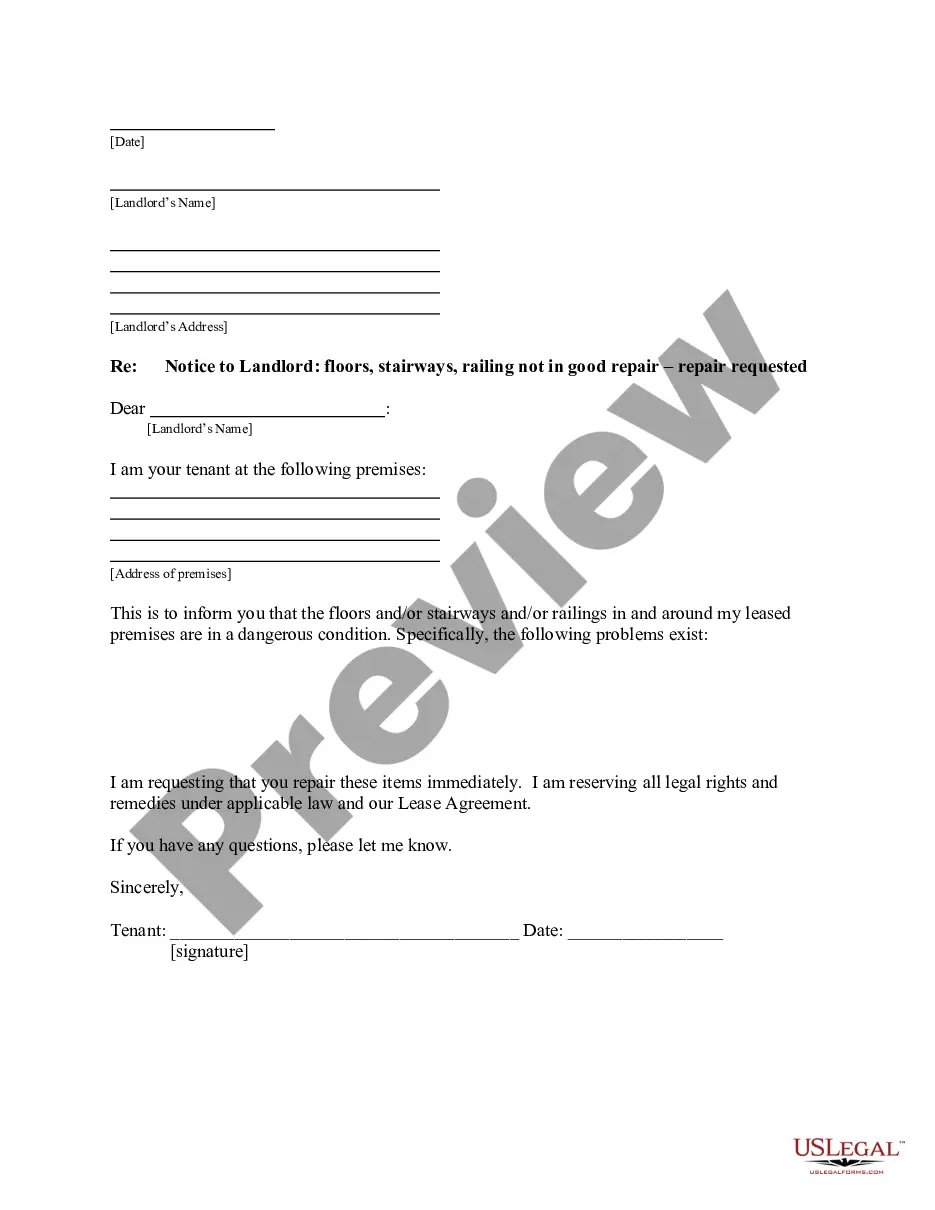

How to fill out Employee Notice To Correct IRCA Compliance?

You may spend numerous hours online looking for the legal document format that satisfies the state and federal requirements you have.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can download or print the Rhode Island Employee Notice to Correct IRCA Compliance from the service.

If available, use the Review button to browse through the document format as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- Afterward, you can complete, alter, print, or sign the Rhode Island Employee Notice to Correct IRCA Compliance.

- Every legal document format you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the county/area of your choice.

- Refer to the form outline to verify you have chosen the right document.

Form popularity

FAQ

Three-day RuleAn E-Verify case is considered late if you create it later than the third business day after the employee first started work for pay. If the case you create is late, E-Verify will ask why, and you can either select one of the reasons provided or enter you own.

The Immigration Reform and Compliance Act of 1986 (IRCA) prohibits the employment of unauthorized aliens and requires all employers to: (1) not knowingly hire or continue to employ any person not authorized to work in the United States, (2) verify the employment eligibility of every new employee (whether the employee

Employment law and compliance concerns the legal framework within which organizations must operate in their treatment of employees. Employers must comply with a myriad of federal and state laws and regulations.

IRCA applies to all employers with four or more employees. Who does this law protect? This law protects all those authorized to work in the US: US citizens, non-citizen nationals, lawful permanent residents, and non-citizens who are authorized to work.

The IRCA requires employers to certify (using the I-9 form) within three days of employment the identity and eligibility to work of all employees hired. I-9 forms must be retained for three years following employment or 1 year following termination whichever is later.

Background: President Bush amended Executive Order 12989 on June 6, 2008, requiring all federal contractors to verify the employment eligibility of all persons hired during the contract term and all persons performing work within the United States on the federal contract by using the employment eligibility verification

IRCA prohibits employers from knowingly hiring, recruiting, or referring for a fee any alien who is unauthorized to work. The public policy behind this law reflects the concern that the problem of illegal immigration and employment requires greater control and stronger enforcement mechanisms by the federal government.

Form DWC-11-ICR "Notice of Withdrawal of Designation as Independent Contractor Pursuant to Rigl 28-29-17.1" - Rhode Island.

The document review and certification must occur by the third day after the employee begins employment. Employers may elect whether or not to photocopy (and retain) the documents submitted by employees for the Form I-9 process (8 C.F.R. § 274a.