Rhode Island Employee Evaluation Form for Sole Trader

Description

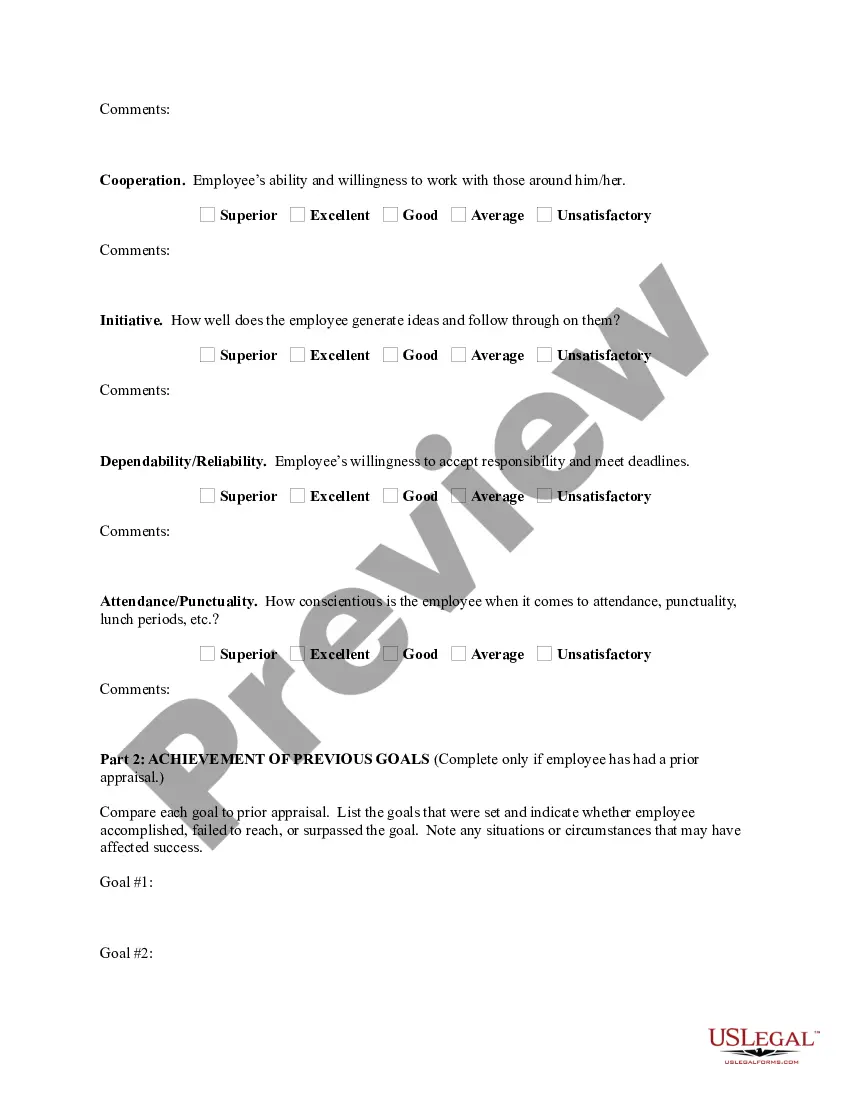

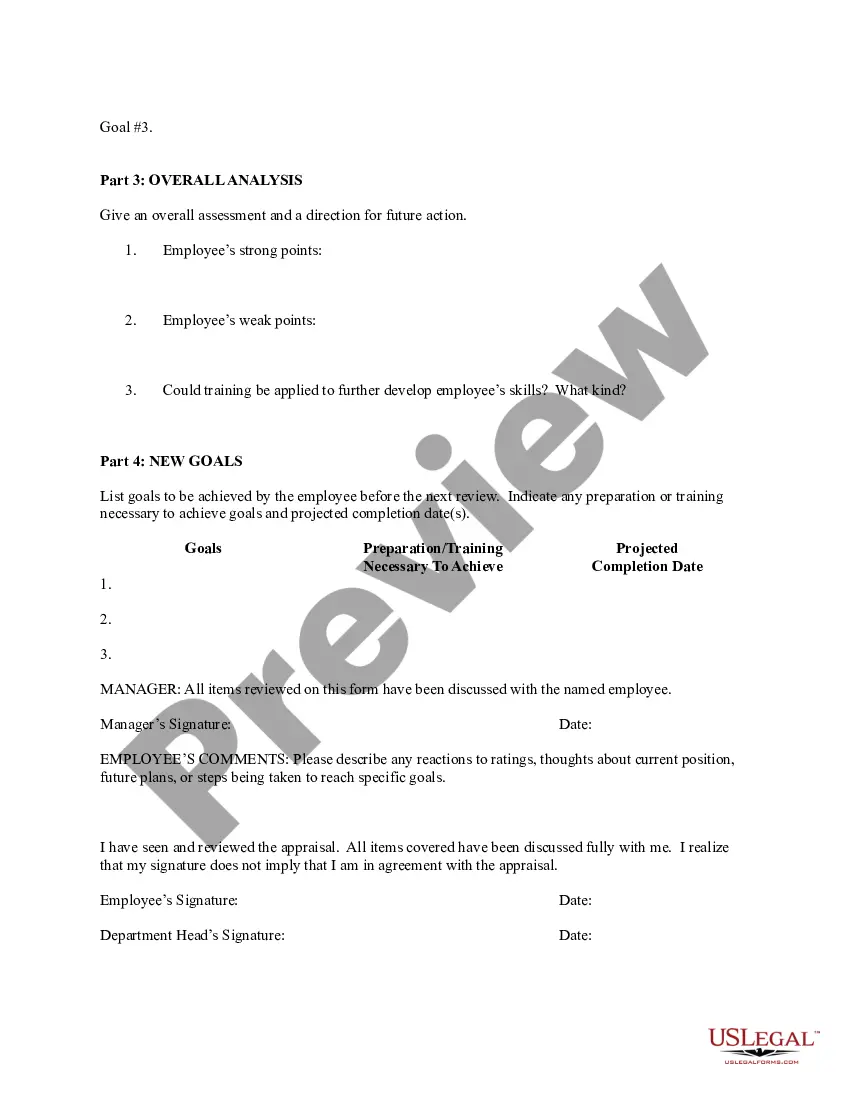

How to fill out Rhode Island Employee Evaluation Form For Sole Trader?

If you wish to full, download, or printing lawful record templates, use US Legal Forms, the greatest assortment of lawful kinds, which can be found on the web. Take advantage of the site`s simple and hassle-free search to discover the papers you want. A variety of templates for business and individual purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to discover the Rhode Island Employee Evaluation Form for Sole Trader in a couple of click throughs.

When you are previously a US Legal Forms client, log in for your bank account and then click the Acquire button to obtain the Rhode Island Employee Evaluation Form for Sole Trader. You can even entry kinds you previously acquired within the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the form for the correct area/land.

- Step 2. Utilize the Preview choice to look through the form`s information. Never forget about to see the explanation.

- Step 3. When you are not happy with the form, take advantage of the Research industry at the top of the monitor to find other types from the lawful form template.

- Step 4. Upon having identified the form you want, go through the Get now button. Choose the costs program you prefer and add your accreditations to sign up on an bank account.

- Step 5. Process the transaction. You can utilize your bank card or PayPal bank account to complete the transaction.

- Step 6. Pick the structure from the lawful form and download it in your gadget.

- Step 7. Full, revise and printing or sign the Rhode Island Employee Evaluation Form for Sole Trader.

Each lawful record template you purchase is your own property forever. You might have acces to each and every form you acquired in your acccount. Go through the My Forms area and pick a form to printing or download once more.

Compete and download, and printing the Rhode Island Employee Evaluation Form for Sole Trader with US Legal Forms. There are thousands of professional and state-particular kinds you can utilize to your business or individual needs.

Form popularity

FAQ

UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated and withheld.

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form.

Unemployment benefits available to gig workers, self-employed, small business owners. CRANSTON, R.I. (WJAR) Jobless benefits during the coronavirus crisis are being extended to those who typically would not qualify for unemployment insurance.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer. Form RI W-4 must be completed each year if you claim EXEMPT or EXEMPT-MS on line 3 below.

How to fill out a W-4: step by stepStep 1: Enter your personal information.Step 2: Account for all jobs you and your spouse have.Step 3: Claim your children and other dependents.Step 4: Make other adjustments.Step 5: Sign and date your form.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

Federal Form W-4 can no longer be used for Rhode Island withholding purposes. You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer.

How to fill out a W-4: step by stepStep 1: Enter your personal information.Step 2: Account for all jobs you and your spouse have.Step 3: Claim your children and other dependents.Step 4: Make other adjustments.Step 5: Sign and date your form.