Rhode Island Summary of Schedules - Form 6CONTSUM - Post 2005

Description

How to fill out Summary Of Schedules - Form 6CONTSUM - Post 2005?

If you want to comprehensive, obtain, or produce authorized document themes, use US Legal Forms, the most important collection of authorized varieties, that can be found online. Use the site`s basic and hassle-free lookup to obtain the papers you want. Different themes for enterprise and specific purposes are sorted by classes and states, or key phrases. Use US Legal Forms to obtain the Rhode Island Summary of Schedules - Form 6CONTSUM - Post 2005 in a number of click throughs.

If you are already a US Legal Forms customer, log in in your bank account and then click the Down load option to have the Rhode Island Summary of Schedules - Form 6CONTSUM - Post 2005. You can also access varieties you in the past acquired within the My Forms tab of the bank account.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your proper city/land.

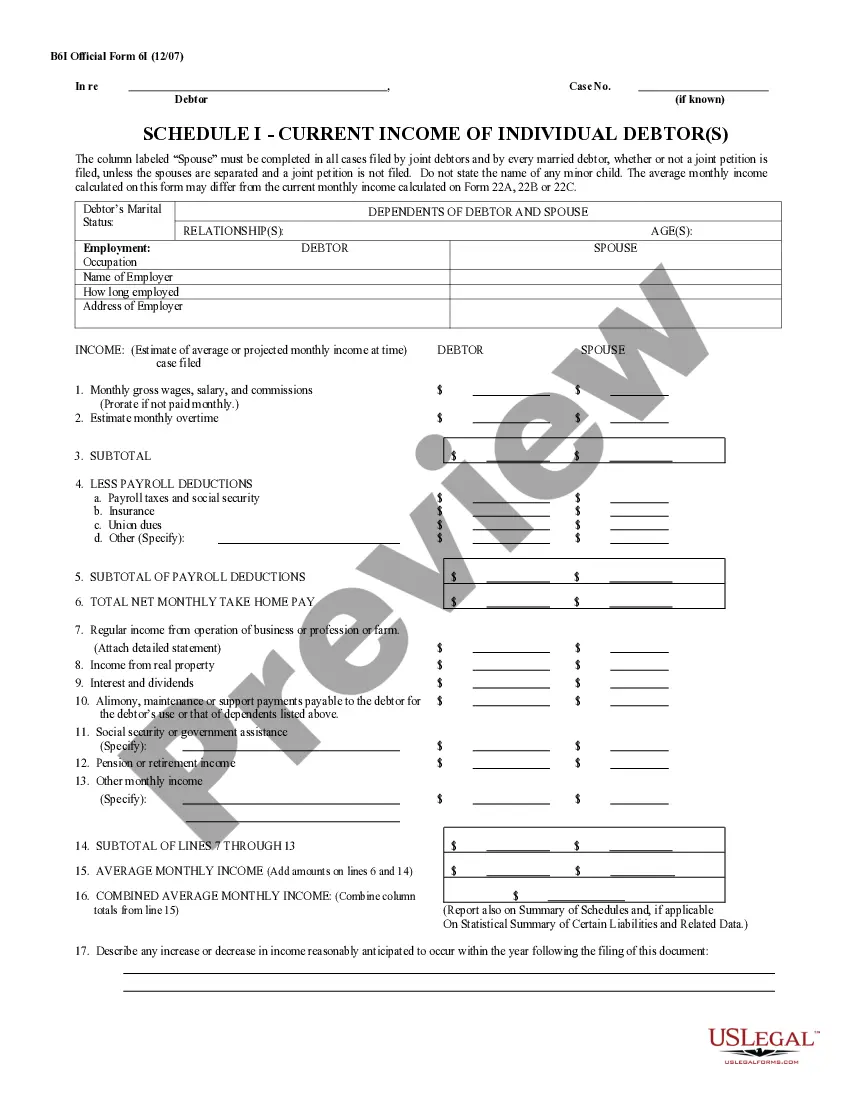

- Step 2. Take advantage of the Review option to examine the form`s content material. Don`t neglect to see the outline.

- Step 3. If you are unsatisfied together with the develop, make use of the Search field on top of the display screen to discover other versions of your authorized develop design.

- Step 4. When you have located the form you want, click on the Acquire now option. Opt for the rates strategy you like and add your references to register for an bank account.

- Step 5. Procedure the transaction. You may use your charge card or PayPal bank account to complete the transaction.

- Step 6. Select the format of your authorized develop and obtain it in your product.

- Step 7. Comprehensive, revise and produce or signal the Rhode Island Summary of Schedules - Form 6CONTSUM - Post 2005.

Each and every authorized document design you purchase is the one you have eternally. You may have acces to every develop you acquired inside your acccount. Click on the My Forms segment and pick a develop to produce or obtain yet again.

Contend and obtain, and produce the Rhode Island Summary of Schedules - Form 6CONTSUM - Post 2005 with US Legal Forms. There are thousands of professional and state-certain varieties you can utilize to your enterprise or specific demands.

Form popularity

FAQ

Whether the trustee can take money you receive after filing your case depends on whether you were entitled to the money at the time your case was filed and how it was listed on your forms, if at all.

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth.

Schedule D: Secured Debts Official Form 106D, called Schedule D: Creditors Who Hold Claims Secured By Property (individuals), is for secured debts. It lists debt secured by an interest in either real property (like a house) or personal property. The most common types of secured debts are car loans and home mortgages.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

Official Form 106Sum is the Summary of Your Assets and Liabilities and Certain Statistical Information. It contains the ?bottom line? kind of information from your schedules. Things like the total value of your property, the total amount of your debts, and information about your income and expenses.

Schedules of Assets and Liabilities means the "Schedule of All Liabilities of Debtor and Statement of All Property of Debtor" Filed by the Debtors, as the same have been or may be amended from time to time prior to the Effective Date.