Rhode Island Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

How to fill out Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

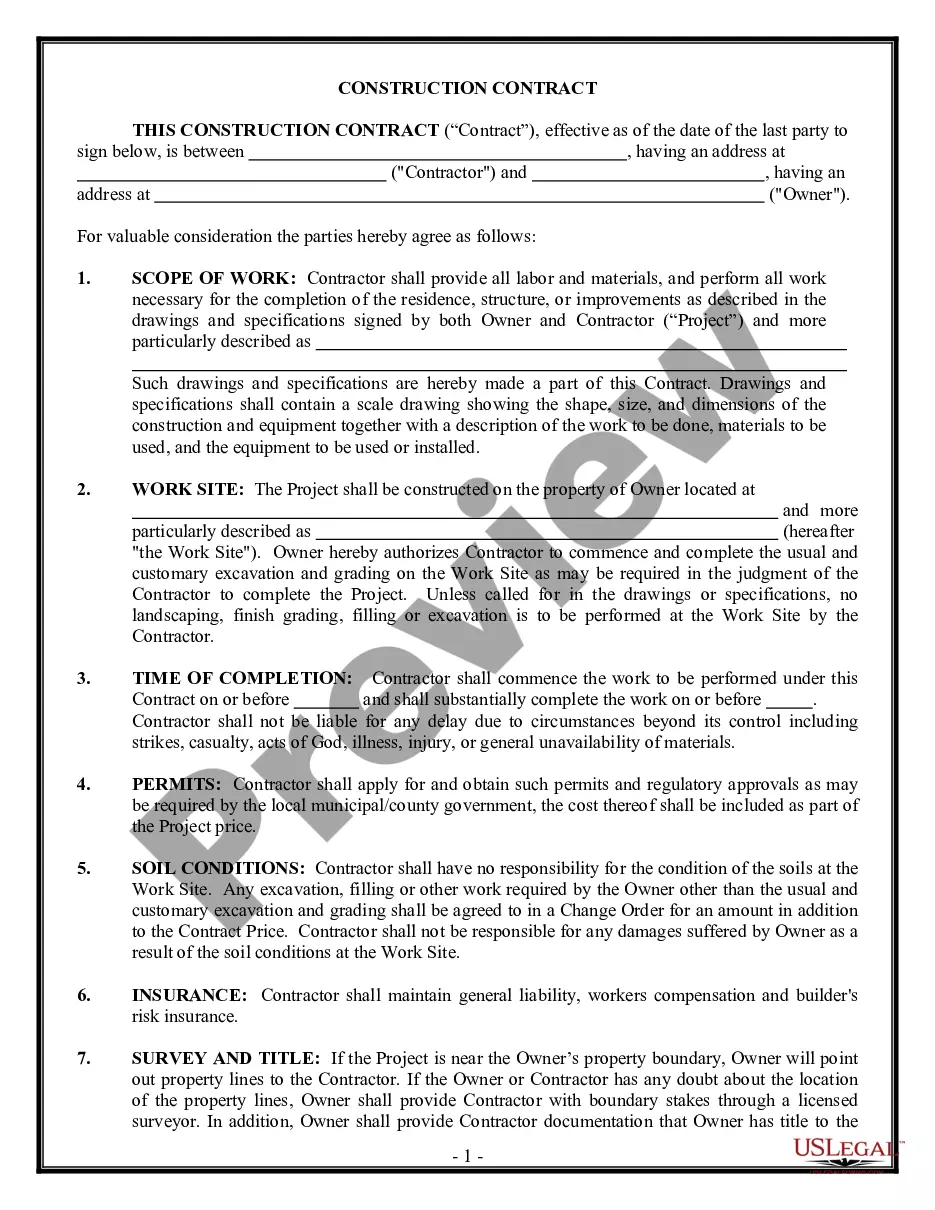

Choosing the right legitimate document web template could be a have a problem. Needless to say, there are tons of themes available on the net, but how would you discover the legitimate kind you want? Take advantage of the US Legal Forms internet site. The services provides 1000s of themes, like the Rhode Island Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005, that can be used for company and private needs. Every one of the forms are examined by specialists and fulfill federal and state specifications.

When you are previously registered, log in for your account and then click the Obtain switch to get the Rhode Island Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005. Use your account to look from the legitimate forms you possess acquired previously. Proceed to the My Forms tab of your account and have an additional version of your document you want.

When you are a new customer of US Legal Forms, listed below are basic guidelines that you should follow:

- Initially, be sure you have chosen the correct kind for your personal metropolis/area. You can look through the form utilizing the Preview switch and look at the form explanation to ensure this is basically the right one for you.

- In the event the kind fails to fulfill your requirements, take advantage of the Seach industry to obtain the correct kind.

- When you are positive that the form is proper, go through the Buy now switch to get the kind.

- Choose the rates prepare you desire and enter the necessary information. Create your account and pay money for an order making use of your PayPal account or bank card.

- Opt for the submit structure and download the legitimate document web template for your product.

- Complete, modify and print out and indication the attained Rhode Island Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005.

US Legal Forms may be the greatest catalogue of legitimate forms where you can find numerous document themes. Take advantage of the service to download professionally-created paperwork that follow state specifications.

Form popularity

FAQ

Income averaging for farmers and fishermen provides a way to balance an income tax burden over several years, reducing the effects of both lean and bounty years. Schedule J is the Internal Revenue Service form used when you want to average your fishing or farming income.

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Please access our website via . Please click on the link ?STATEMENT OF AFFAIRS FOR BANKRUPTCY?. Please select your login option; SingPass Holder or Non-SingPass Holder. For SingPass Holder, please login with your SingPass ID and Password.

Official Form 106I (Schedule I) is the form where you disclose your monthly household income. Official Form 106J (Schedule J) is the form where you disclose your current household monthly expenses. At the end of Schedule J, you will subtract your income from your expenses.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.