Rhode Island Share Exchange Agreement with exhibits

Description

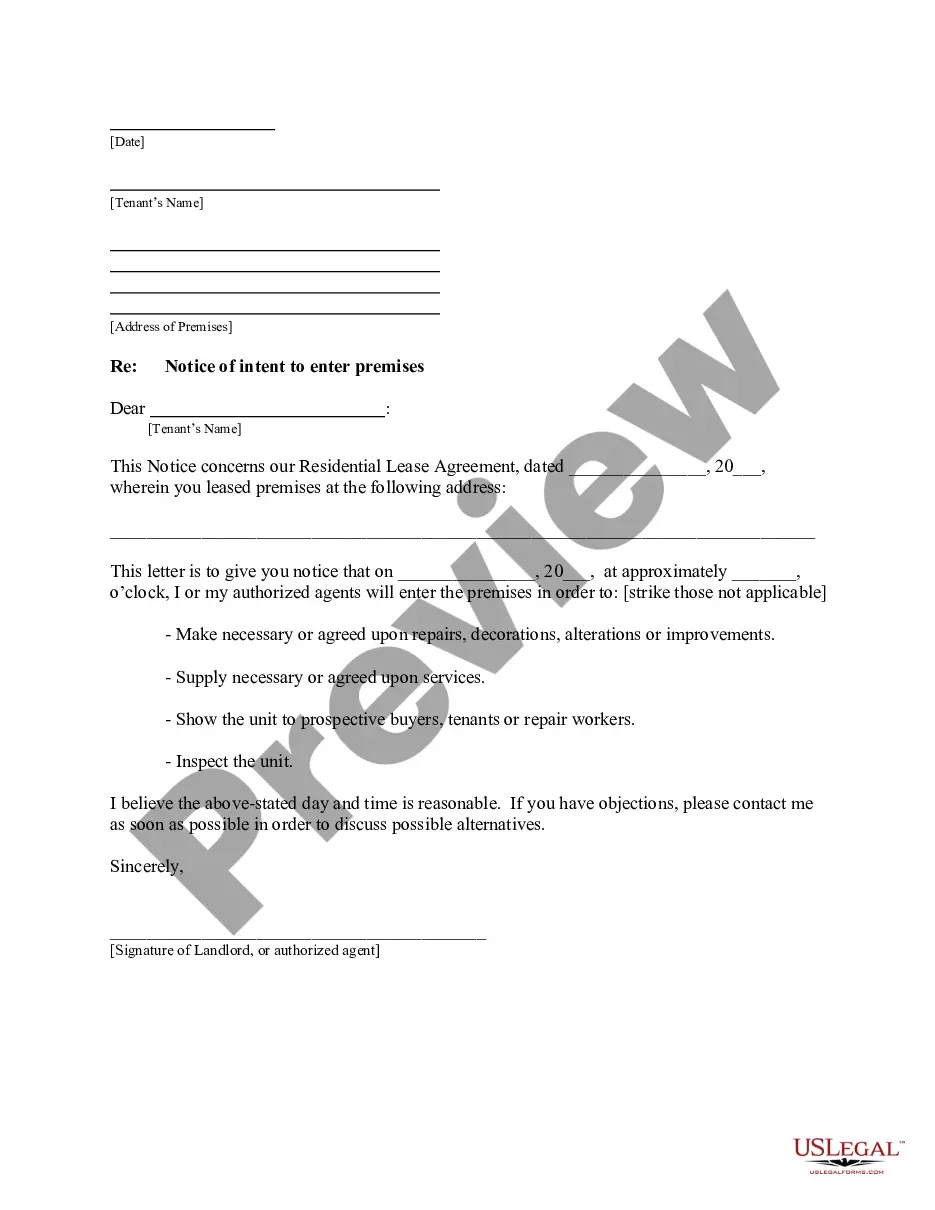

How to fill out Rhode Island Share Exchange Agreement With Exhibits?

Choosing the right legitimate papers format could be a struggle. Naturally, there are plenty of themes available on the net, but how do you obtain the legitimate kind you require? Make use of the US Legal Forms site. The service gives a huge number of themes, including the Rhode Island Share Exchange Agreement with exhibits, which you can use for enterprise and personal demands. Each of the forms are examined by experts and satisfy state and federal specifications.

In case you are presently listed, log in for your bank account and click on the Obtain button to get the Rhode Island Share Exchange Agreement with exhibits. Make use of your bank account to appear through the legitimate forms you may have bought formerly. Check out the My Forms tab of your bank account and get yet another duplicate from the papers you require.

In case you are a new customer of US Legal Forms, here are basic directions for you to comply with:

- Initially, make sure you have selected the right kind for the town/county. You can check out the form utilizing the Review button and read the form explanation to make certain it will be the best for you.

- When the kind will not satisfy your requirements, utilize the Seach discipline to obtain the proper kind.

- When you are sure that the form is acceptable, click the Get now button to get the kind.

- Choose the rates strategy you want and enter in the required details. Make your bank account and purchase the order using your PayPal bank account or Visa or Mastercard.

- Pick the data file format and download the legitimate papers format for your device.

- Full, edit and print out and signal the acquired Rhode Island Share Exchange Agreement with exhibits.

US Legal Forms may be the biggest collection of legitimate forms where you can see numerous papers themes. Make use of the company to download professionally-produced papers that comply with express specifications.

Form popularity

FAQ

In most cases, an SPA will be signed as a simple contract and not as a deed (executing a contract as a deed requires the signatures to be witnessed and sealed).

A shareholders' agreement is a contract that regulates the relationship between the shareholders and the corporation. The agreement will detail what models or forms which the corporation should run and outline and the basic rights and obligations of the shareholders.

An agreement can provide for many eventualities including the financing of the company, the management of the company, the dividend policy, the procedure to be followed on a transfer of shares, deadlock situations and valuation of the shares.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

5 easy steps to file share purchase agreementReview of the share purchase agreement by both the parties. Signature by both the parties. A witness can be signatory as well in case of any doubt on the purchaser. Copies should be made for a purchaser, seller and the company.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

A share exchange is a type of business transaction governed by statutory law in which all or part of one corporation's shares are exchanged for those of another corporation, but both companies remain in existence.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

A Share Purchase Agreement, also called a Stock Purchase Agreement, is used to transfer the ownership of shares (also called stock) in a company from a seller to a buyer. Shares (or stock) are units of ownership in a company that are divided among shareholders (also called stockholders).

Introduction.Step 1: Decide on the issues the agreement should cover.Step 2: Identify the interests of shareholders.Step 3: Identify shareholder value.Step 4: Identify who will make decisions - shareholders or directors.Step 5: Decide how voting power of shareholders should add up.Further information and documents.