The Rhode Island Agreement and Plan of Merger is a legally binding agreement that outlines the terms and conditions of a merger between Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank. This merger aims to combine the resources, expertise, and customer bases of these financial institutions to create a stronger and more competitive entity in the Rhode Island banking market. Keywords: Rhode Island Agreement and Plan of Merger, Cascade Financial, Cascade Bank, Am first Ban corporation, American First National Bank, merger, agreement, financial institutions, banking market. This agreement encompasses various aspects of the merger, including the exchange of shares, assets, liabilities, and company operations. It establishes the structure and governance of the merged entity, detailing the roles and responsibilities of the respective parties involved. The agreement also addresses any potential financial risks, legal considerations, and regulatory requirements that must be fulfilled for the merger to proceed smoothly. The Rhode Island Agreement and Plan of Merger may include specific provisions such as the timeline for completion, regulatory approvals needed, and any necessary amendments to corporate governance documents. It may also outline the strategic objectives and benefits expected from the merger, such as enhanced operational efficiencies, increased market share, and improved financial performance. This type of merger agreement is typically designed to protect the interests of all stakeholders involved. It sets forth the terms of the transaction, including the rights of shareholders, executive compensation, and any potential changes to employee benefits or company policies. Additionally, the agreement may establish guidelines for integration planning, customer communications, and employee retention during the merger process. In some cases, there may be different types or variations of the Rhode Island Agreement and Plan of Merger. These could include specific provisions tailored to the unique circumstances of each merger scenario. For example, if there are multiple subsidiaries or divisions involved, the agreement may outline how they will be consolidated or restructured under the merged entity. Alternatively, if the merger involves a change in corporate control or ownership, additional legal considerations and approvals may be necessary. Overall, the Rhode Island Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank represents a strategic collaboration that aims to capitalize on the strengths of each institution to achieve greater success in the Rhode Island banking market.

Rhode Island Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

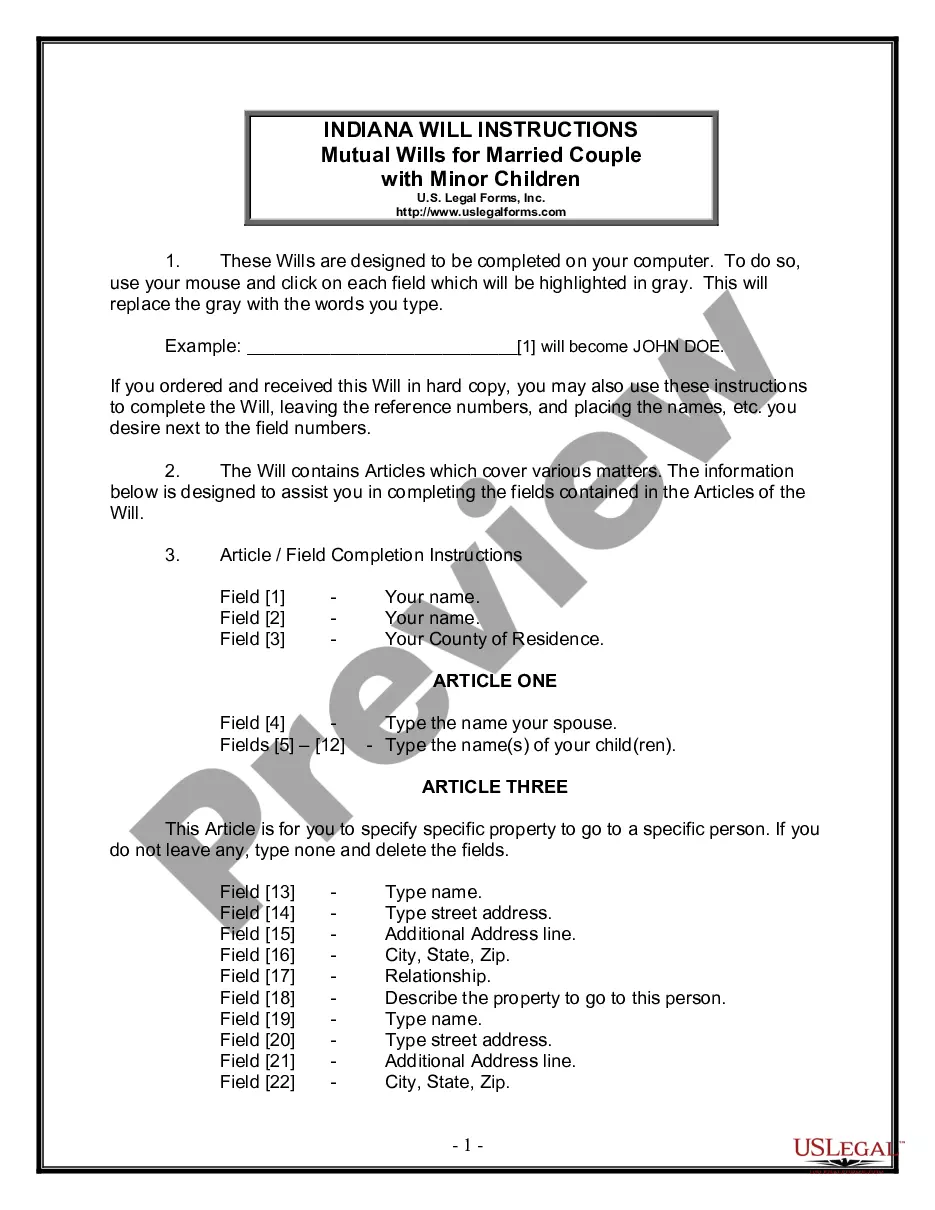

How to fill out Rhode Island Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

If you have to complete, acquire, or print out authorized papers layouts, use US Legal Forms, the largest assortment of authorized types, that can be found on the web. Take advantage of the site`s easy and handy look for to discover the files you require. Various layouts for organization and specific functions are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Rhode Island Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank in a couple of mouse clicks.

If you are presently a US Legal Forms consumer, log in in your accounts and then click the Obtain key to find the Rhode Island Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank. You may also gain access to types you in the past saved in the My Forms tab of your accounts.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for the proper area/nation.

- Step 2. Use the Preview solution to check out the form`s articles. Don`t neglect to read through the outline.

- Step 3. If you are unsatisfied together with the type, use the Search industry on top of the display screen to discover other models from the authorized type template.

- Step 4. Upon having discovered the form you require, select the Buy now key. Choose the costs program you choose and include your references to sign up for an accounts.

- Step 5. Method the financial transaction. You can use your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the structure from the authorized type and acquire it on your device.

- Step 7. Comprehensive, modify and print out or indicator the Rhode Island Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank.

Each authorized papers template you buy is your own forever. You might have acces to each and every type you saved with your acccount. Select the My Forms segment and decide on a type to print out or acquire once more.

Remain competitive and acquire, and print out the Rhode Island Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank with US Legal Forms. There are millions of specialist and state-specific types you can use to your organization or specific demands.