Rhode Island Proposal to Approve Directors' Compensation Plan with copy of plan

Description

How to fill out Proposal To Approve Directors' Compensation Plan With Copy Of Plan?

Choosing the right legal document template could be a have difficulties. Obviously, there are plenty of templates available on the Internet, but how do you obtain the legal form you want? Use the US Legal Forms web site. The service gives 1000s of templates, such as the Rhode Island Proposal to Approve Directors' Compensation Plan with copy of plan, that you can use for organization and private requires. All of the varieties are inspected by professionals and fulfill federal and state demands.

In case you are currently authorized, log in for your accounts and click on the Obtain button to obtain the Rhode Island Proposal to Approve Directors' Compensation Plan with copy of plan. Utilize your accounts to check throughout the legal varieties you might have purchased earlier. Visit the My Forms tab of your accounts and get yet another backup of your document you want.

In case you are a new user of US Legal Forms, here are basic recommendations for you to stick to:

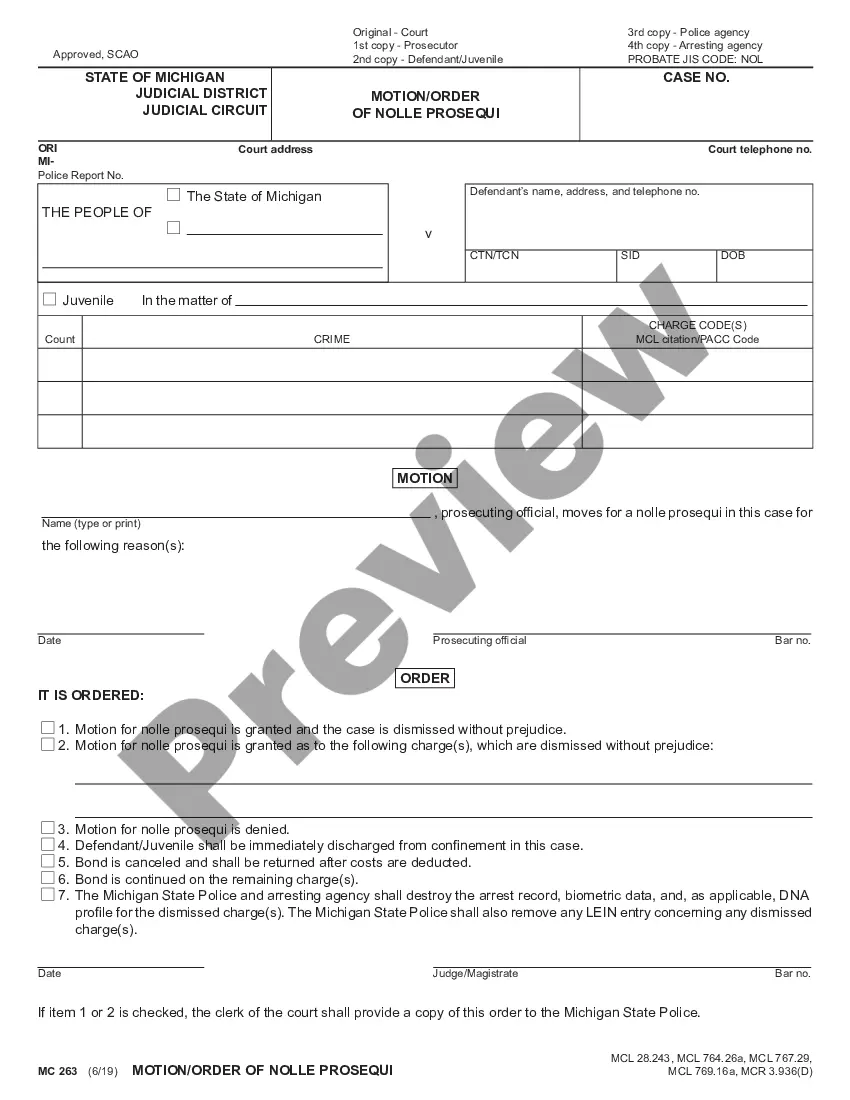

- Initially, be sure you have selected the proper form for the metropolis/county. You may examine the shape making use of the Review button and look at the shape description to make sure it will be the best for you.

- If the form is not going to fulfill your requirements, make use of the Seach area to get the right form.

- Once you are sure that the shape is suitable, click on the Buy now button to obtain the form.

- Choose the pricing prepare you desire and enter in the required information and facts. Build your accounts and pay money for an order making use of your PayPal accounts or charge card.

- Opt for the document format and down load the legal document template for your device.

- Comprehensive, change and produce and indication the obtained Rhode Island Proposal to Approve Directors' Compensation Plan with copy of plan.

US Legal Forms is definitely the greatest collection of legal varieties that you can see various document templates. Use the service to down load skillfully-produced documents that stick to status demands.