Rhode Island Approval of Restricted Share Plan for Directors with Copy of Plan

Description

How to fill out Approval Of Restricted Share Plan For Directors With Copy Of Plan?

Choosing the best legal file format could be a battle. Obviously, there are a lot of layouts available online, but how will you obtain the legal form you need? Utilize the US Legal Forms site. The service offers a large number of layouts, for example the Rhode Island Approval of Restricted Share Plan for Directors with Copy of Plan, that can be used for business and personal requirements. Each of the varieties are checked by specialists and fulfill federal and state specifications.

When you are previously authorized, log in to the account and click on the Down load option to find the Rhode Island Approval of Restricted Share Plan for Directors with Copy of Plan. Make use of account to search through the legal varieties you may have acquired formerly. Visit the My Forms tab of your own account and get one more version in the file you need.

When you are a whole new end user of US Legal Forms, here are basic guidelines that you should follow:

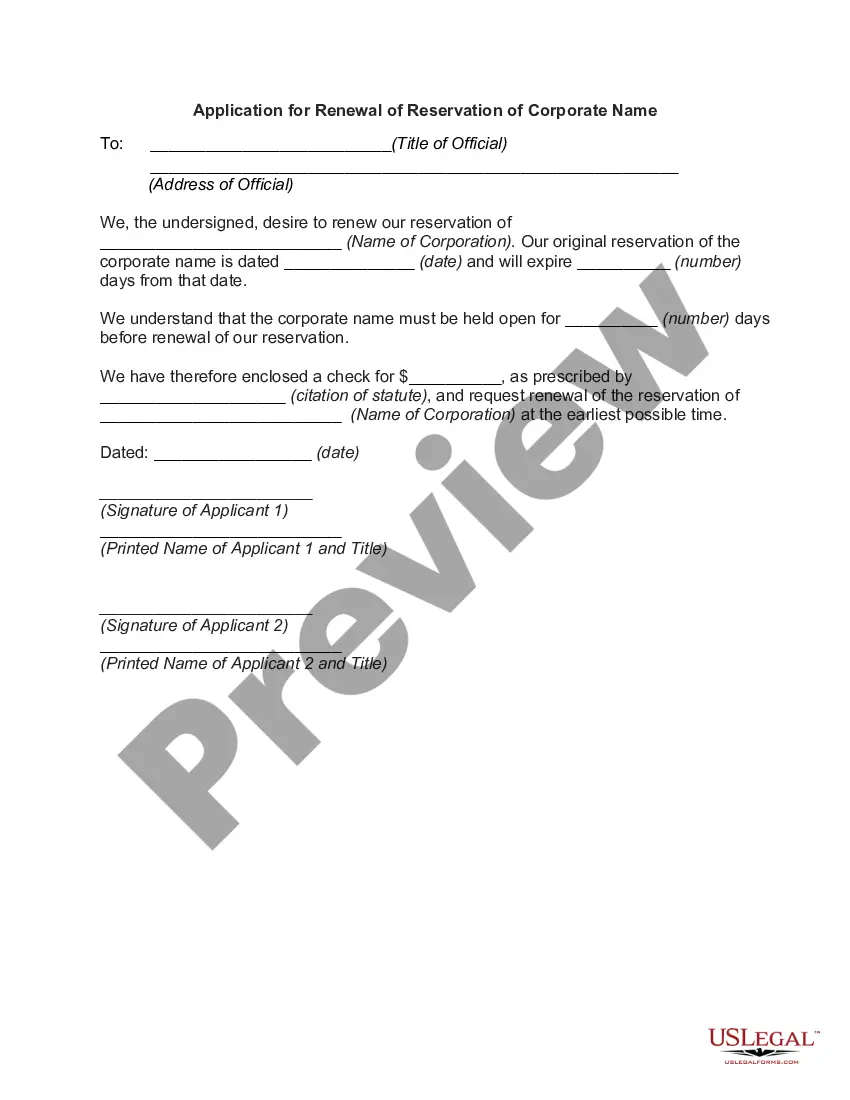

- First, make sure you have selected the right form to your town/region. You may check out the shape while using Preview option and read the shape description to make sure it is the best for you.

- In case the form fails to fulfill your expectations, make use of the Seach discipline to find the appropriate form.

- Once you are certain that the shape would work, select the Get now option to find the form.

- Opt for the rates prepare you would like and enter the necessary info. Build your account and purchase the order making use of your PayPal account or bank card.

- Pick the file file format and obtain the legal file format to the device.

- Complete, revise and print out and signal the acquired Rhode Island Approval of Restricted Share Plan for Directors with Copy of Plan.

US Legal Forms is definitely the greatest catalogue of legal varieties for which you can find numerous file layouts. Utilize the company to obtain appropriately-produced files that follow condition specifications.

Form popularity

FAQ

It is the policy of the state of Rhode Island that public officials and employees must adhere to the highest standards of ethical conduct, respect the public trust and the rights of all persons, be open, accountable and responsive, avoid the appearance of impropriety, and not use their position for private gain or ...

About. Cortney M. Nicolato President & CEO United Way of Rhode Island Cortney M. Nicolato is a mission-driven executive leader with two decades of experience in nonprofit management and healthcare.

You also may contact the Rhode Island Ethics Commission directly at (401) 222-3790, or by email at ethics.email@ethics.ri.gov.

Deceptive trade practices in the state are dealt with in Rhode Island General Laws, under Title 6, Chapter 13.1. The term 'trade and commerce' is defined in Section 6-13.1-1 to include advertising. Section 6-13.1-2 declares false and fraudulent advertising as a deceptive act or practice which is declared unlawful.

An ethics complaint is a written document filed by the Inspector General with the SEC. This document cites the specific ethics rule which is alleged to have been violated along with the general supporting facts. This is a civil rather than a criminal proceeding.

(a) A person subject to this code of ethics has an interest which is in substantial conflict with the proper discharge of his or her duties or employment in the public interest and of his or her responsibilities as prescribed in the laws of this state, if he or she has reason to believe or expect that he or she or any ...

Welcome to the Rhode Island Ethics Commission For assistance, please feel free to call us at (401) 222-3790 or email us at ethics.email@ethics.ri.gov.