Rhode Island Acquisition, Merger, or Liquidation

Description

How to fill out Acquisition, Merger, Or Liquidation?

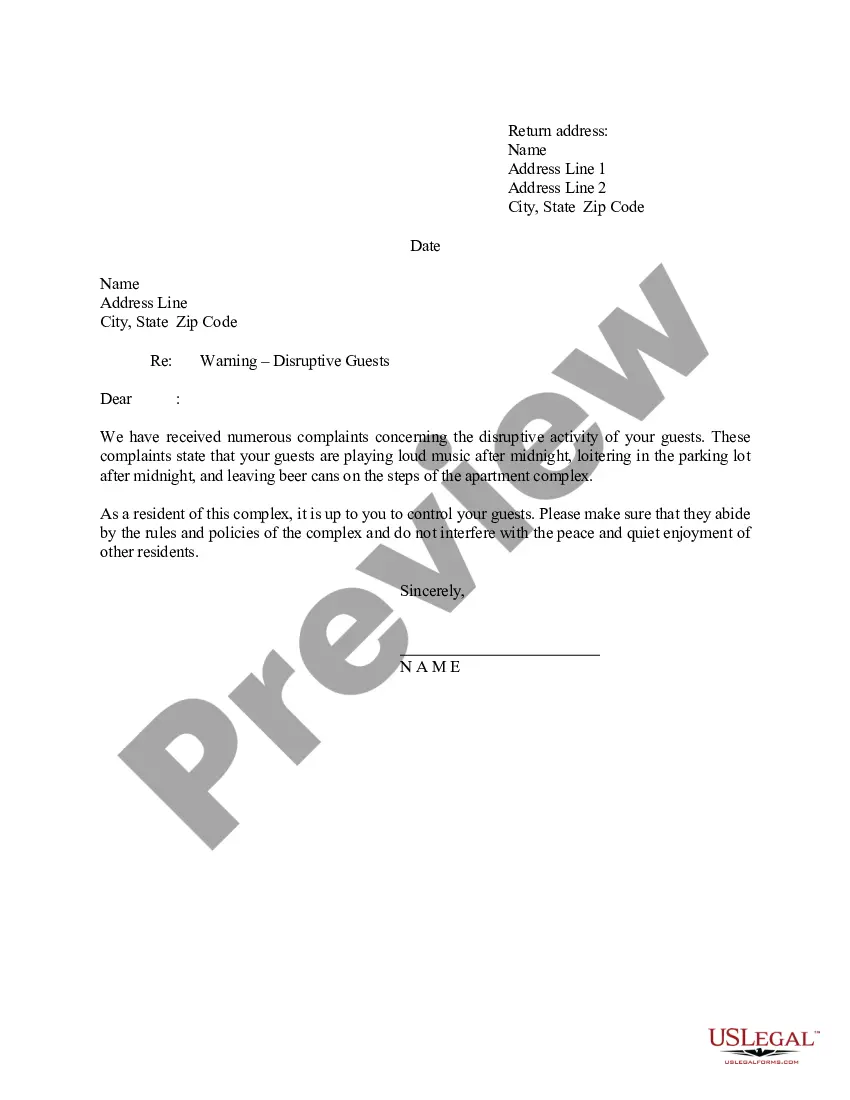

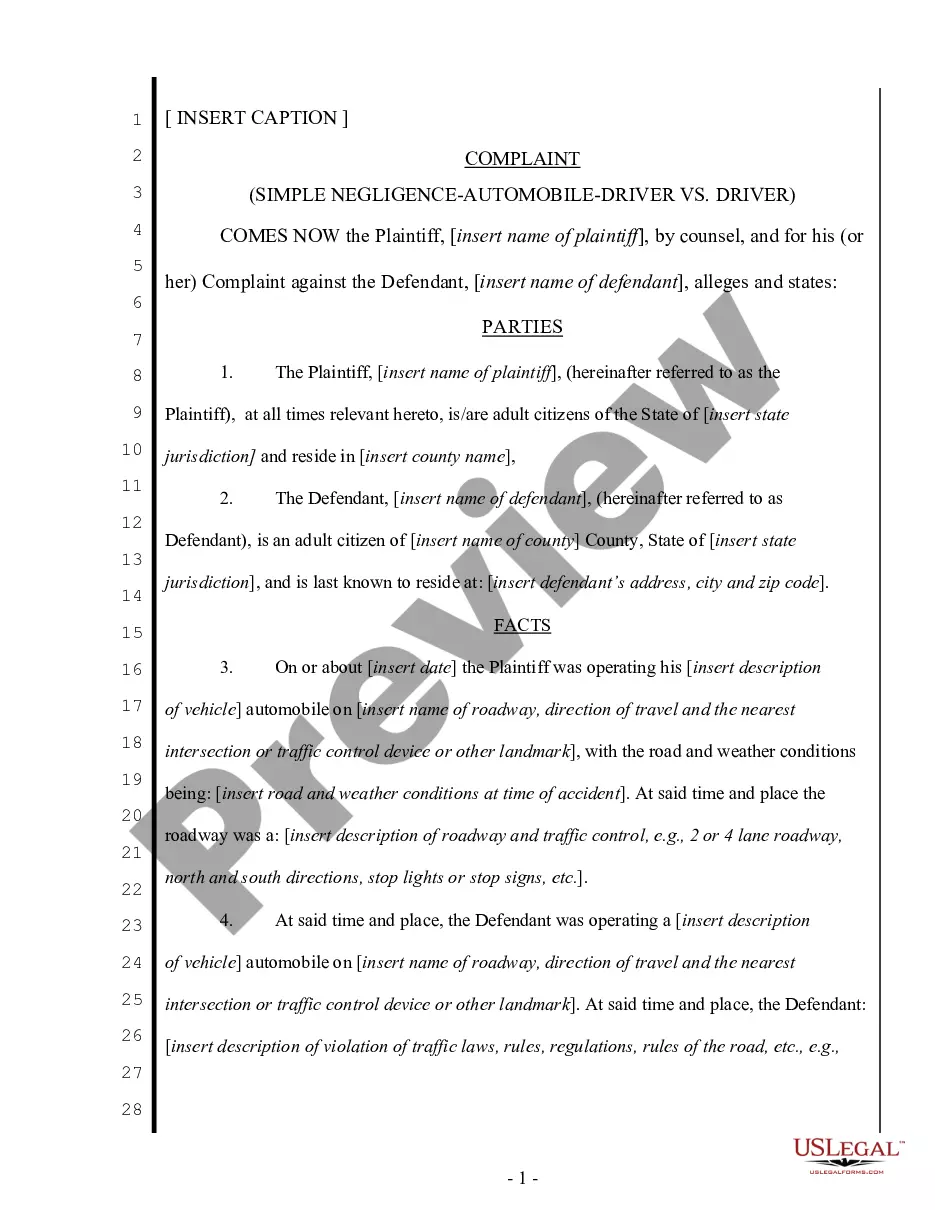

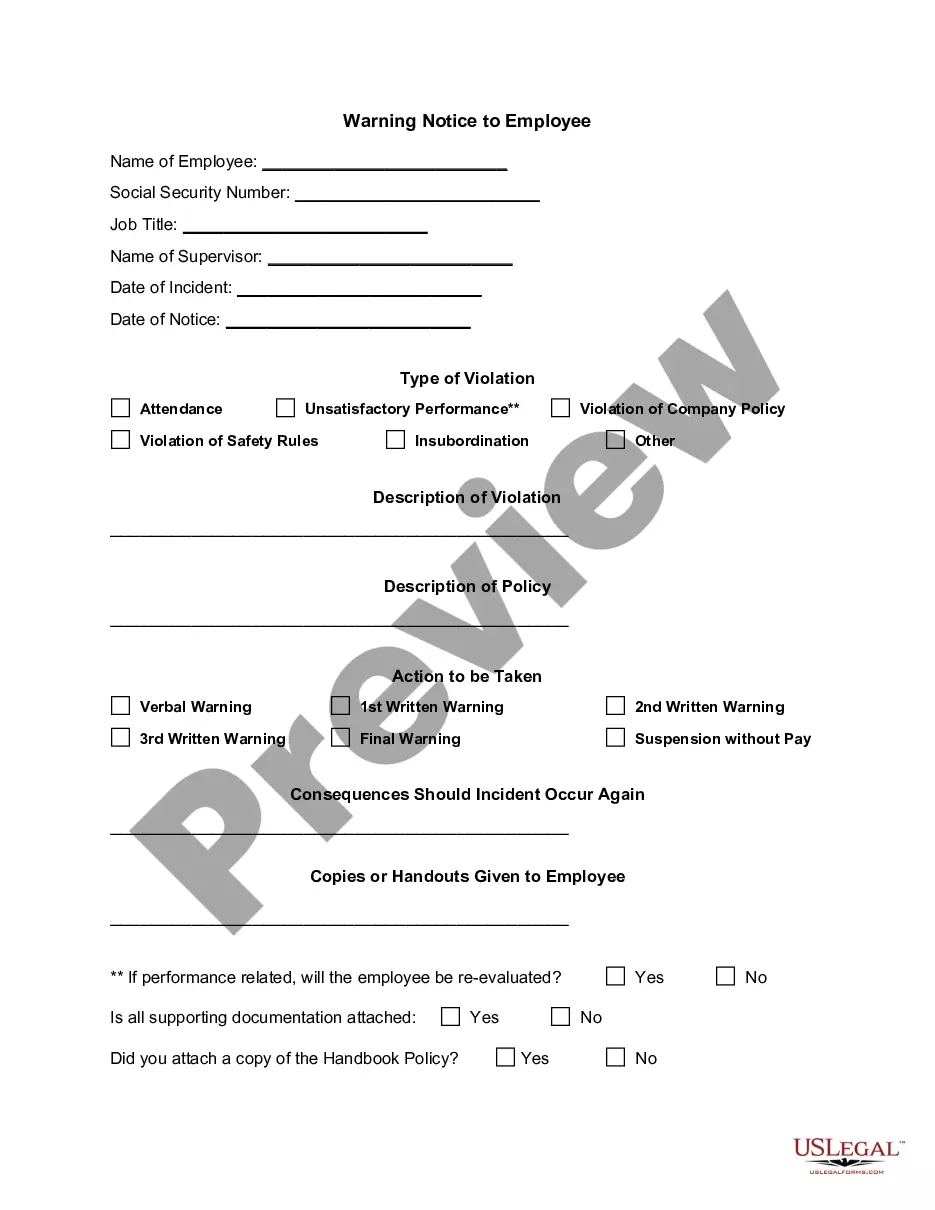

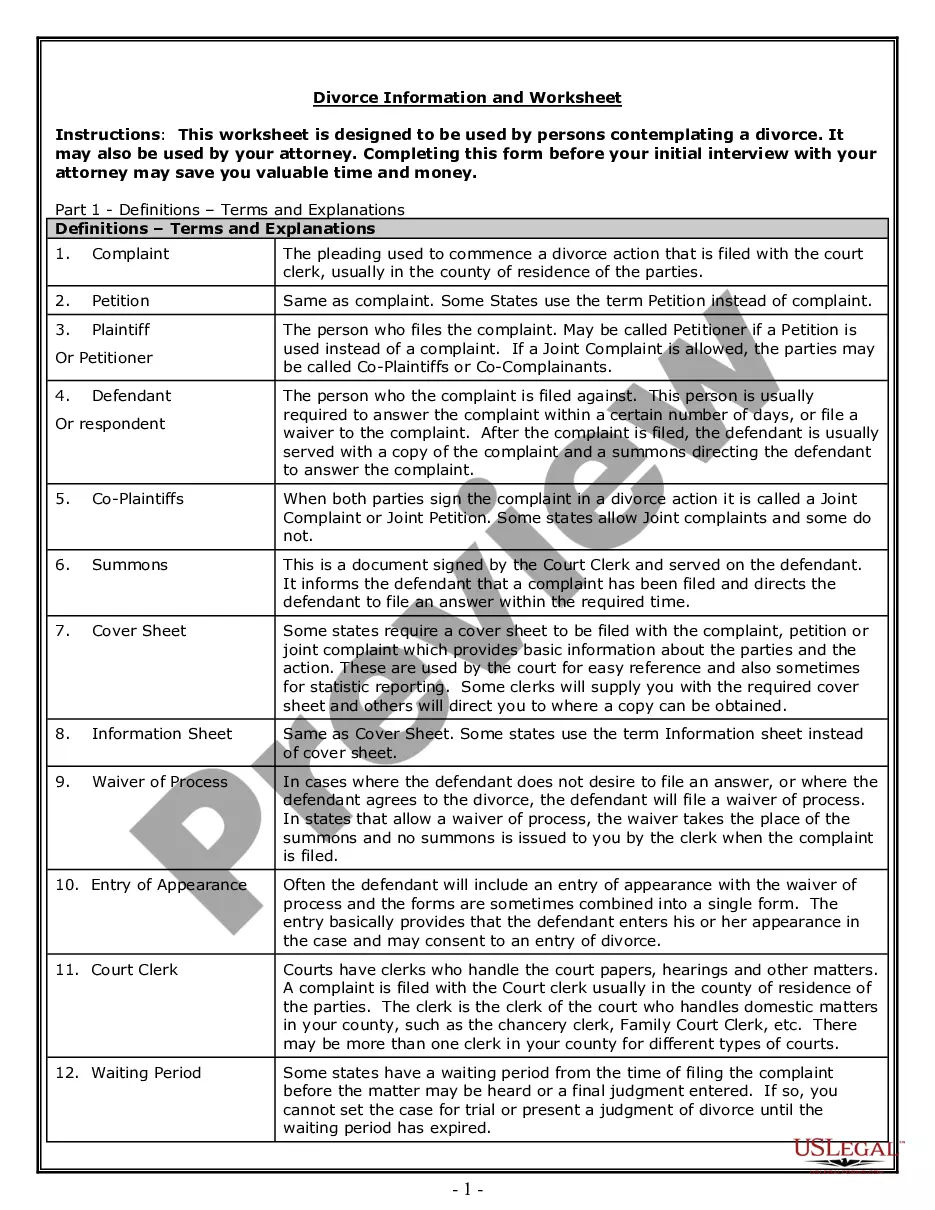

Have you been in the placement that you need to have papers for either enterprise or individual reasons just about every day time? There are tons of legal papers templates available online, but finding kinds you can trust is not effortless. US Legal Forms gives a huge number of develop templates, like the Rhode Island Acquisition, Merger, or Liquidation, that are composed to satisfy state and federal demands.

When you are currently acquainted with US Legal Forms website and have your account, simply log in. Afterward, you can acquire the Rhode Island Acquisition, Merger, or Liquidation format.

If you do not provide an profile and want to begin using US Legal Forms, follow these steps:

- Find the develop you need and ensure it is to the right metropolis/region.

- Make use of the Review key to review the form.

- See the outline to ensure that you have selected the appropriate develop.

- In the event the develop is not what you`re searching for, use the Research area to obtain the develop that meets your needs and demands.

- If you find the right develop, click Get now.

- Opt for the prices strategy you want, fill out the desired info to produce your account, and purchase the order with your PayPal or credit card.

- Pick a practical data file format and acquire your backup.

Locate each of the papers templates you possess bought in the My Forms menus. You can get a further backup of Rhode Island Acquisition, Merger, or Liquidation at any time, if needed. Just go through the essential develop to acquire or print the papers format.

Use US Legal Forms, one of the most substantial selection of legal forms, to save some time and avoid errors. The service gives expertly manufactured legal papers templates which can be used for a variety of reasons. Produce your account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

The Name. This state was named by Dutch explorer Adrian Block. He named it "Roodt Eylandt" meaning "red island" in reference to the red clay that lined the shore. The name was later anglicized when the region came under British rule.

Rhode Island, the smallest state in the country, covers an area of 1,545 square miles. Massachusetts ranks second among the smallest states, with a total area of 10,554 square miles. Hawaii is the third smallest state with an area of 10,932 square miles.

Rhode Island also had an important influence on the industrial development of the United States. Area 1,545 square miles (4,001 square km). Population (2020) 1,097,379; (2022 est.) 1,093,734.

The extreme compactness of area, proportionally large population, and economic activity have tied it closely to its neighbouring states. In addition, Rhode Island's intimate connection to the sea?including more than 400 miles (640 km) of coastline?is the basis of its nickname, the Ocean State.

Delaware is the second smallest state, by area, in the US. Delaware, like Rhode Island, is on the East Coast and is also one of the original 13 colonies.

Rhode Island is the smallest state in size in the United States. It covers an area of 1,214 square miles. Its distances North to South are 48 miles and East to West 37 miles. Rhode Island was the last of the original thirteen colonies to become a state.

Goa is the smallest state of India. Puducherry is smaller than Goa but a Union Territory. Sikkim and Tripura are the second and third smallest states of India respectively.

Rhode Island antitrust law is similar to antitrust statutes in other states in that it focuses on the prevention of monopolies and conspiracies to restrain trade. Violators face the possibility of criminal penalties, including prison, in addition to civil lawsuits.