The Rhode Island Eligible Directors' Stock Option Plan of Kyle Electronics is a comprehensive compensation program designed specifically for eligible directors serving on the board of Kyle Electronics in Rhode Island. This stock option plan provides a means of incentivizing and rewarding directors for their contributions to the company's success. Under this plan, eligible directors are granted the opportunity to purchase a specified number of company shares at a predetermined exercise price. These stock options are typically granted as part of the overall director compensation package and serve as an effective tool for aligning the interests of directors with those of the company's shareholders. The Rhode Island Eligible Directors' Stock Option Plan provides several key benefits for eligible directors. Firstly, it allows directors to participate in the company's financial performance and share in the potential growth of the company's stock value. This incentivizes directors to work towards the long-term success and profitability of Kyle Electronics. Secondly, these stock options offer a tax advantage for eligible directors. Depending on the plan, directors may be able to defer the tax liability associated with the stock options until they exercise their rights and sell the stock. This can provide significant tax savings for directors, enhancing the overall value of their compensation package. Furthermore, the Rhode Island Eligible Directors' Stock Option Plan typically includes vesting provisions, which means that directors must meet certain criteria, such as remaining on the board for a specified period of time, before they can exercise their stock options. This helps to ensure that directors are committed to the company's long-term success and motivates them to continue serving on the board. It's important to mention that there may be different types of Rhode Island Eligible Directors' Stock Option Plans, each with its unique terms and conditions. Some plans may have a graded vesting schedule, where the percentage of stock options exercisable increases over time. Other plans may have performance-based criteria that must be met before directors can exercise their stock options. These variations in the plan design allow for flexibility in tailoring the compensation package to suit the specific needs and objectives of Kyle Electronics. In conclusion, the Rhode Island Eligible Directors' Stock Option Plan is a valuable component of Kyle Electronics' director compensation program, offering eligible directors the opportunity to benefit from the company's success and aligning their long-term interests with those of the company and its shareholders.

Rhode Island Eligible Directors' Stock Option Plan of Wyle Electronics

Description

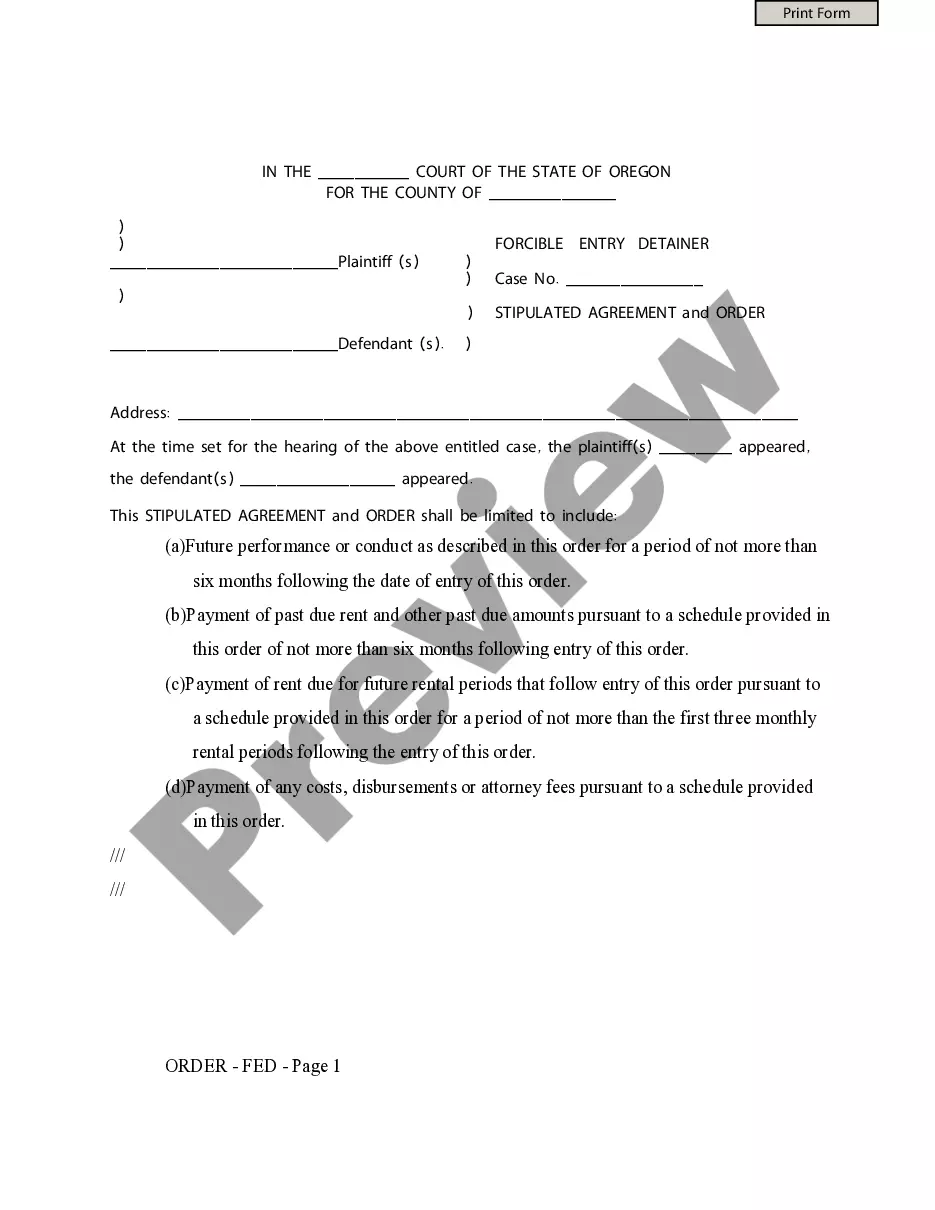

How to fill out Rhode Island Eligible Directors' Stock Option Plan Of Wyle Electronics?

Discovering the right authorized file design might be a battle. Naturally, there are a lot of layouts available online, but how would you obtain the authorized kind you require? Make use of the US Legal Forms web site. The service offers thousands of layouts, for example the Rhode Island Eligible Directors' Stock Option Plan of Wyle Electronics, which you can use for enterprise and private demands. All the forms are checked by experts and satisfy federal and state specifications.

If you are currently signed up, log in to your profile and click the Download switch to obtain the Rhode Island Eligible Directors' Stock Option Plan of Wyle Electronics. Make use of profile to search through the authorized forms you may have ordered earlier. Proceed to the My Forms tab of your respective profile and have an additional copy of the file you require.

If you are a fresh user of US Legal Forms, listed below are basic guidelines so that you can follow:

- First, make sure you have selected the appropriate kind for your personal town/state. It is possible to look through the form using the Review switch and browse the form information to guarantee this is the right one for you.

- In the event the kind fails to satisfy your expectations, utilize the Seach discipline to obtain the appropriate kind.

- When you are certain that the form would work, click the Purchase now switch to obtain the kind.

- Select the prices prepare you would like and enter in the required details. Design your profile and pay money for the transaction using your PayPal profile or Visa or Mastercard.

- Select the data file file format and acquire the authorized file design to your product.

- Complete, edit and print and signal the received Rhode Island Eligible Directors' Stock Option Plan of Wyle Electronics.

US Legal Forms is definitely the greatest library of authorized forms that you can see different file layouts. Make use of the company to acquire professionally-created paperwork that follow condition specifications.