Rhode Island Approval of director warrants

Description

How to fill out Approval Of Director Warrants?

Are you presently within a position where you need files for either business or individual uses nearly every time? There are a lot of authorized file themes available online, but finding versions you can depend on isn`t easy. US Legal Forms provides a large number of kind themes, just like the Rhode Island Approval of director warrants, which are created to meet state and federal requirements.

Should you be already knowledgeable about US Legal Forms site and have a merchant account, basically log in. Afterward, it is possible to download the Rhode Island Approval of director warrants format.

Unless you come with an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is for that proper area/county.

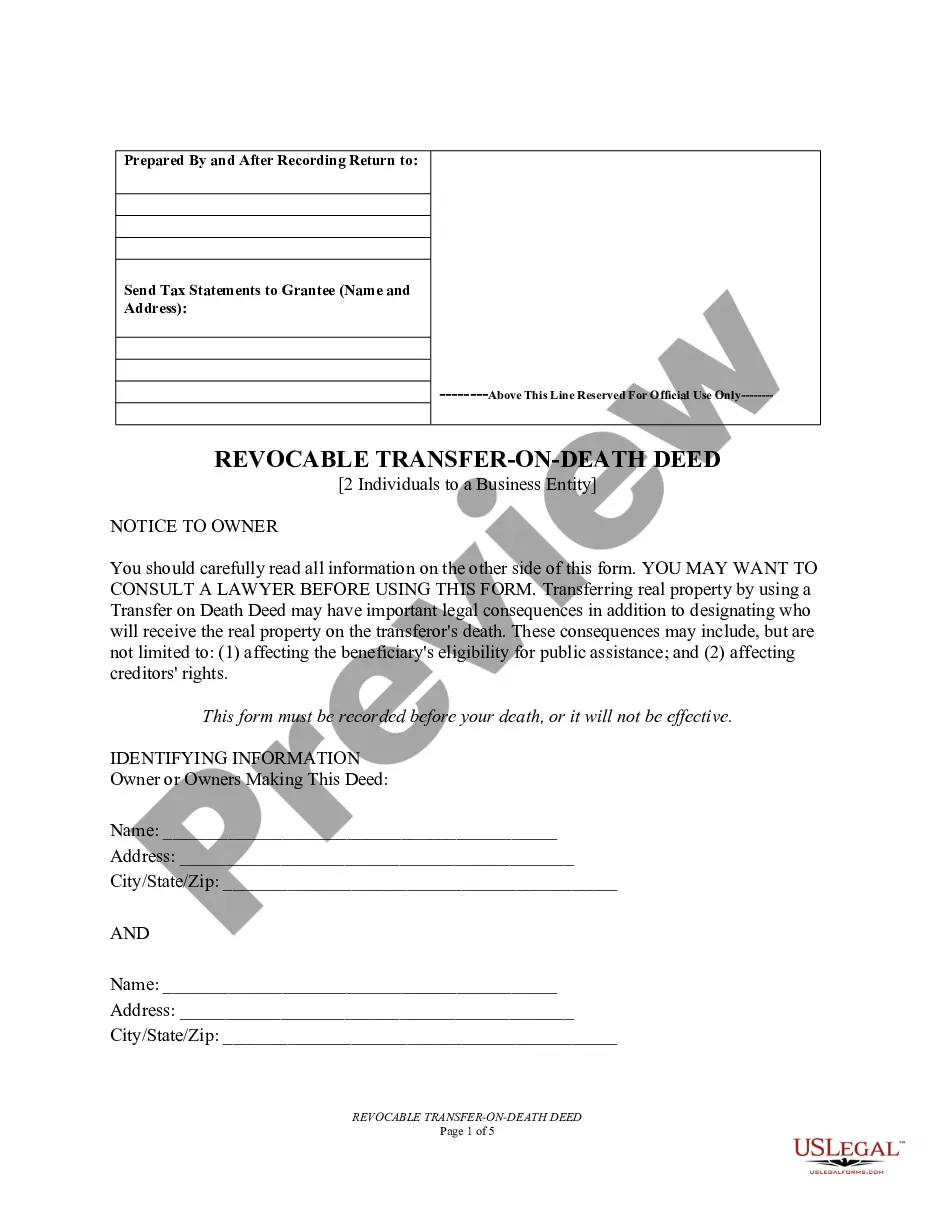

- Take advantage of the Review button to check the form.

- See the outline to actually have selected the correct kind.

- If the kind isn`t what you`re trying to find, utilize the Search field to get the kind that fits your needs and requirements.

- When you find the proper kind, simply click Purchase now.

- Pick the pricing strategy you would like, complete the specified details to produce your bank account, and buy your order using your PayPal or Visa or Mastercard.

- Decide on a practical file format and download your version.

Get all of the file themes you might have purchased in the My Forms food list. You can aquire a further version of Rhode Island Approval of director warrants whenever, if possible. Just go through the necessary kind to download or printing the file format.

Use US Legal Forms, one of the most substantial assortment of authorized forms, to save lots of time and prevent faults. The services provides skillfully made authorized file themes that you can use for an array of uses. Generate a merchant account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Once an arrest warrant is issued, it may only be removed by the Court that issued it. Removing a warrant is also referred to as withdrawing or vacating a warrant. Under normal circumstances, a warrant will not be removed unless and until the person named in the warrant appears before the Court.

Hear this out loud PauseIf you have failed to appear, the judge may issue a bench warrant and you may be arrested by the police and brought to the court that issued the warrant.

Hear this out loud PauseThe most convenient way to find court records in RI is by searching via the Rhode Island Judiciary Public Portal.

Luckily, in the state of Rhode Island, you have access to a ?Public Portal? online. From here, you can find information like your charges, case numbers, upcoming court dates, court debts, payments, and bench warrants.