Rhode Island Stock Option Plan of National Penn Ranchers, Inc. is a comprehensive employee benefit program that offers stock options to eligible employees of National Penn Ranchers, Inc., a banking and financial services company headquartered in Pennsylvania. This program enables employees to purchase company stock at a predetermined price within a specific period, providing them with an opportunity to own a stake in the organization's success. The Rhode Island Stock Option Plan is designed to incentivize and reward employees for their contributions, aligning their interests with the shareholders' interests, fostering a sense of ownership, and motivating them to drive the company's growth. The program encourages employee retention, as stock options typically have a vesting schedule, promoting long-term commitment and dedication to the organization. There are several types of stock option plans offered by National Penn Ranchers, Inc. to its employees in Rhode Island. These include: 1. Non-Qualified Stock Options (Nests): Nests are stock options that do not meet specific requirements outlined by the Internal Revenue Service (IRS). Although Nests have certain tax implications, they provide flexibility in terms of exercise price and vesting conditions. 2. Incentive Stock Options (SOS): SOS are stock options that meet specific IRS requirements. These options provide tax advantages to employees while offering potential long-term capital gains upon the sale of the stock. SOS typically have more stringent eligibility criteria and specific holding periods. 3. Restricted Stock Units (RSS): RSS are an alternative form of stock compensation where employees receive units that are equivalent to a specific number of shares of company stock. RSS typically have a vesting schedule and convert into shares of stock upon meeting specific conditions, such as continued employment or achieving performance targets. 4. Employee Stock Purchase Plans (ESPN): ESPN enable employees to purchase company stock at a discounted price using payroll deductions. These plans promote broad-based employee participation and can provide significant financial benefits to employees. The Rhode Island Stock Option Plan of National Penn Ranchers, Inc. is a vital component of the company's overall compensation and benefits package. It serves as a valuable tool to attract, retain, and motivate talented employees, fostering a culture of ownership and aligning employee interests with the organization's long-term success.

Rhode Island Stock Option Plan of National Penn Bancshares, Inc.

Description

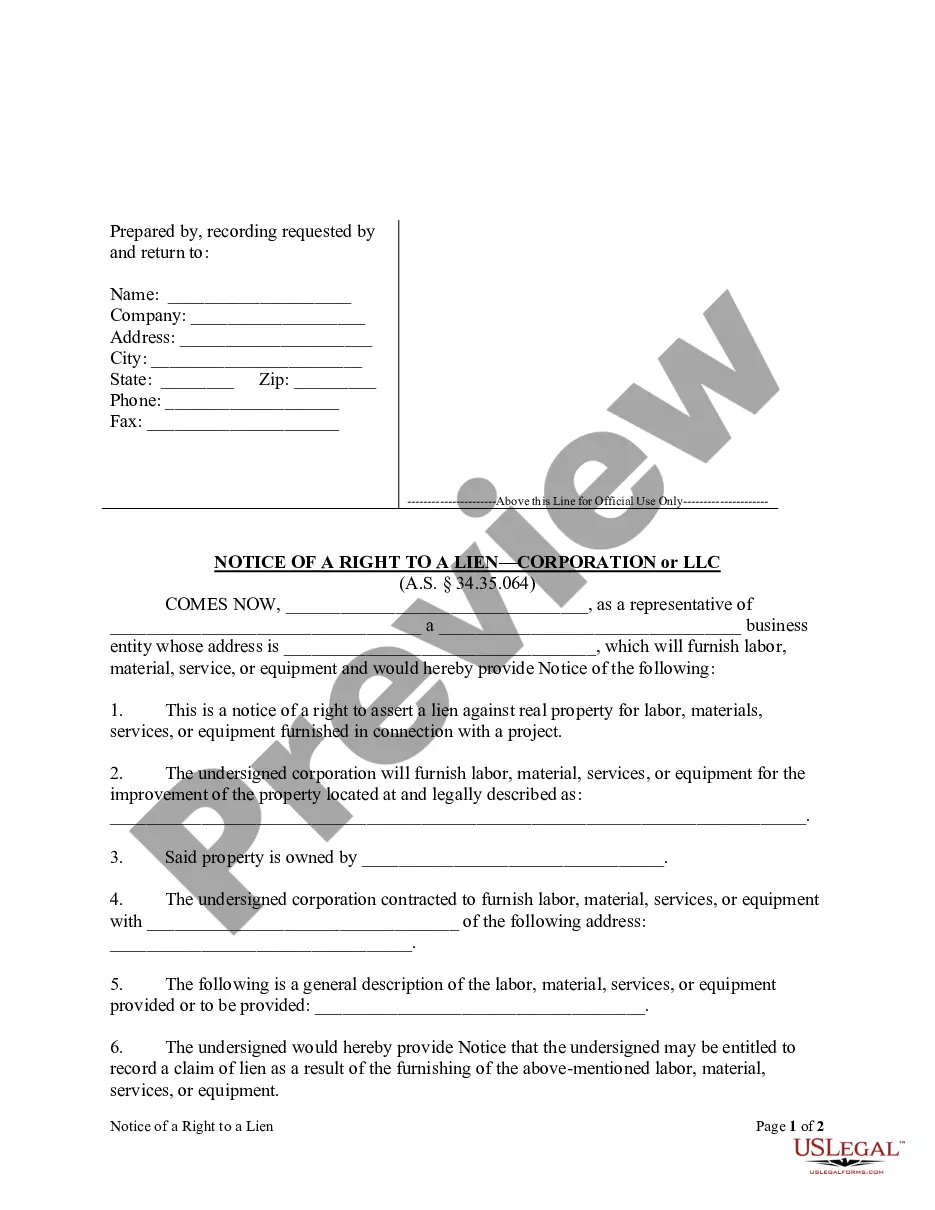

How to fill out Rhode Island Stock Option Plan Of National Penn Bancshares, Inc.?

Are you presently within a place the place you will need files for possibly company or individual purposes virtually every time? There are plenty of legitimate document themes accessible on the Internet, but finding versions you can trust is not straightforward. US Legal Forms provides a huge number of form themes, like the Rhode Island Stock Option Plan of National Penn Bancshares, Inc., which are written to meet state and federal needs.

Should you be previously acquainted with US Legal Forms web site and possess a free account, just log in. Following that, you can down load the Rhode Island Stock Option Plan of National Penn Bancshares, Inc. web template.

If you do not have an profile and need to begin using US Legal Forms, abide by these steps:

- Get the form you want and make sure it is for that appropriate area/state.

- Utilize the Review button to review the shape.

- Browse the information to actually have chosen the appropriate form.

- If the form is not what you are trying to find, take advantage of the Research industry to find the form that fits your needs and needs.

- When you obtain the appropriate form, click Acquire now.

- Opt for the costs prepare you would like, fill out the required info to generate your money, and pay money for an order with your PayPal or credit card.

- Pick a hassle-free document file format and down load your copy.

Find all the document themes you may have purchased in the My Forms food selection. You can get a further copy of Rhode Island Stock Option Plan of National Penn Bancshares, Inc. whenever, if needed. Just click on the needed form to down load or print the document web template.

Use US Legal Forms, by far the most comprehensive assortment of legitimate kinds, to save time as well as stay away from errors. The service provides skillfully created legitimate document themes which you can use for a variety of purposes. Produce a free account on US Legal Forms and commence making your life a little easier.