Rhode Island Deferred Compensation Investment Account Plan

Description

How to fill out Deferred Compensation Investment Account Plan?

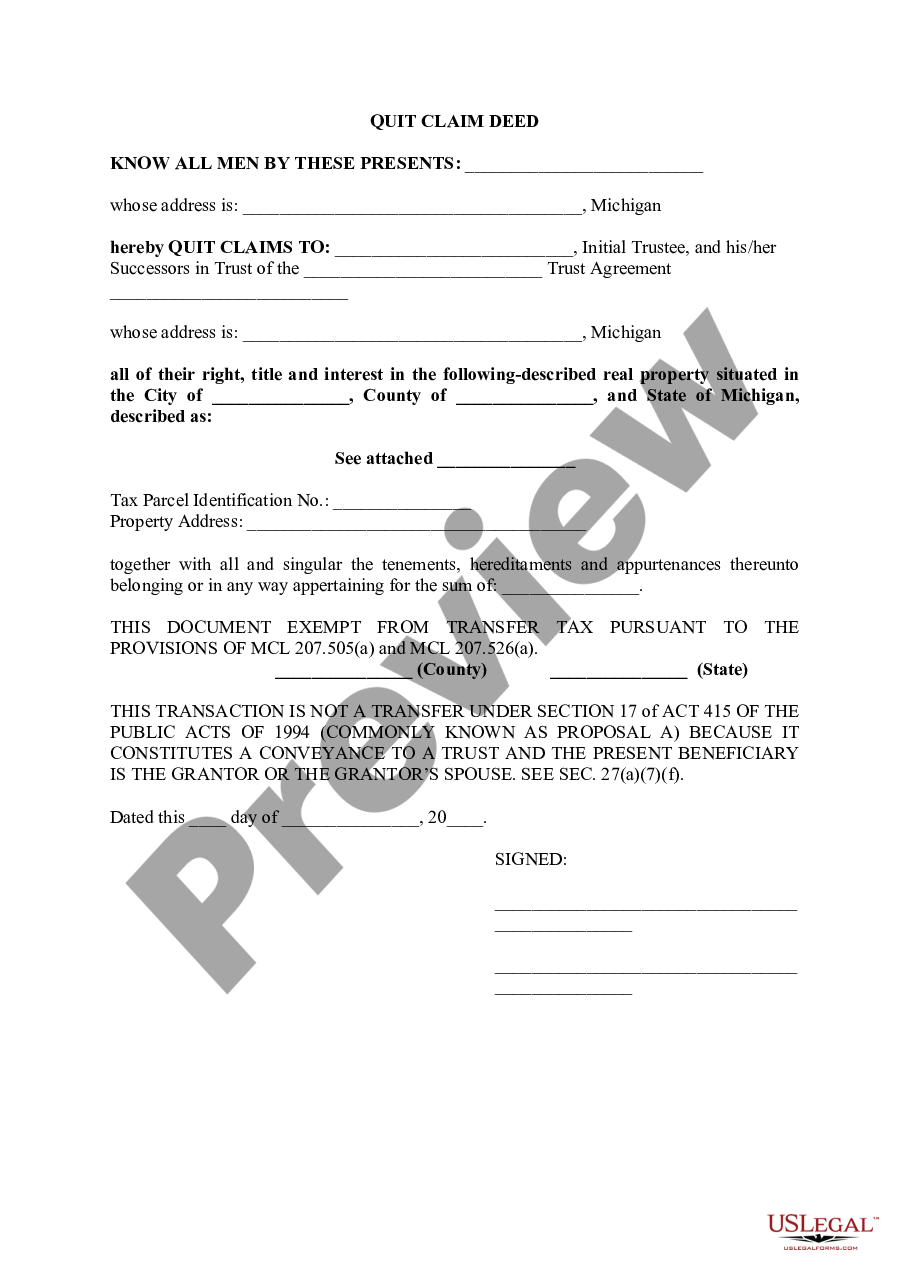

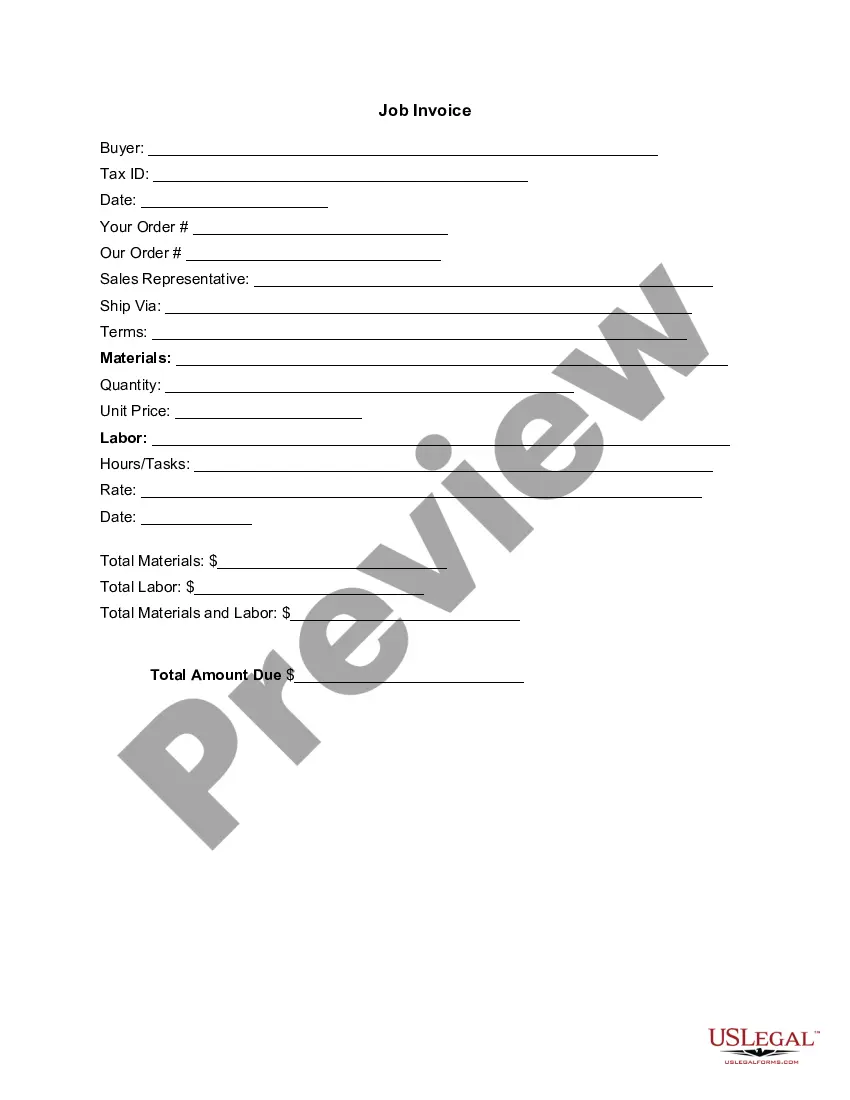

Are you in a placement the place you need papers for both organization or person reasons almost every day time? There are a lot of legitimate file templates available online, but getting ones you can depend on isn`t straightforward. US Legal Forms delivers 1000s of kind templates, just like the Rhode Island Deferred Compensation Investment Account Plan, that happen to be written to fulfill federal and state specifications.

If you are previously acquainted with US Legal Forms internet site and also have an account, just log in. Afterward, you are able to download the Rhode Island Deferred Compensation Investment Account Plan design.

Should you not offer an profile and wish to begin using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is for your appropriate town/region.

- Utilize the Preview option to review the form.

- Look at the description to ensure that you have selected the correct kind.

- In case the kind isn`t what you are searching for, make use of the Lookup field to obtain the kind that meets your requirements and specifications.

- When you find the appropriate kind, click on Get now.

- Opt for the prices prepare you need, complete the specified information to create your bank account, and pay money for your order with your PayPal or charge card.

- Choose a hassle-free paper format and download your copy.

Discover every one of the file templates you may have bought in the My Forms menus. You can obtain a additional copy of Rhode Island Deferred Compensation Investment Account Plan any time, if needed. Just select the required kind to download or print out the file design.

Use US Legal Forms, the most substantial collection of legitimate kinds, in order to save time as well as stay away from faults. The services delivers professionally created legitimate file templates that can be used for a range of reasons. Generate an account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

You are eligible to withdraw funds from your 457(b) plan when you separate service from your employer (for any reason) or for an approved unforeseeable emergency. After separation from service, you may also rollover your account into an IRA or an existing qualified retirement plan.

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

The 457 plan is an IRS-sanctioned, tax-advantaged employee retirement plan. The plan is offered only to public service employees and employees at tax-exempt organizations. Participants are allowed to contribute up to 100% of their salaries up to a dollar limit for the year.

Just like a 401(k) or 403(b) retirement savings plan, a 457 plan allows you to invest a portion of your salary on a pretax basis. The money grows, tax-deferred, waiting for you to decide what to do with it when you retire. You're about to retire.

Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state. The biggest risk of deferred compensation plans is they're not guaranteed; if your company goes bankrupt, you might receive none of the income you deferred.

If your employer offers a 457(b) plan, they're a great option for saving for retirement. While they might not have quite as many options as a standard 401(k), they still offer tax benefits and encourage employees to grow their nest egg.

The two plans are also different in that 401(k) plans do not offer a three-year Pre-Retirement Catch-Up; and 457(b) plans do. Another difference is that a 401(k) distribution prior to age 59½ may be subject to a 10% early withdrawal penalty and 457(b) plans generally do not have the same early withdrawal penalty.

State of Rhode Island 457(b) Deferred Compensation Plan A 457(b) plan allows eligible employees to defer compensation to the future, lowering current taxable income and offering potential tax-deferred growth.