Rhode Island Approval of executive director loan plan

Description

How to fill out Approval Of Executive Director Loan Plan?

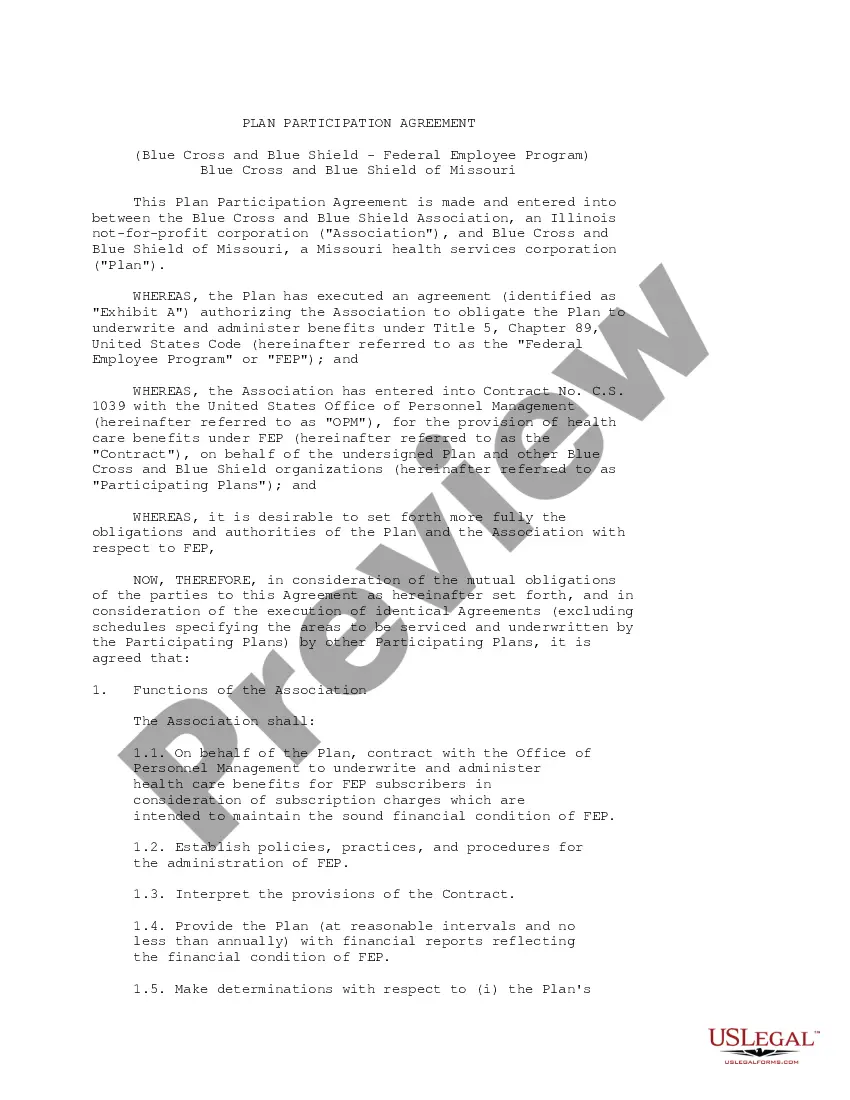

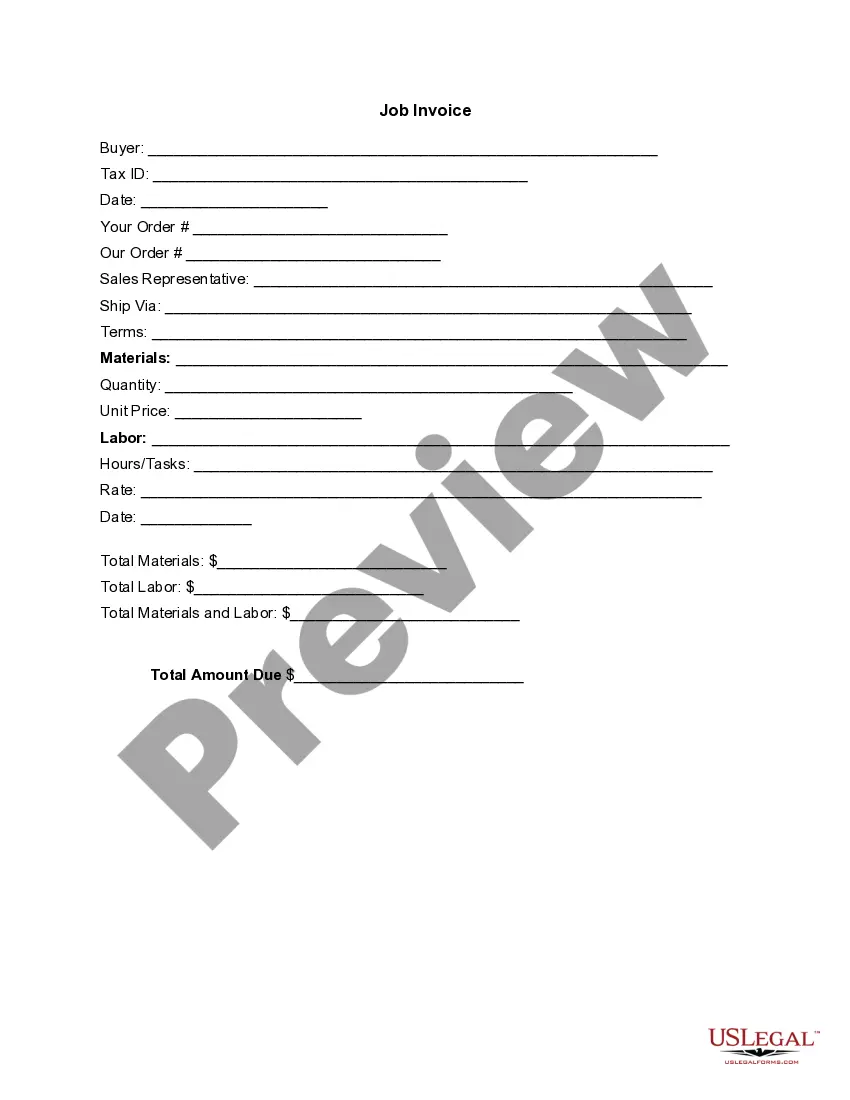

If you want to total, download, or print out legal record themes, use US Legal Forms, the greatest selection of legal kinds, that can be found online. Utilize the site`s simple and practical lookup to find the documents you require. A variety of themes for organization and individual uses are categorized by types and states, or keywords. Use US Legal Forms to find the Rhode Island Approval of executive director loan plan in a handful of click throughs.

Should you be already a US Legal Forms buyer, log in to your bank account and click on the Download option to find the Rhode Island Approval of executive director loan plan. You can even entry kinds you formerly saved inside the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for that correct town/land.

- Step 2. Make use of the Preview choice to check out the form`s information. Do not forget to read through the explanation.

- Step 3. Should you be unhappy together with the form, utilize the Look for industry on top of the monitor to get other types of the legal form format.

- Step 4. Once you have found the form you require, click on the Purchase now option. Select the costs program you prefer and put your qualifications to sign up for an bank account.

- Step 5. Approach the financial transaction. You should use your bank card or PayPal bank account to finish the financial transaction.

- Step 6. Pick the file format of the legal form and download it in your gadget.

- Step 7. Comprehensive, edit and print out or sign the Rhode Island Approval of executive director loan plan.

Each and every legal record format you acquire is your own property eternally. You possess acces to each and every form you saved inside your acccount. Select the My Forms portion and pick a form to print out or download once more.

Contend and download, and print out the Rhode Island Approval of executive director loan plan with US Legal Forms. There are thousands of expert and state-distinct kinds you can use to your organization or individual requirements.