Rhode Island Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment

Description

How to fill out Proposed Amendment To The Certificate Of Incorporation To Authorize Up To 10,000,000 Shares Of Preferred Stock With Amendment?

Are you presently in the position in which you need to have papers for both company or individual uses almost every working day? There are a variety of legal papers themes available on the net, but discovering versions you can trust is not easy. US Legal Forms offers thousands of kind themes, such as the Rhode Island Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment, that happen to be composed in order to meet federal and state requirements.

Should you be previously knowledgeable about US Legal Forms internet site and get your account, basically log in. Following that, it is possible to down load the Rhode Island Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment format.

If you do not come with an bank account and wish to begin to use US Legal Forms, follow these steps:

- Find the kind you want and ensure it is for the right city/county.

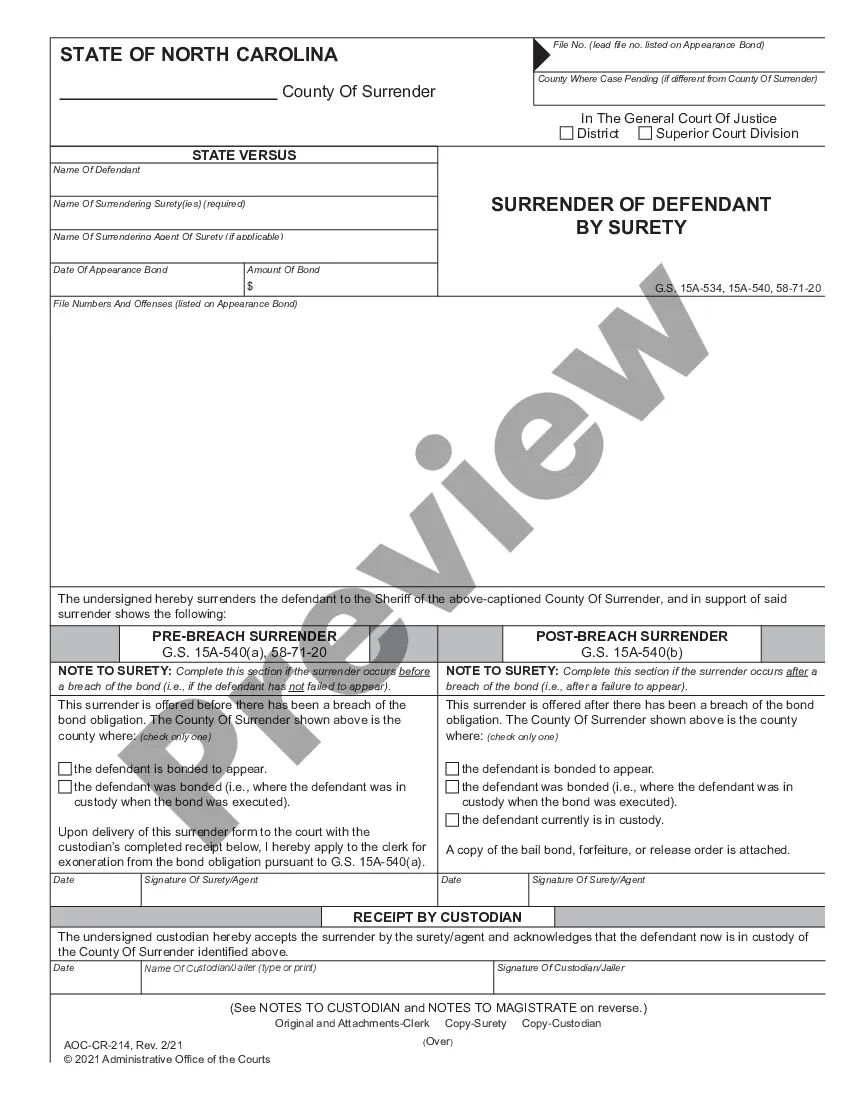

- Use the Preview button to examine the form.

- Look at the explanation to ensure that you have selected the correct kind.

- In the event the kind is not what you are trying to find, take advantage of the Search industry to discover the kind that meets your requirements and requirements.

- Whenever you find the right kind, click on Buy now.

- Select the rates prepare you need, fill out the required details to produce your money, and pay for the transaction using your PayPal or charge card.

- Select a hassle-free paper formatting and down load your backup.

Get every one of the papers themes you have purchased in the My Forms food list. You can obtain a more backup of Rhode Island Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment anytime, if possible. Just select the required kind to down load or print out the papers format.

Use US Legal Forms, the most considerable variety of legal types, to save some time and stay away from errors. The services offers appropriately created legal papers themes which can be used for a range of uses. Generate your account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

A general stock corporation is divided into three groups: the Shareholders, the Directors, and the Officers. Each group has different rights and responsibilities within the corporate structure.

Articles of incorporation are a set of formal documents filed with a government body to legally document the creation of a corporation. Articles of incorporation generally contain pertinent information such as the firm's name, street address, agent for service of process, and the amount and type of stock to be issued.

Typically, the articles must contain, at the very least: the corporation's name and business address. the number of authorized shares and the par value (if any) of the shares. the name and address of the in-state registered agent.

Every corporation must have at least one type of stock. This rule even applies to S corporations, but they are limited to 100 total shares and only one type of stock. The term ?stock? is often used interchangeably with ?shares? or ?equity.? Those who own stock are called ?shareholders? or ?stockholders.?

Usually the number of shares you can issue in the market are listed in the articles of incorporation. But if you are looking to issue more shares than those stated in the article, you can file an amendment in the articles and pay the fee for it.