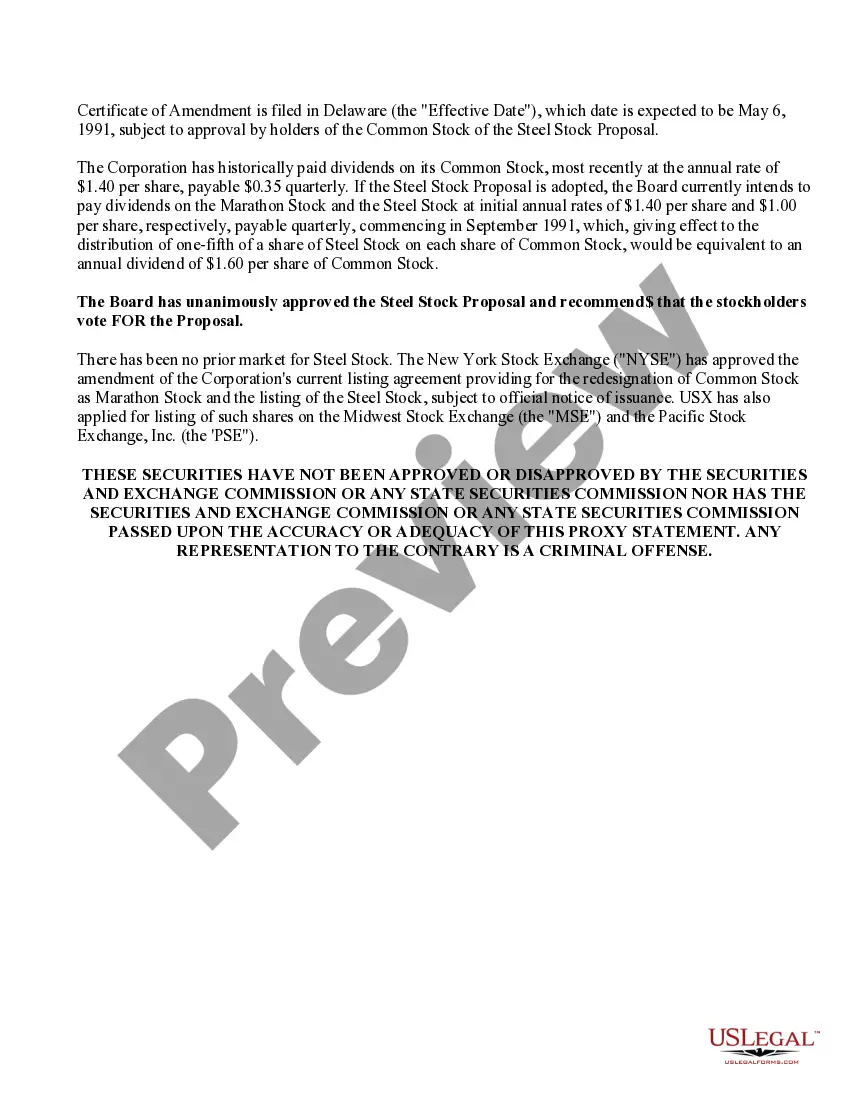

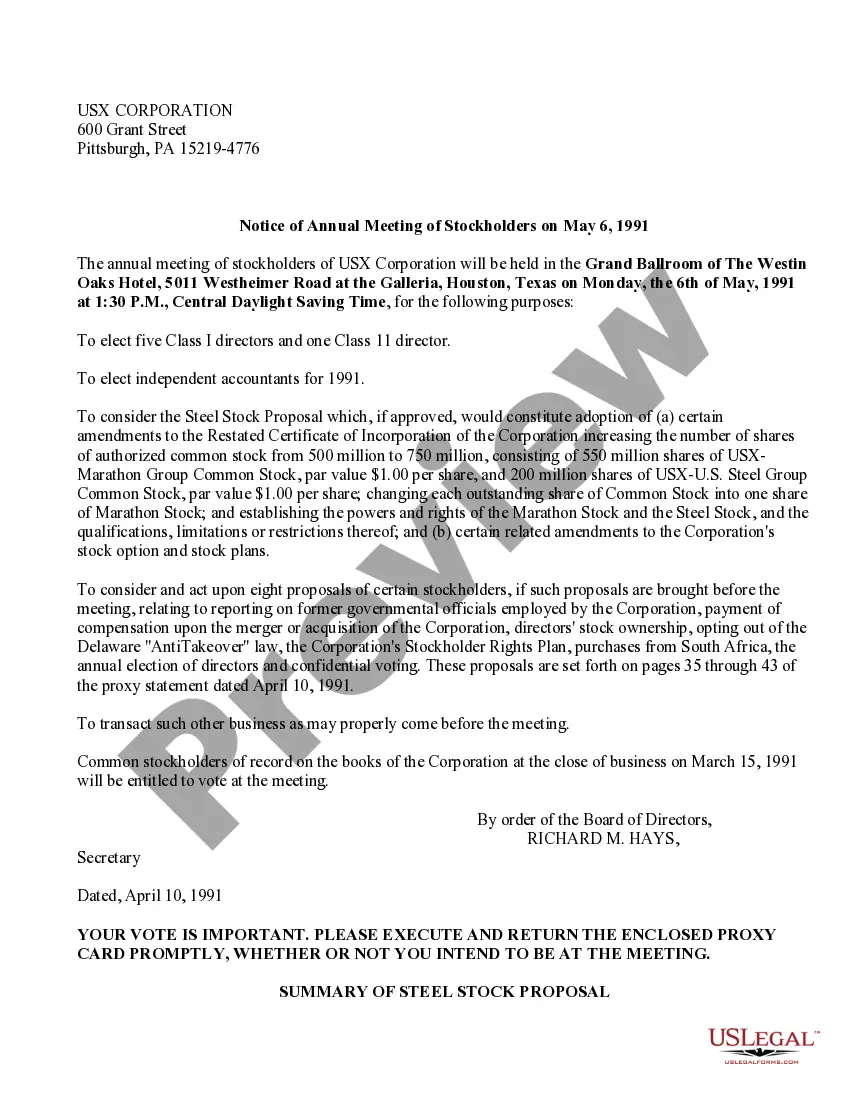

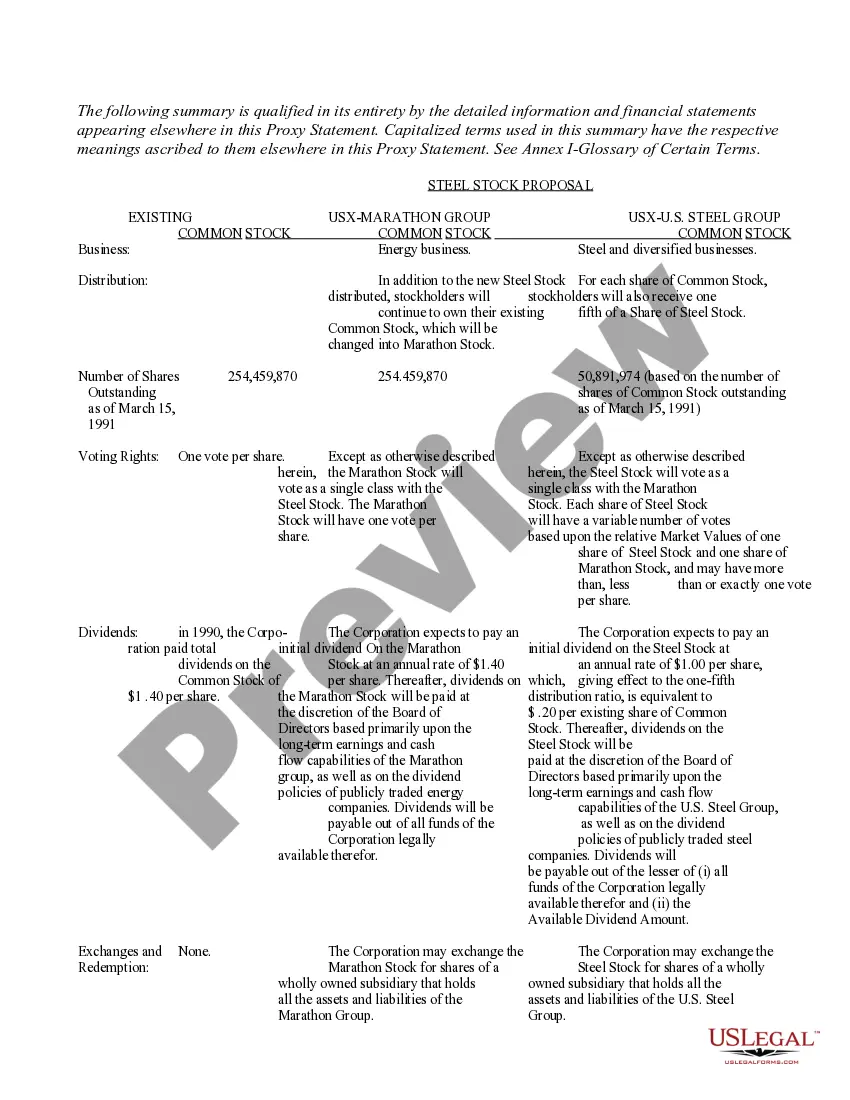

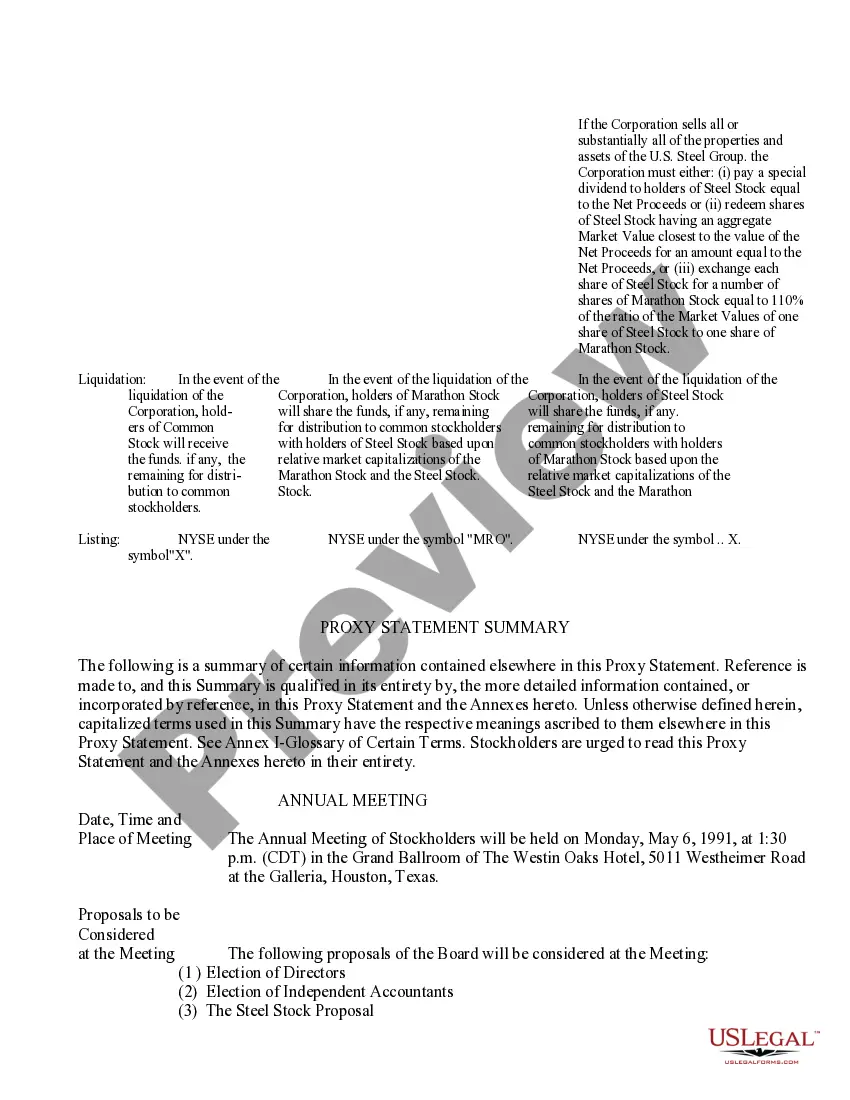

Rhode Island Proxy Statement and Prospectus of US Corporation: An In-depth Overview In the corporate world, proxy statements and prospectuses are essential documents that provide detailed information about a company to its shareholders and potential investors. This content aims to provide a comprehensive description of the Rhode Island Proxy Statement and Prospectus of US Corporation, discussing their types and significance while utilizing relevant keywords. 1. Rhode Island Proxy Statement: The Rhode Island Proxy Statement of US Corporation is an important legal document that outlines crucial information related to the company's annual shareholder meetings. This statement is distributed to shareholders to give them an opportunity to vote on corporate matters, including electing board members, approving executive compensation plans, or supporting proposed resolutions. Keywords: Rhode Island Proxy Statement, US Corporation, shareholder meetings, voting, board members, executive compensation, proposed resolutions. 2. Rhode Island Prospectus: The Rhode Island Prospectus of US Corporation is a comprehensive document provided to potential investors, allowing them to make informed decisions regarding buying or investing in the company's securities. This document typically accompanies an IPO (Initial Public Offering) or any subsequent public offering, presenting detailed financial information, business strategy, risk factors, and other material disclosures. Keywords: Rhode Island Prospectus, US Corporation, potential investors, securities, IPO, public offering, financial information, business strategy, risk factors, material disclosures. Types of Rhode Island Proxy Statement and Prospectus: 1. Annual Proxy Statement: This type of Rhode Island Proxy Statement is issued to shareholders before the company's annual meeting, enabling them to exercise their voting rights regarding various corporate matters. 2. Special Proxy Statement: US Corporation may release a special proxy statement when crucial matters arise outside the scope of the annual meeting. This document informs shareholders and gives them the opportunity to vote on significant decisions such as mergers, acquisitions, or changes in corporate structure. 3. Preliminary Prospectus: If US Corporation plans to launch an IPO or a public offering, they may release a preliminary prospectus in compliance with Securities and Exchange Commission (SEC) regulations. This document offers an initial overview of the company's financial information and business prospects, and the final prospectus is released subsequently. 4. Final Prospectus: The final prospectus provides potential investors with complete and binding details regarding US Corporation's securities offering. It includes audited financial statements, risk factors, use of proceeds, and any other pertinent information, allowing investors to evaluate the investment opportunity thoroughly. Keywords: Annual Proxy Statement, Special Proxy Statement, Preliminary Prospectus, Final Prospectus, shareholder meetings, voting rights, mergers, acquisitions, corporate structure, IPO, public offering, Securities and Exchange Commission, audited financial statements, risk factors, use of proceeds. To conclude, the Rhode Island Proxy Statement and Prospectus of US Corporation play crucial roles in providing essential information to shareholders and potential investors. The proxy statement empowers shareholders to participate in corporate decisions, while the prospectus enables informed investment decisions. Understanding the different types of these documents is vital for shareholders and investors to stay informed about US Corporation's operations and investment opportunities.

Rhode Island Proxy Statement and Prospectus of USX Corporation

Description

How to fill out Rhode Island Proxy Statement And Prospectus Of USX Corporation?

Are you currently within a situation that you will need documents for sometimes business or person reasons almost every day? There are a variety of legitimate document themes available on the net, but locating ones you can rely on isn`t effortless. US Legal Forms gives a huge number of type themes, just like the Rhode Island Proxy Statement and Prospectus of USX Corporation, that are published in order to meet federal and state demands.

Should you be previously familiar with US Legal Forms web site and get an account, basically log in. Next, you may obtain the Rhode Island Proxy Statement and Prospectus of USX Corporation template.

Should you not provide an bank account and need to start using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for your correct town/county.

- Take advantage of the Preview switch to examine the shape.

- See the outline to ensure that you have selected the right type.

- In case the type isn`t what you are searching for, take advantage of the Look for industry to find the type that meets your requirements and demands.

- Once you get the correct type, simply click Acquire now.

- Choose the pricing strategy you want, complete the specified info to make your bank account, and pay money for the order with your PayPal or charge card.

- Pick a practical data file format and obtain your duplicate.

Find all of the document themes you possess purchased in the My Forms food selection. You may get a more duplicate of Rhode Island Proxy Statement and Prospectus of USX Corporation any time, if necessary. Just click on the essential type to obtain or print the document template.

Use US Legal Forms, probably the most considerable assortment of legitimate kinds, to conserve time as well as avoid faults. The services gives skillfully manufactured legitimate document themes that you can use for a selection of reasons. Create an account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

Contents. The statement includes: Voting procedure and information. Background information about the company's nominated directors including relevant history in the company or industry, positions on other corporate boards, and potential conflicts of interest.

A proxy is a person who represents a member in the shareholders' meeting of a company, with a legal document that could prove their authority.

A proxy is an SEC filing (called the 14A) that is required when a public company does something that its shareholders have to vote on, such as getting acquired. For a vote on a proposed merger, the proxy is called a merger proxy (or a merger prospectus if the proceeds include acquirer stock) and is filed as a DEFM14A.

A proxy statement is a document filed by public-traded companies before annual or special shareholder meetings to give shareholders the necessary information to make informed votes on board business.

Proxy statements describe matters up for shareholder vote, and include management and executive compensation information if the shareholders are voting for the election of directors.

Proxy Statement Details Description of the merger agreement. Background and reasons for the merger. The recommendation of the board of directors with respect to the merger. Fairness opinion of the financial advisor, which summarizes whether the price being paid or received in the merger is fair.

A proxy statement is a document that public companies must provide their shareholders prior to a shareholder meeting. The Securities and Exchange Commission (SEC) requires companies to file their proxy statement in compliance with Schedule 14A. Companies file proxy statements on a Form DEF 14A.

A proxy statement is a document provided by public corporations so that their shareholders can understand how to vote at shareholder meetings and make informed decisions about how to delegate their votes to a proxy.