Rhode Island Purchase by company of its stock

Description

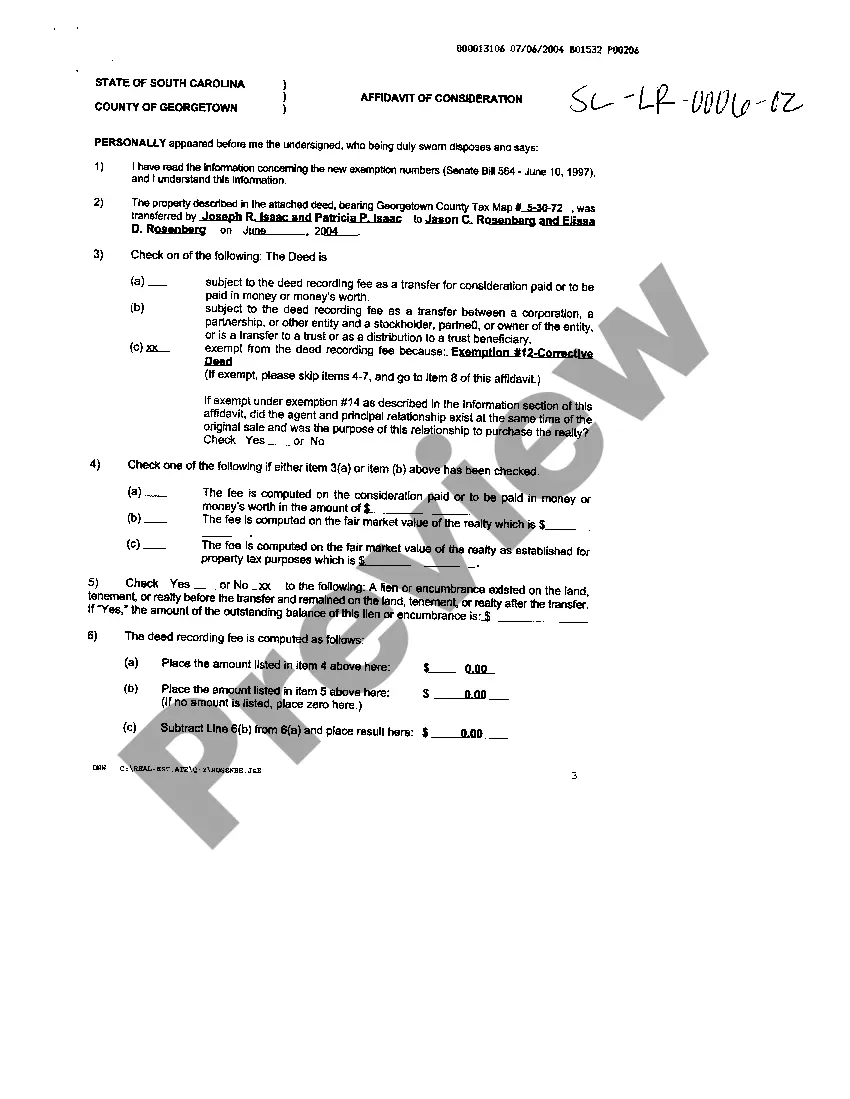

How to fill out Purchase By Company Of Its Stock?

If you wish to total, download, or print legal document templates, use US Legal Forms, the most important variety of legal kinds, which can be found on the web. Make use of the site`s simple and convenient lookup to find the papers you need. Numerous templates for business and personal functions are categorized by groups and states, or keywords and phrases. Use US Legal Forms to find the Rhode Island Purchase by company of its stock within a number of mouse clicks.

In case you are currently a US Legal Forms client, log in in your accounts and click on the Down load key to have the Rhode Island Purchase by company of its stock. You can even entry kinds you earlier acquired in the My Forms tab of your respective accounts.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for your right town/country.

- Step 2. Use the Preview method to look through the form`s content material. Do not forget about to see the description.

- Step 3. In case you are unhappy using the form, make use of the Search discipline on top of the screen to locate other models of your legal form template.

- Step 4. After you have discovered the shape you need, go through the Get now key. Select the prices prepare you prefer and include your references to sign up on an accounts.

- Step 5. Process the transaction. You should use your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Pick the formatting of your legal form and download it in your device.

- Step 7. Complete, edit and print or indication the Rhode Island Purchase by company of its stock.

Every single legal document template you purchase is your own for a long time. You possess acces to each form you acquired in your acccount. Click the My Forms portion and select a form to print or download again.

Compete and download, and print the Rhode Island Purchase by company of its stock with US Legal Forms. There are millions of professional and express-particular kinds you may use for your business or personal requires.

Form popularity

FAQ

The Name. This state was named by Dutch explorer Adrian Block. He named it "Roodt Eylandt" meaning "red island" in reference to the red clay that lined the shore. The name was later anglicized when the region came under British rule.

One explanation is that explorer Giovanni da Verrazzano compared the land he found to the Greek island of Rhodes, and that inspired colonist Roger Williams to name the colony Rhode Island.

Rhode Island is the smallest state in size in the United States. It covers an area of 1,214 square miles. Its distances North to South are 48 miles and East to West 37 miles.

Today, major Rhode Island industries include biomedicine, defense shipbuilding and maritime products and manufacturing.

The sales tax is a levy imposed on the retail sale, rental or lease of many goods and services. Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business. The sales tax is imposed upon the retailer at the rate of 7% of the gross receipts from taxable sales.

47 Fascinating Facts About Rhode Island Rhode Island is the smallest US state. Until 2020, it had the longest state name. ... Despite its diminutive size, Newport has over 400 miles of coastline. Rhode Island is one of the original US colonies. ... Connecticut, Massachusetts, and New York surround Rhode Island.

Rhode Island is the smallest state in size in the United States. It covers an area of 1,214 square miles. Its distances North to South are 48 miles and East to West 37 miles. Rhode Island was the last of the original thirteen colonies to become a state.

Williams purchased land from the Narragansett Indians and started a new settlement with a policy of religious and political freedom. He named his new home "Providence," in thanks to God for protecting him during his exile from Massachusetts. Easily accessible by water, Providence became a major New World seaport.