Rhode Island Approval of Amendment to Articles of Incorporation Allowing Distributions from Capital Surplus for Certain Uses In Rhode Island, the approval of an amendment to the articles of incorporation is required for certain uses of distributions from capital surplus by entities. Capital surplus refers to the excess funds generated by a corporation through the issuance of stock that exceeds its par value. By amending the articles of incorporation, corporations can expand the permissible uses of capital surplus distributions, ensuring flexibility and adaptability to their evolving financial needs. Here are some key points and relevant keywords related to the Rhode Island approval of an amendment to articles of incorporation concerning the permitted uses of distributions from capital surplus: 1. Types of Rhode Island Approval: a. General Amendment: This type of amendment modifies the articles of incorporation to allow for specified uses of distributions from capital surplus. It involves the approval of a majority of the shareholders or the board of directors depending on the corporation's bylaws. b. Restricted Purpose Amendment: Alternatively, this type of amendment may be required if the corporation wishes to limit the uses of distributions from capital surplus to specific purposes defined in the bylaws. 2. Permitted Uses of Distributions: a. Investments: The amendment may permit the corporation to invest capital surplus distributions in stocks, bonds, real estate, or other forms of investments. b. Expansion: Corporations may be allowed to utilize capital surplus distributions for expanding operations, including opening new branches, acquiring businesses, or purchasing additional assets. c. Research and Development: The amendment may enable corporations to allocate funds from capital surplus to support research and development initiatives, driving innovation and growth. d. Debt Repayment: Distributions from capital surplus can be used to repay debts and obligations, enhancing the financial stability and creditworthiness of the corporation. e. Shareholder Dividends: Depending on the shareholders' agreement, the amendment may authorize using capital surplus distributions to pay dividends to shareholders, providing them with a return on their investment. f. Charitable Donations: Corporations aiming to engage in philanthropy can allocate funds from capital surplus to support charitable causes, contributing to the betterment of society. 3. Approval Process: a. Board of Directors' Resolution: In most cases, an amendment to the articles of incorporation regarding capital surplus distributions requires a resolution approved by the board of directors. A majority vote is typically necessary for the amendment to proceed. b. Shareholder Approval: Depending on the nature of the amendment and applicable regulations, shareholder approval may be required. This can involve a vote during a shareholders' meeting or obtaining written consent from the majority of shareholders. c. Filing with Rhode Island Secretary of State: Once the amendment is approved internally, it should be filed with the Rhode Island Secretary of State's office, along with the necessary fees and documentation. In conclusion, the Rhode Island approval of an amendment to the articles of incorporation regarding the uses of distributions from capital surplus is crucial for corporations seeking to maximize their financial strategies. By expanding the purposes for which capital surplus distributions can be utilized, businesses can adapt to changing market conditions and make sound financial decisions in the best interest of their stakeholders.

Rhode Island Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

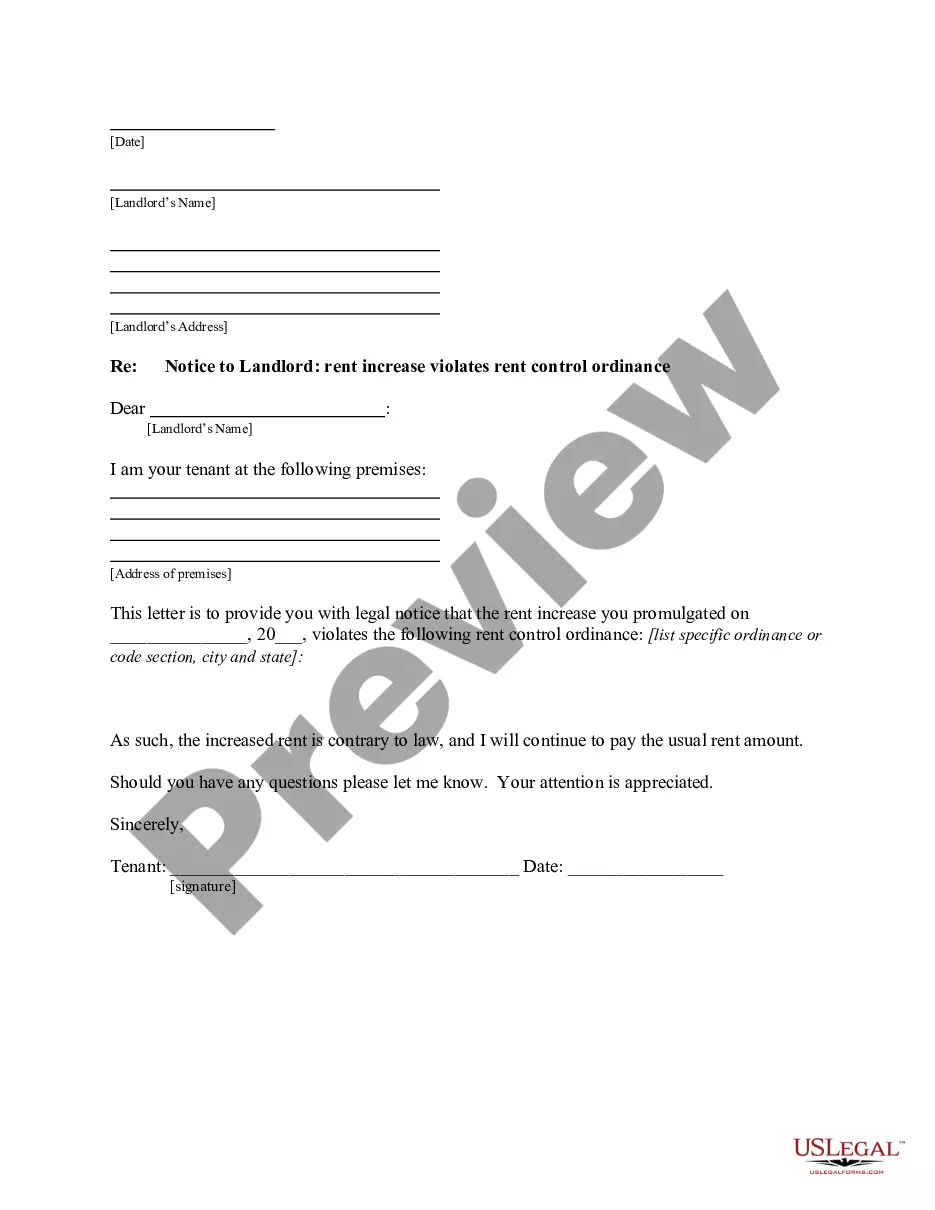

How to fill out Rhode Island Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

Finding the right legal document format might be a have difficulties. Naturally, there are a lot of layouts available online, but how do you find the legal develop you will need? Use the US Legal Forms website. The service delivers a large number of layouts, including the Rhode Island Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, which can be used for organization and private needs. All of the kinds are inspected by professionals and fulfill federal and state requirements.

If you are presently listed, log in to your profile and then click the Acquire button to obtain the Rhode Island Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus. Use your profile to look from the legal kinds you might have acquired formerly. Visit the My Forms tab of your profile and get one more copy in the document you will need.

If you are a new user of US Legal Forms, listed below are straightforward instructions so that you can follow:

- Initial, be sure you have chosen the appropriate develop for your personal town/region. You may examine the form using the Review button and look at the form explanation to ensure it is the best for you.

- If the develop does not fulfill your requirements, make use of the Seach field to discover the appropriate develop.

- Once you are sure that the form would work, select the Acquire now button to obtain the develop.

- Choose the prices program you need and enter in the required information. Create your profile and buy an order utilizing your PayPal profile or credit card.

- Select the data file formatting and acquire the legal document format to your gadget.

- Full, revise and produce and sign the attained Rhode Island Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

US Legal Forms may be the greatest local library of legal kinds for which you can find different document layouts. Use the service to acquire skillfully-created files that follow status requirements.