Rhode Island Proposed issuance of common stock

Description

How to fill out Proposed Issuance Of Common Stock?

Have you been in a position where you require paperwork for sometimes company or person reasons virtually every day time? There are a variety of authorized record themes accessible on the Internet, but finding versions you can rely isn`t easy. US Legal Forms delivers a huge number of type themes, just like the Rhode Island Proposed issuance of common stock, which can be published to fulfill state and federal requirements.

In case you are currently familiar with US Legal Forms website and also have a free account, merely log in. After that, it is possible to obtain the Rhode Island Proposed issuance of common stock template.

Should you not provide an account and wish to begin using US Legal Forms, follow these steps:

- Discover the type you will need and ensure it is for that correct city/state.

- Utilize the Preview button to examine the form.

- See the description to ensure that you have chosen the right type.

- If the type isn`t what you are looking for, utilize the Search industry to obtain the type that meets your needs and requirements.

- Once you discover the correct type, click Purchase now.

- Pick the rates strategy you would like, submit the specified info to make your bank account, and pay for the order making use of your PayPal or charge card.

- Decide on a hassle-free data file file format and obtain your copy.

Locate every one of the record themes you may have bought in the My Forms food selection. You can obtain a more copy of Rhode Island Proposed issuance of common stock anytime, if possible. Just click the needed type to obtain or print out the record template.

Use US Legal Forms, one of the most comprehensive assortment of authorized varieties, to save time as well as prevent blunders. The assistance delivers professionally created authorized record themes which can be used for a variety of reasons. Generate a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

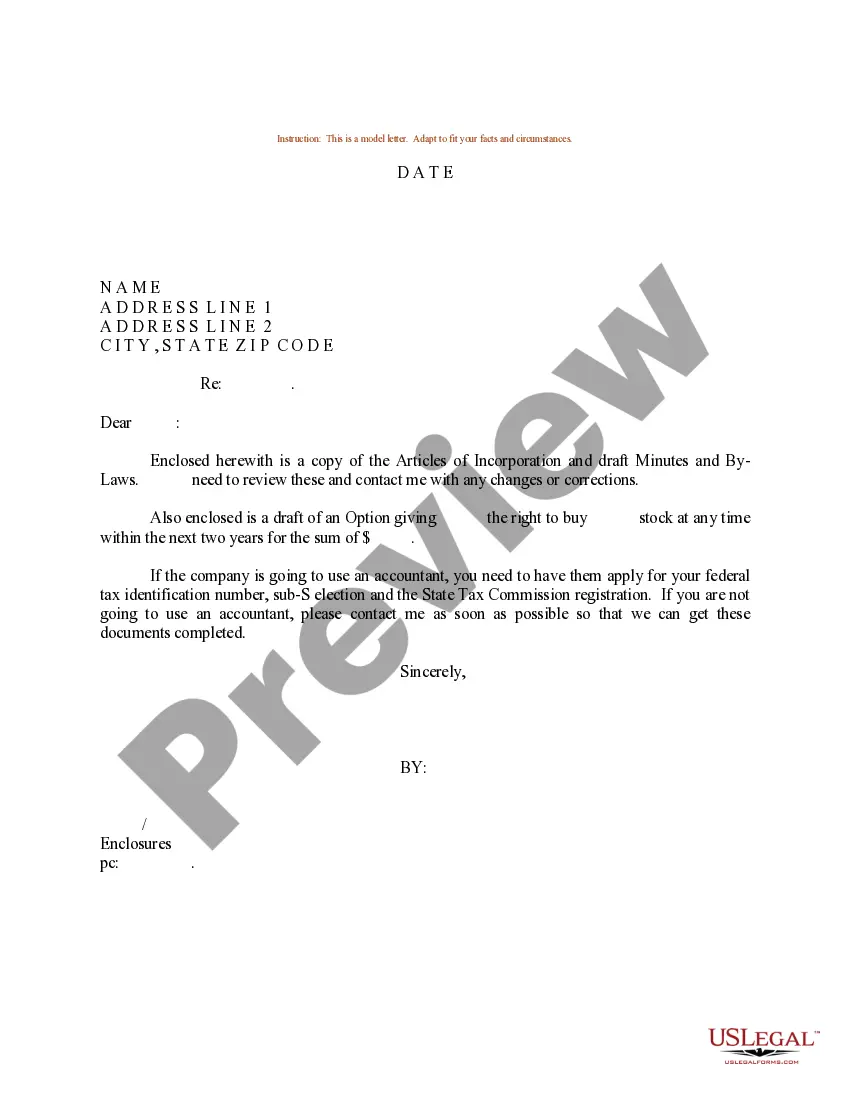

To start a corporation in Rhode Island, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Business Services Division. You can file this document online, by mail or in person. The articles cost $125 to file.

Name your Rhode Island LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

In Rhode Island, there is no paperwork required to become a sole proprietor and no associated fee. If you want to operate under a name other than your own, you can file a Fictitious Business Name application and pay a $10 fee, but this is not required. You can start a sole proprietorship today with no formalities.

You can submit your Rhode Island Annual Report online, by mail, or in person. In each case, you'll need to visit the Rhode Island Secretary of State website. On the state website, go to the Document Library ? Annual Reports page. Next to your business type, click ?Download? for paper filings OR ?File Online.?

Witnesses: A Rhode Island will must be signed by at least two individuals present at the same time who subscribe to the will in the presence of the testator. Writing: A Rhode Island will must be in writing. Beneficiaries: A testator can leave property to anyone.

A Resident is an individual that is domiciled in Rhode Island or an individual that maintains a place of abode in Rhodes Island spending at least 183 days in the state.