Rhode Island Granter Trust Agreement is a legal document that establishes a trust relationship between three parties: Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA, and Bank One, National Assoc. This agreement outlines the terms and conditions for the transfer of assets from the granter (Credit Suisse) to the trustee (Washington Mutual) for the benefit of the beneficiaries (Bank One). One type of Rhode Island Granter Trust Agreement between these parties could be a Residential Mortgage-Backed Securities Trust (RMBS Trust) Agreement. This type of agreement typically involves the securitization of residential mortgage loans by Credit Suisse, where the loans are transferred to Washington Mutual as the trustee. Bank One may be the beneficiary of this trust, entitled to the cash flows generated by the mortgage loans. Another type of Rhode Island Granter Trust Agreement could be a Collateralized Debt Obligation (CDO) Trust Agreement. In this scenario, Credit Suisse may bundle various types of debt securities (such as corporate bonds or loans) and transfer them to Washington Mutual as the trustee. Bank One would then be the beneficiary, receiving payments generated by these debt securities. The Rhode Island Granter Trust Agreement is a comprehensive document that includes key provisions such as the duration of the trust, the powers and responsibilities of the trustee, the rights and obligations of the granter, and the specifics of the beneficiaries' interests. It also addresses the conditions for the transfer of assets, the allocation of income and expenses, the potential termination circumstances, and dispute resolution mechanisms. It is important to consult legal professionals to ensure compliance with Rhode Island trust laws and to tailor the agreement to the specific circumstances and objectives of the parties involved.

Rhode Island Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc.

Description

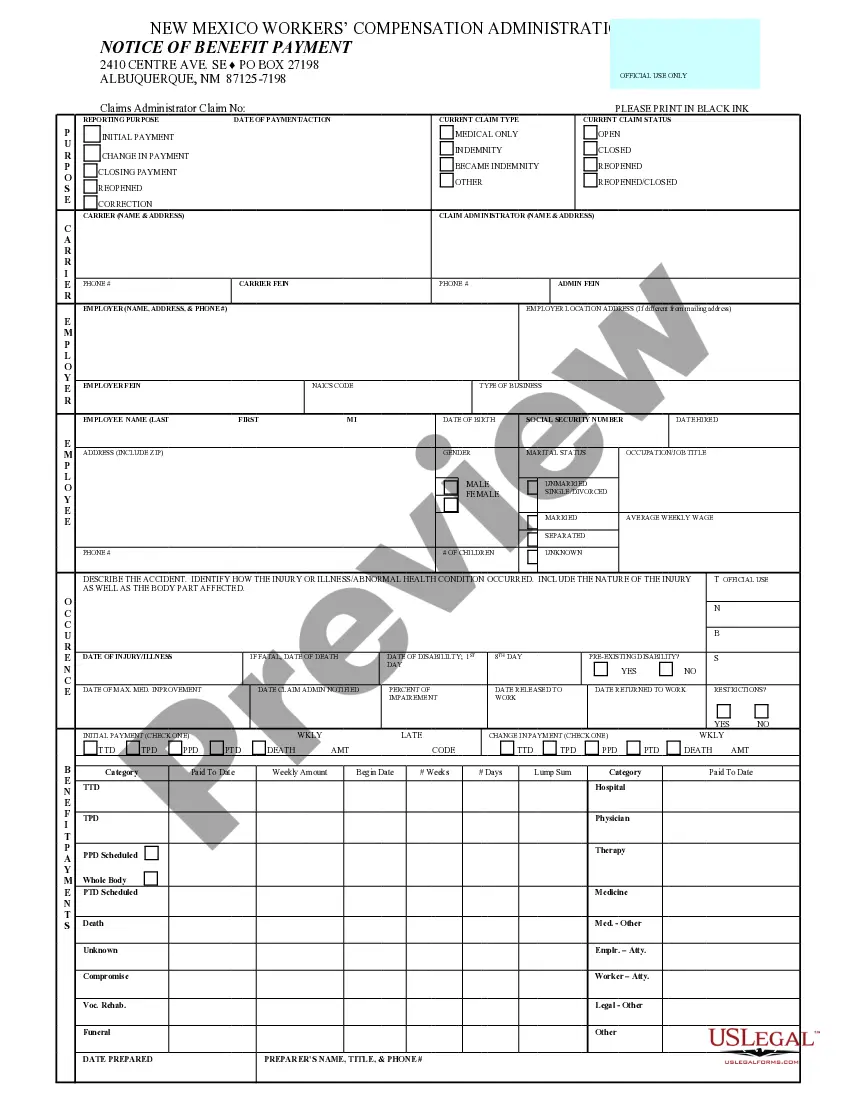

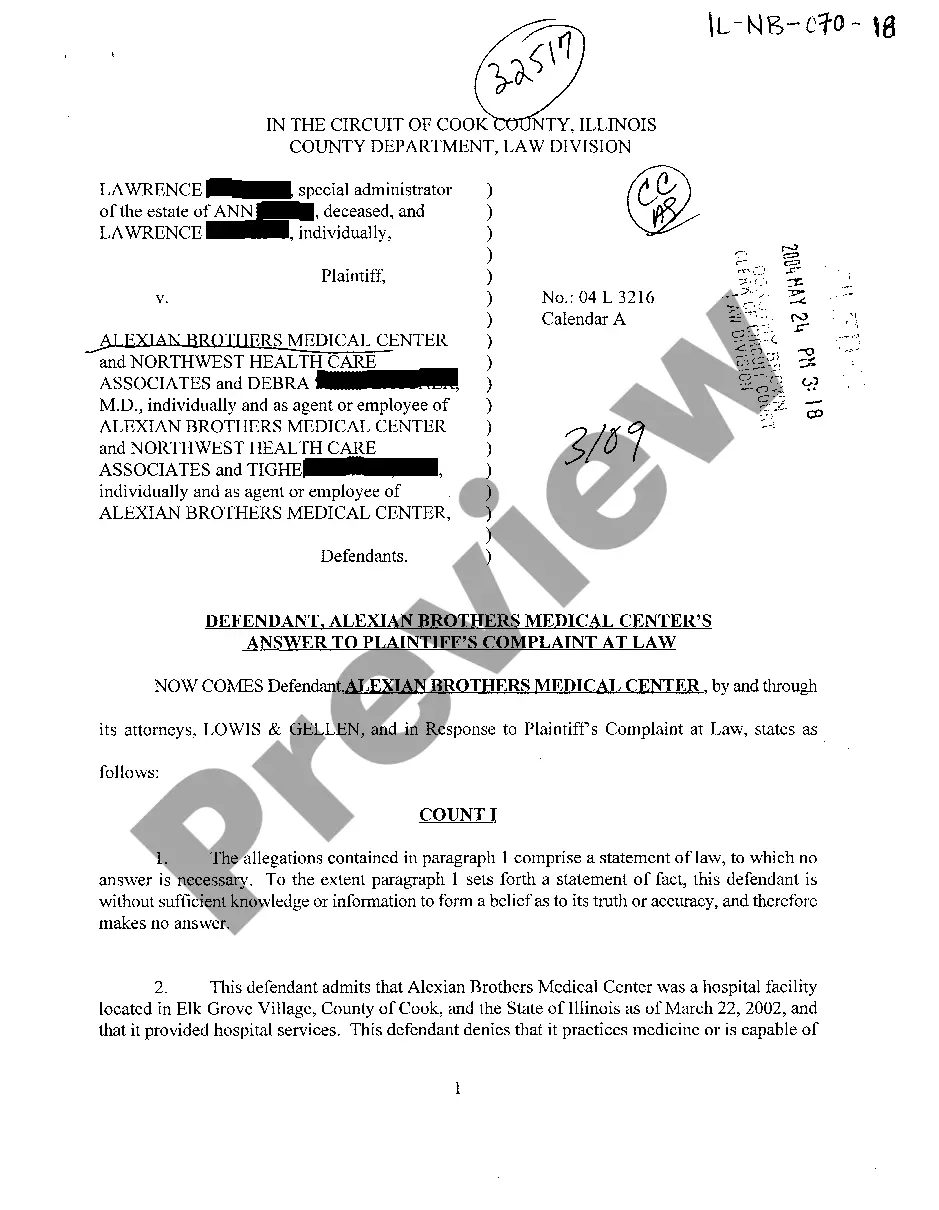

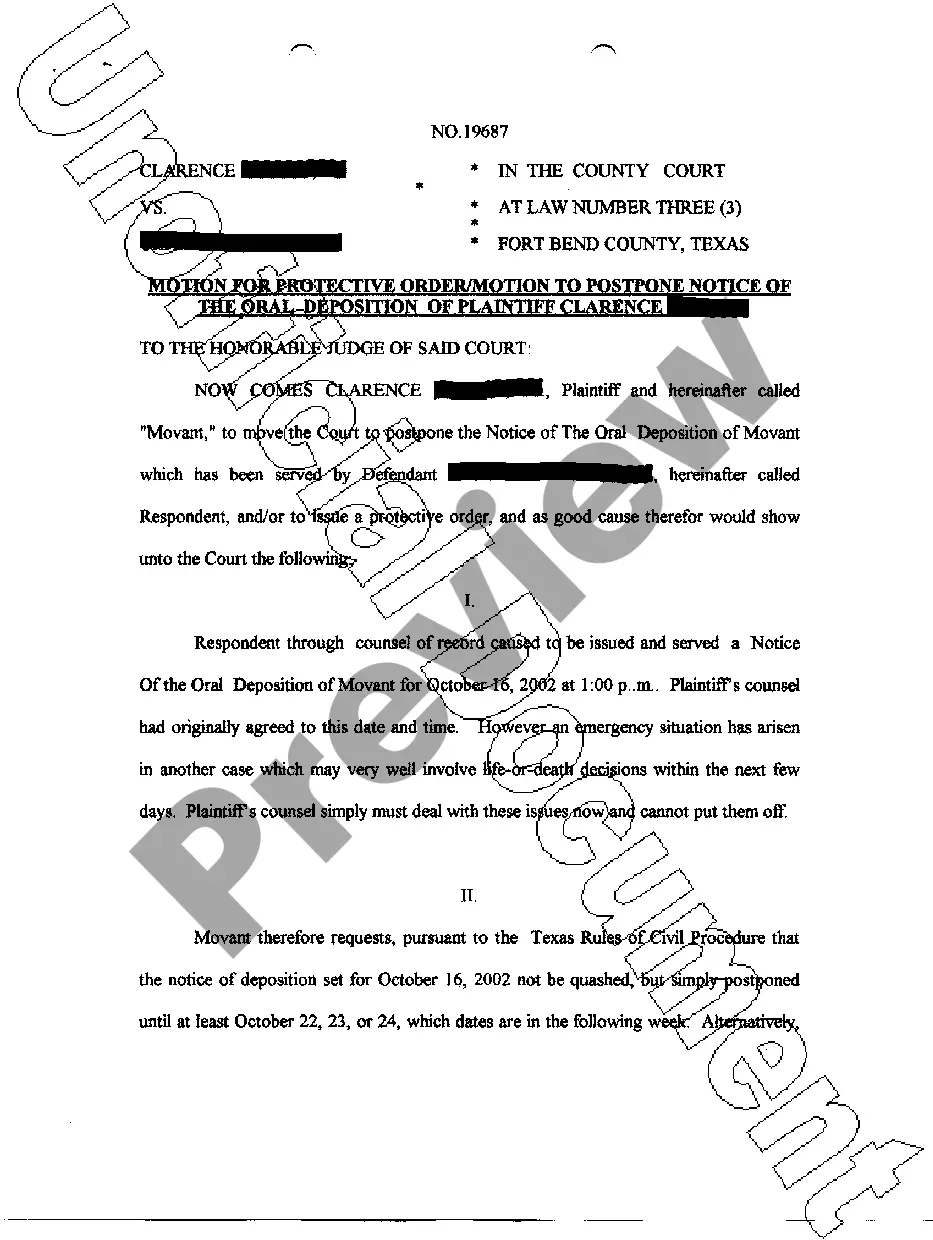

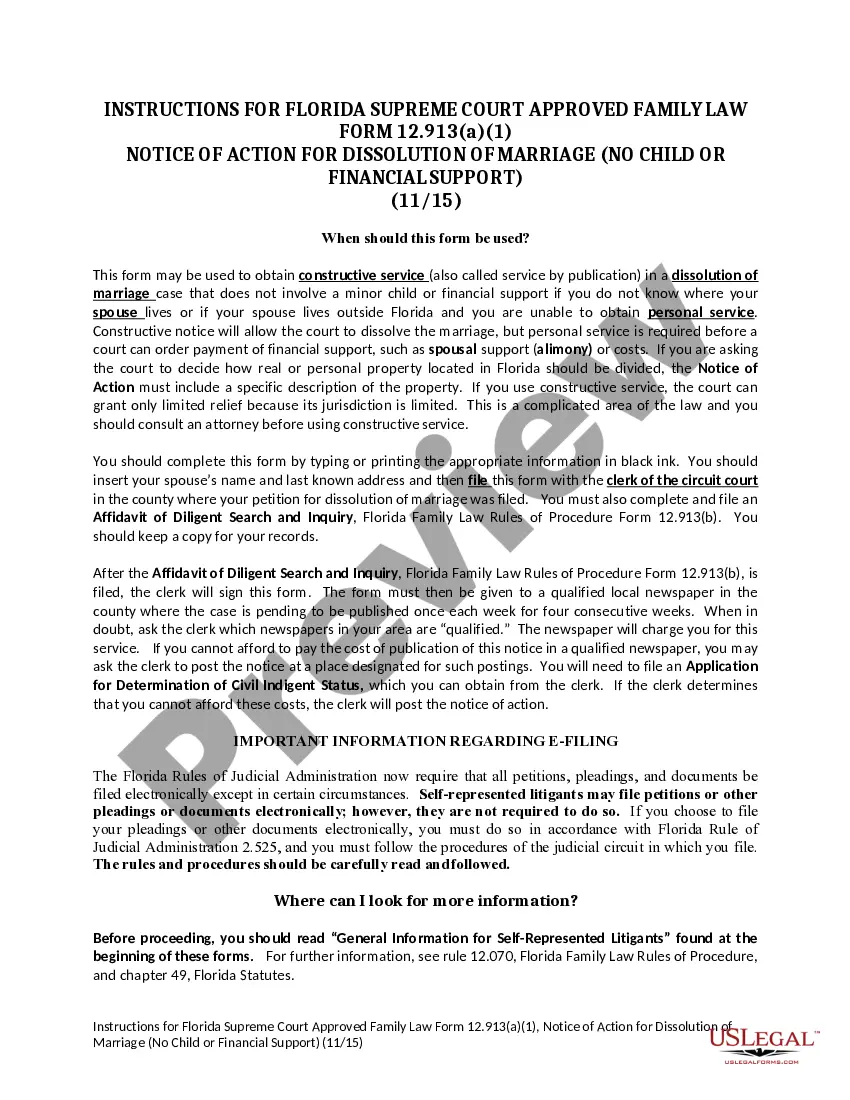

How to fill out Rhode Island Grantor Trust Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA And Bank One, National Assoc.?

You are able to invest hours on the Internet searching for the legitimate record template that fits the federal and state needs you need. US Legal Forms gives 1000s of legitimate types that happen to be evaluated by specialists. You can actually acquire or printing the Rhode Island Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc. from our service.

If you have a US Legal Forms profile, it is possible to log in and click the Download key. Following that, it is possible to complete, change, printing, or signal the Rhode Island Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc.. Each legitimate record template you purchase is the one you have for a long time. To have another duplicate for any bought form, check out the My Forms tab and click the corresponding key.

If you use the US Legal Forms internet site initially, adhere to the easy guidelines under:

- First, be sure that you have selected the proper record template for the area/town that you pick. Browse the form information to ensure you have picked out the correct form. If available, use the Review key to check with the record template also.

- If you wish to discover another variation in the form, use the Look for industry to discover the template that meets your needs and needs.

- Once you have located the template you need, simply click Get now to carry on.

- Find the pricing prepare you need, enter your references, and register for your account on US Legal Forms.

- Comprehensive the transaction. You can use your Visa or Mastercard or PayPal profile to cover the legitimate form.

- Find the structure in the record and acquire it for your product.

- Make adjustments for your record if required. You are able to complete, change and signal and printing Rhode Island Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc..

Download and printing 1000s of record layouts utilizing the US Legal Forms site, which provides the greatest collection of legitimate types. Use specialist and status-certain layouts to take on your small business or personal requirements.