Rhode Island Nonqualified Stock Option Agreement of N(2)H(2), Inc. is a legal document that outlines the terms and conditions regarding the granting of nonqualified stock options to employees of the company based in Rhode Island. This agreement is designed to provide employees the opportunity to purchase company stock at a predetermined price within a specified time frame. The Rhode Island Nonqualified Stock Option Agreement serves as a contract between N(2)H(2), Inc. and the recipient of the stock options, ensuring both parties understand their rights and obligations. It covers important details such as the number of options granted, exercise price, vesting period, and expiration date. The agreement typically specifies that the stock options are nonqualified, meaning they do not qualify for special tax treatment under the Internal Revenue Code. Consequently, when employees exercise their options and later sell the stock, the difference between the exercise price and the fair market value of the stock will be subject to ordinary income tax. Different types of Rhode Island Nonqualified Stock Option Agreements may exist based on various factors such as executive-level options, employee incentives, or specific vesting schedules. These agreements may also contain provisions for acceleration of vesting in the event of a merger or acquisition, termination, or other corporate transactions. It is crucial for both the company and the employees to carefully review the Rhode Island Nonqualified Stock Option Agreement. Employees should fully understand the terms and potential tax implications associated with exercising their options. Likewise, the company must ensure the agreement complies with relevant laws and aligns with its overall compensation and stock option plans. Overall, the Rhode Island Nonqualified Stock Option Agreement of N(2)H(2), Inc. is a pivotal document that outlines the rights and responsibilities of both parties involved in the granting and exercise of nonqualified stock options. By comprehensively addressing the terms and conditions, it aims to foster an equitable and transparent relationship between the company and its employees.

Rhode Island Nonqualified Stock Option Agreement of N(2)H(2), Inc.

Description

How to fill out Rhode Island Nonqualified Stock Option Agreement Of N(2)H(2), Inc.?

If you need to comprehensive, acquire, or print authorized record web templates, use US Legal Forms, the greatest selection of authorized types, that can be found on-line. Use the site`s basic and handy research to get the documents you will need. Numerous web templates for enterprise and person purposes are categorized by categories and suggests, or search phrases. Use US Legal Forms to get the Rhode Island Nonqualified Stock Option Agreement of N(2)H(2), Inc. with a few click throughs.

When you are already a US Legal Forms buyer, log in in your bank account and click the Down load option to have the Rhode Island Nonqualified Stock Option Agreement of N(2)H(2), Inc.. You can also access types you in the past acquired from the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for your proper metropolis/nation.

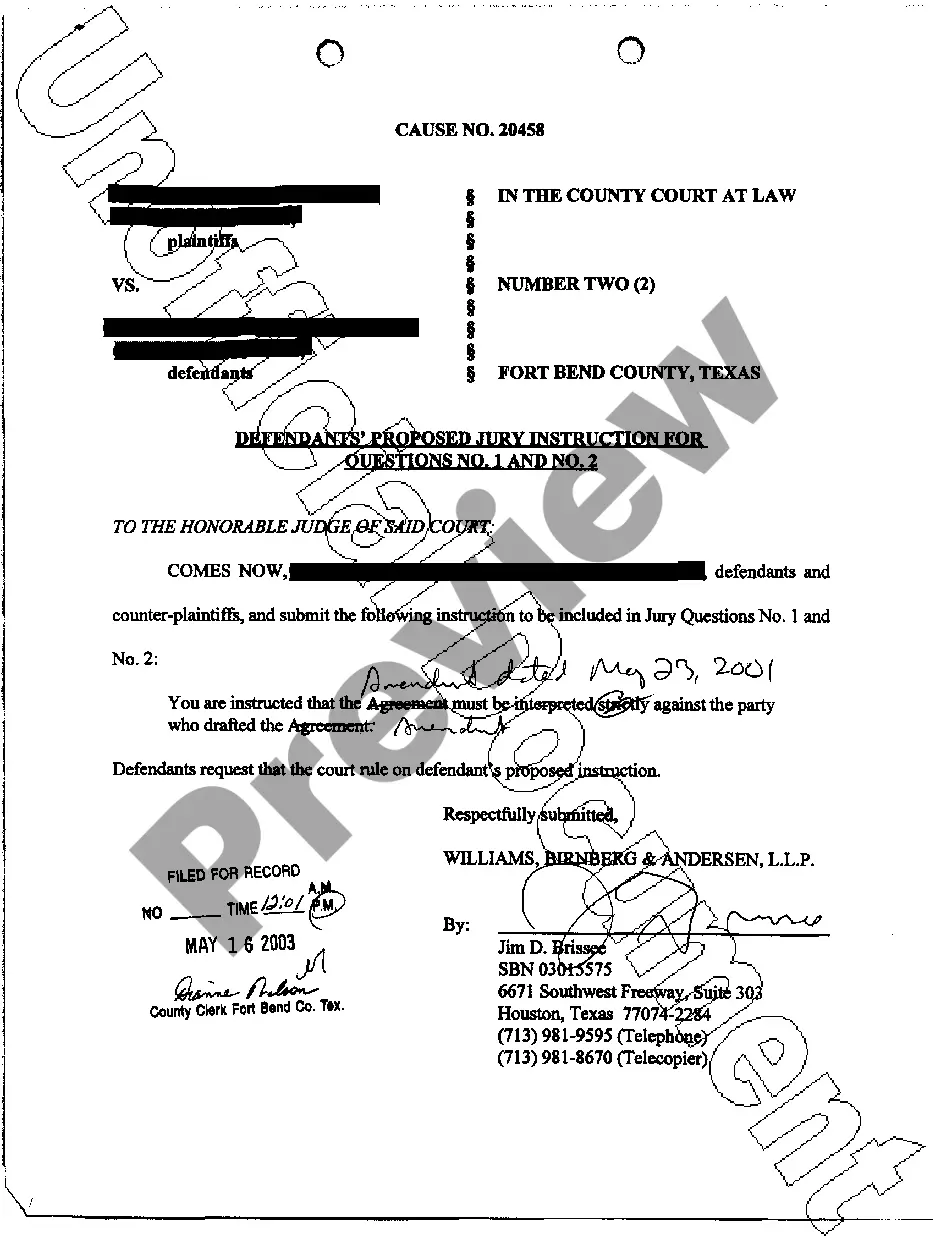

- Step 2. Utilize the Review choice to check out the form`s information. Don`t neglect to learn the description.

- Step 3. When you are unhappy together with the develop, utilize the Search industry on top of the screen to discover other versions in the authorized develop web template.

- Step 4. Once you have discovered the shape you will need, select the Buy now option. Opt for the pricing strategy you prefer and include your qualifications to register to have an bank account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the formatting in the authorized develop and acquire it on your gadget.

- Step 7. Total, modify and print or indicator the Rhode Island Nonqualified Stock Option Agreement of N(2)H(2), Inc..

Every single authorized record web template you get is the one you have permanently. You possess acces to each develop you acquired within your acccount. Select the My Forms area and choose a develop to print or acquire again.

Contend and acquire, and print the Rhode Island Nonqualified Stock Option Agreement of N(2)H(2), Inc. with US Legal Forms. There are millions of professional and status-particular types you can use for your enterprise or person requires.

Form popularity

FAQ

However, when you sell an option?or the stock you acquired by exercising the option?you must report the profit or loss on Schedule D of your Form 1040. If you've held the stock or option for one year or less, your sale will result in a short-term gain or loss, which will either add to or reduce your ordinary income.

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)

When you exercise your employee stock options, a taxable benefit will be calculated. This benefit should be reported on the T4 slip issued by your employer. The taxable benefit is the difference between the price you paid for the shares (the ?strike price?) and their value on the date of exercise.

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

After you exercise an option or receive free stocks, your employer should note the value of the benefits you received, and he should report that amount in box 14 of your T4 slip.

New Rules. As of July 1, 2021, the New Rules limit the availability of the Stock Option Deduction to an annual maximum of $200,000 in a calendar year (the Annual Vesting Limit) calculated based on the fair market value of the underlying securities on the date of the grant.

The security options benefit is taxable to you as employment income in the year you exercise the options. It's reported to you on your T4 tax slip, along with your salary, bonus and other sources of employment income. The security options benefit is normally added to the adjusted cost base (ACB) of your shares.