Rhode Island Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York

Description

How to fill out Trust Agreement Between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., And The Bank Of New York?

Finding the right legal record web template could be a have difficulties. Of course, there are tons of layouts available on the net, but how do you get the legal kind you require? Take advantage of the US Legal Forms website. The services gives a huge number of layouts, such as the Rhode Island Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York, which you can use for enterprise and private needs. Each of the forms are checked out by experts and meet federal and state specifications.

When you are currently signed up, log in for your bank account and click the Acquire button to obtain the Rhode Island Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York. Make use of bank account to search throughout the legal forms you might have ordered in the past. Check out the My Forms tab of your bank account and acquire one more backup of the record you require.

When you are a new consumer of US Legal Forms, here are easy instructions for you to comply with:

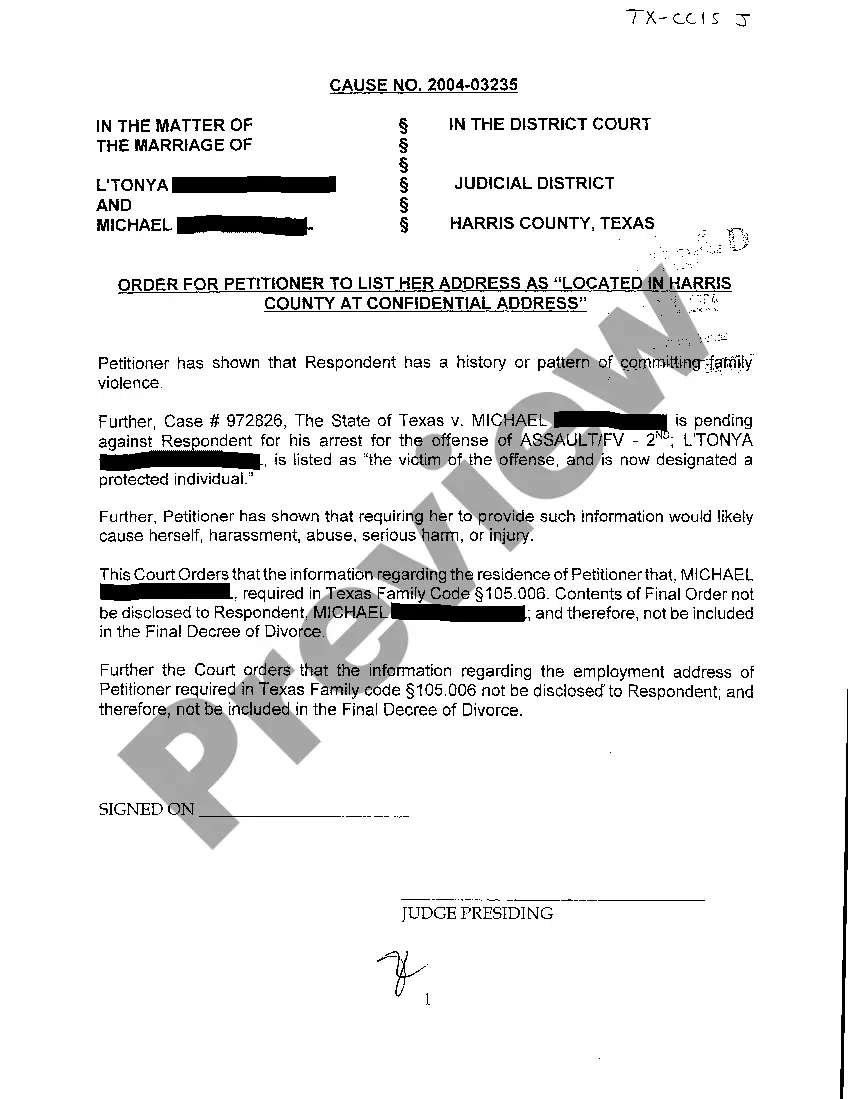

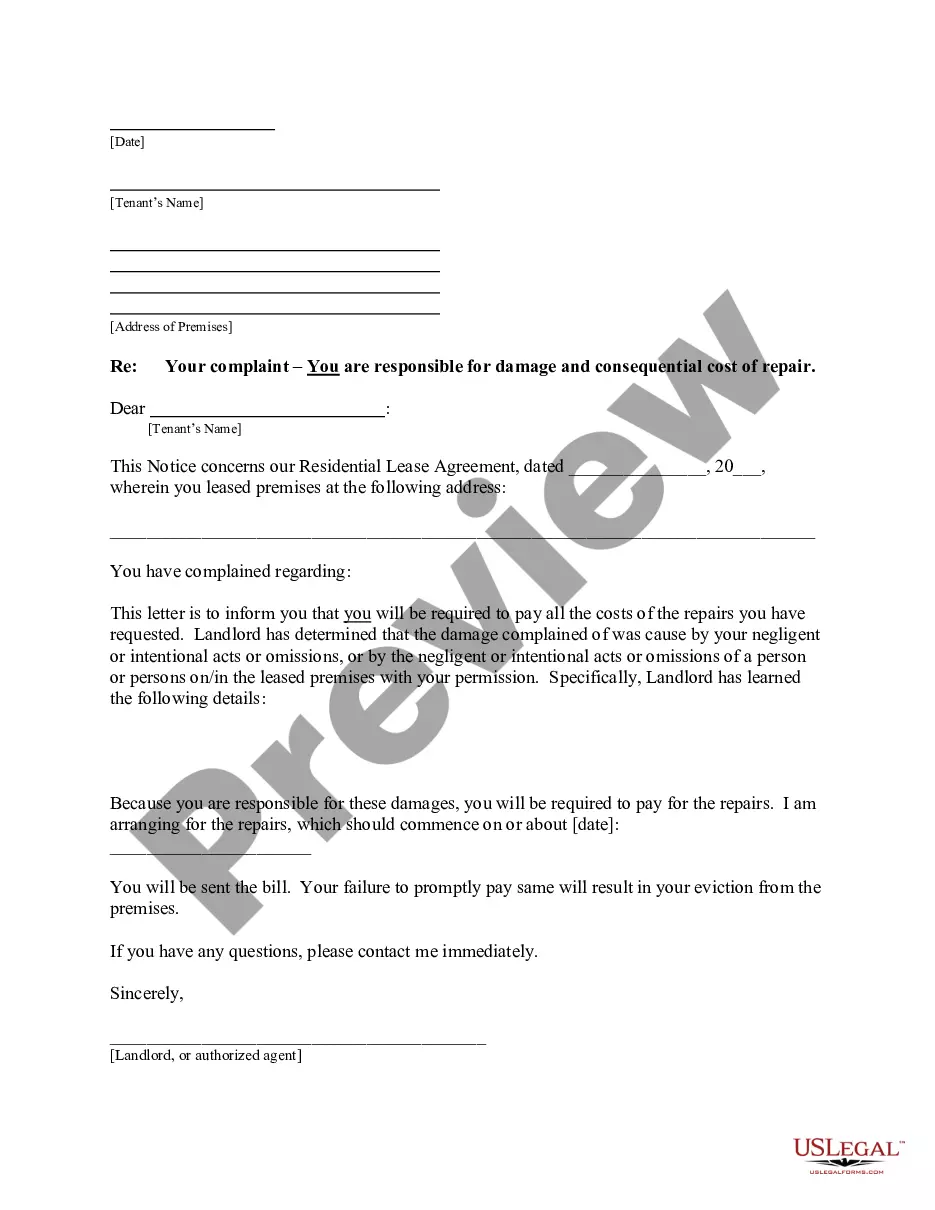

- Initial, make certain you have chosen the right kind for your personal city/region. You are able to look through the shape using the Preview button and read the shape explanation to guarantee it will be the right one for you.

- When the kind does not meet your requirements, make use of the Seach area to find the proper kind.

- When you are certain the shape is acceptable, go through the Buy now button to obtain the kind.

- Choose the rates prepare you would like and enter the needed info. Design your bank account and pay money for the order with your PayPal bank account or Visa or Mastercard.

- Opt for the document format and down load the legal record web template for your gadget.

- Full, revise and print out and indication the obtained Rhode Island Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York.

US Legal Forms is definitely the greatest local library of legal forms where you can find different record layouts. Take advantage of the company to down load appropriately-created documents that comply with express specifications.