Rhode Island Underwriting Agreement between Advance Equipment Receivable Series LLC and Advance Bank Corporation An underwriting agreement is a legal contract between Advance Equipment Receivable Series LLC (the "Issuer") and Advance Bank Corporation (the "Underwriter") in which the underwriter agrees to purchase securities from the issuer for resale to investors. Specifically, the Rhode Island Underwriting Agreement governs the relationship between Advance Equipment Receivable Series LLC, a subsidiary of Advance Corporation, and Advance Bank Corporation, for specific underwriting transactions conducted in Rhode Island. The purpose of this agreement is to establish the terms and conditions under which the Issuer will issue and sell its securities to the Underwriter. It outlines the responsibilities, obligations, rights, and remedies of both parties involved in the underwriting process. The agreement ensures transparency, accountability, and compliance with applicable laws and regulations in the state of Rhode Island. Key provisions covered in the Rhode Island Underwriting Agreement include, but are not limited to: 1. Offerings of Securities: The agreement specifies the types and description of securities offered by the Issuer, their quantities, pricing, and any relevant terms or conditions associated with these offerings. 2. Underwriting Terms: It details the underwriting terms agreed upon by both parties, including the underwriter's commitment to purchase the offered securities from the issuer, the agreed-upon purchase price, and any applicable underwriting fees or discounts. 3. Representations and Warranties: Both parties provide assurances of the accuracy, completeness, and legality of the information contained in the offering documents, financial statements, and other relevant disclosures. These representations and warranties help establish trust and ensure the integrity of the underwriting process. 4. Conditions Precedent: The agreement outlines the conditions that must be satisfied before the underwriting transaction can proceed. This may include regulatory approvals, due diligence procedures, and the fulfillment of any legal or financial requirements. 5. Indemnification and Liability Limitations: The agreement includes provisions related to indemnification, limiting liability, and allocation of risks between the parties involved. This aspect protects either party from potential losses or damages arising from misrepresentations, omissions, or the breach of contractual obligations. It is worth noting that Rhode Island Underwriting Agreements may vary depending on the specific nature of the underwriting transaction, securities being offered, and the prevailing legal and regulatory framework. Different types of underwriting agreements may include firm commitment underwriting, best-efforts underwriting, or standby underwriting, each with unique terms and conditions. In conclusion, the Rhode Island Underwriting Agreement between Advance Equipment Receivable Series LLC and Advance Bank Corporation establishes the terms, obligations, and conditions for underwriting transactions in Rhode Island. This agreement ensures transparency, compliance, and legal protection for both parties involved in the underwriting process.

Rhode Island Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation

Description

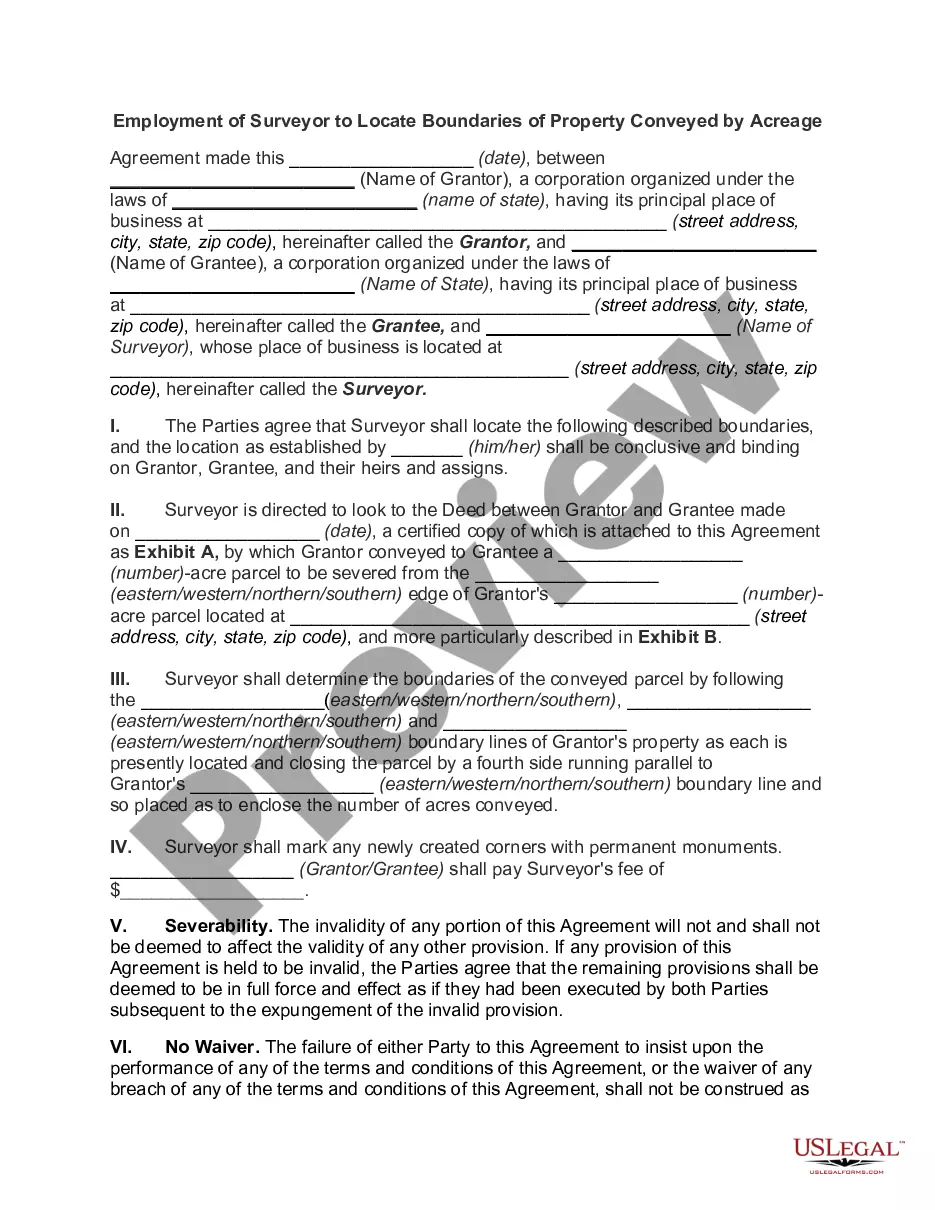

How to fill out Rhode Island Underwriting Agreement Between Advanta Equipment Receivable Series LLC And Advanta Bank Corporation?

Have you been within a position where you need paperwork for possibly business or individual uses almost every time? There are tons of legal papers web templates available online, but getting types you can rely isn`t easy. US Legal Forms delivers a large number of kind web templates, much like the Rhode Island Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation, which can be published in order to meet federal and state requirements.

If you are already acquainted with US Legal Forms web site and also have your account, simply log in. After that, you can obtain the Rhode Island Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation design.

Should you not come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is for the right town/county.

- Take advantage of the Preview option to examine the form.

- Browse the outline to ensure that you have chosen the right kind.

- When the kind isn`t what you are trying to find, make use of the Research field to get the kind that meets your requirements and requirements.

- If you get the right kind, click Get now.

- Select the rates strategy you need, submit the required details to make your bank account, and purchase your order using your PayPal or credit card.

- Select a practical paper file format and obtain your copy.

Locate all of the papers web templates you possess bought in the My Forms food list. You may get a additional copy of Rhode Island Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation at any time, if required. Just click the required kind to obtain or produce the papers design.

Use US Legal Forms, one of the most comprehensive collection of legal types, to conserve time and prevent errors. The support delivers expertly produced legal papers web templates which can be used for a variety of uses. Generate your account on US Legal Forms and begin producing your way of life easier.